Back

22 Nov 2022

Crude Oil Futures: Extra weakness not ruled out

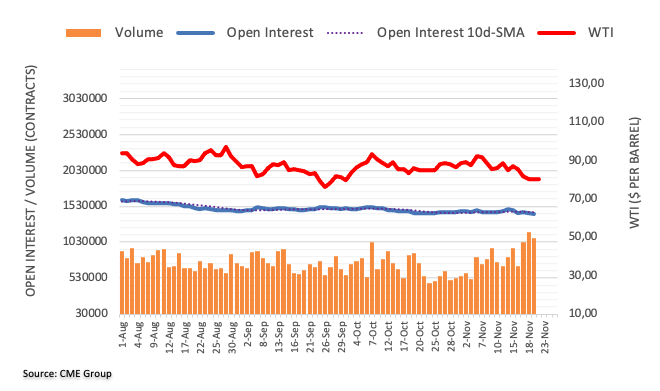

Open interest in crude oil futures markets shrank for the second straight session on Monday, this time by around 21.5K contracts according to preliminary readings from CME Group. Volume followed suit and went up by around 79.5K contracts after two daily builds in a row.

WTI could revisit the 2022 low near $74.00

Prices of the barrel of the WTI started the week with marginal gains amidst a volatile session. Monday’s price action was on the back of diminishing open interest and volume and does not rule out further losses in the very near term. That said, the next support of note emerges at the YTD low at $74.30 recorded on January 3.