AUD/USD bulls eye 0.6670s, RBA around the corner

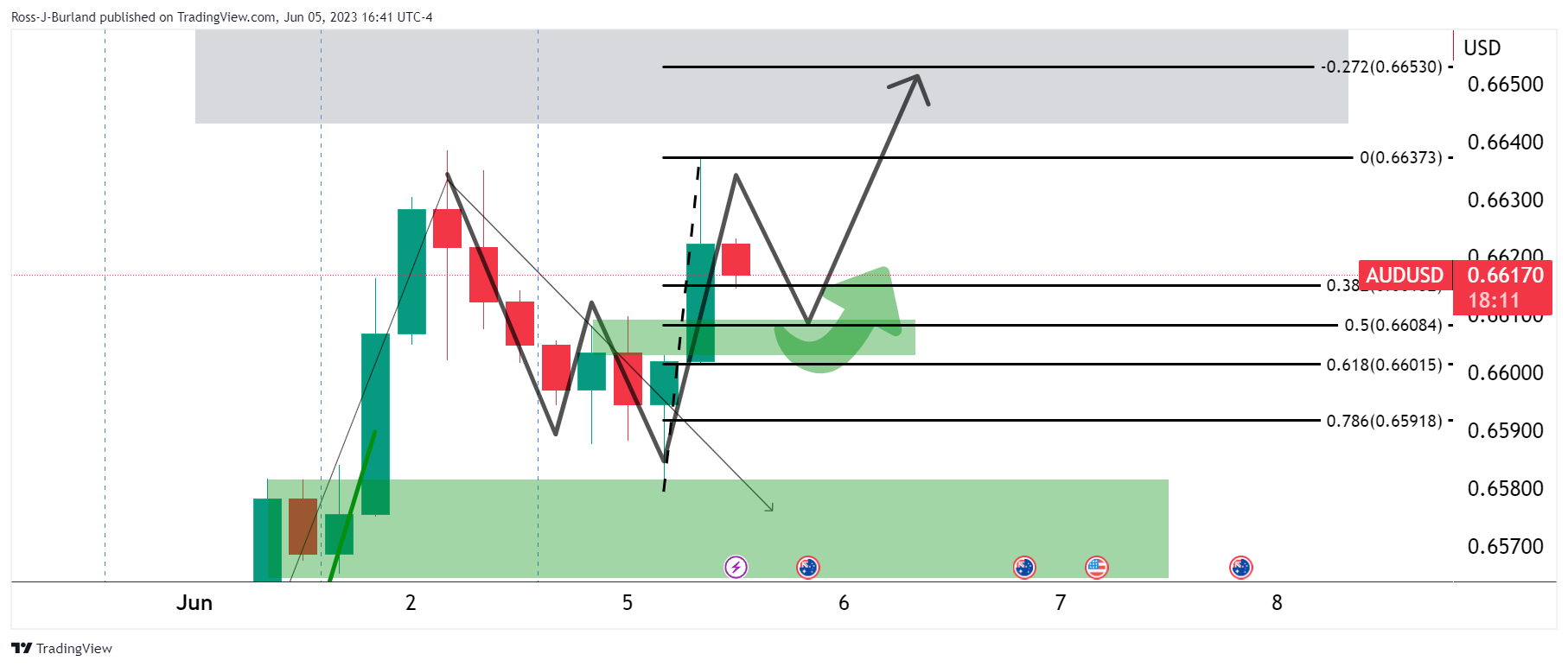

- AUD/USD is moving into the necklines of the W-formations.

- AUD/USD traders await the RBA key event.

AUD/USD is higher by some 0.18% on the day and met support on Monday that attracted buyers to test the prior day´s high of 0.6638. This has occurred as the market gets set for the Reserve Bank of Australia meeting today.

´´Following this week's data we now expect the RBA's target cash rate to peak at 4.35% with a 25bps hike with another in August,´´ analysts at TD Securities explained.

´´Given the monthly April inflation print showed the Bank departing further from its Q2'23 trimmed mean f/c and the higher than expected Fair Wage Commission decision, there is now a strong case for the Bank to move sooner rather than later.´´

Meanwhile, analysts at Rabobank argued that while the market has already assessed that the risks of a RBA rate hike have risen, a policy move would likely result in upside pressure on AUD/USD.

´´Although the AUD may edge a little lower on a steady policy announcement, we would expect that the downside would be limited given our house view that the RBA will be leaving the door open to another rate hike later in the year,´´ the analysts explained.

That said, their expectation that the USD is likely to remain well supported in the coming months suggests that AUD/USD may struggle to break above the 0.66-0.67 area.

As for the US Dollar, the index cut early gains to trade little changed around 104 on Monday on the back of Factory Orders that rose 0.4% in April, well below what had been expected. Additionally, ISM Services PMI fell sharply to the lowest in five months in May.

The data dented the US Dollar that had otherwise enjoyed the Nonfarm Payrolls and a remarkable 339K jobs in May. However, the Unemployment Rate rose by 0.3 percentage points to 3.7% and hourly wage growth slowed. Around 80% of market participants expect the Fed to leave rates steady when it meets next week.

AUD/USD technical analysis

The W-formations are pulling the price into the necklines. There are targets set higher with the 0.6670s eyed.