GBP/JPY Price Analysis: Tuesday plunge into 181.00 proves short-lived

- GBP/JPY took an initial ride down the charts into 181.02 in early Tuesday trading.

- A firm rebound sent the Guppy back into the day's highs near 182.80.

- Intraday action is caught in the middle with prices cycling the neutral pivot.

The GBP/JPY kicked off Tuesday trading near 182.66 before seeing a plunge lower, just missing the 181.00 handle before a quick snap rebound sent the pair into a fresh high for the day at 182.80, and the pair is now waffling into the midrange near the week's P0 neutral pivot point.

Near-term action has been sticking close to the median, with hourly candles routinely tapping the 50-hour Simple Moving Average (SMA) that is currently testing into 182.25.

Last week's declining overall momentum sees weekly pivots tightening their range, with R1 capped at 183.32 and S1 parked at 180.76.

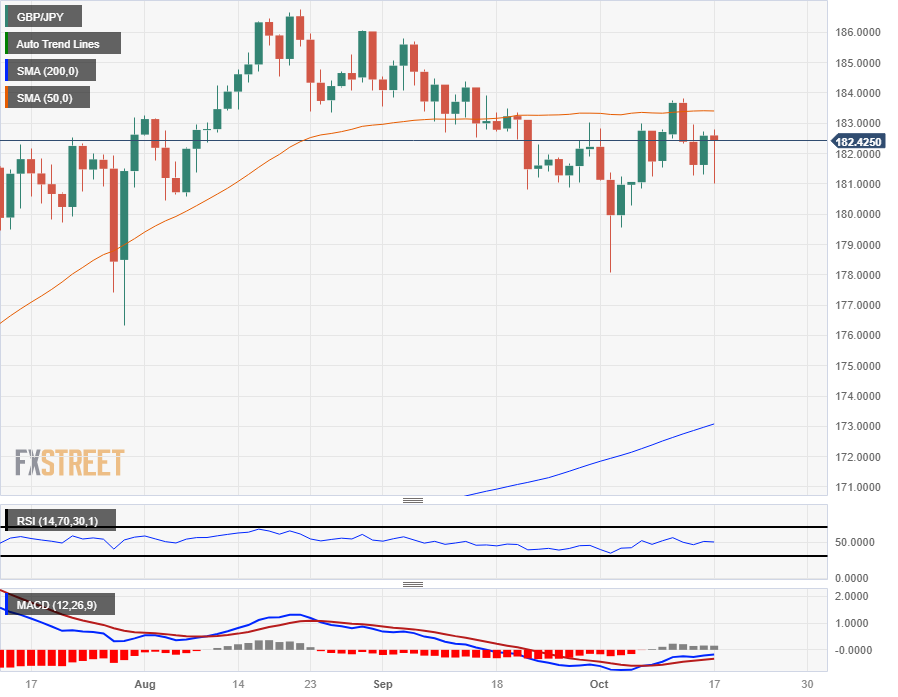

4-hour candles likewise show the pair strung up in the middle with bids constrained between the 200-period SMA and a rising 50-period SMA.

On the daily candlesticks the Guppy is stuck closely to the 50-day SMA and trading far above the 200-day SMA with the pair up over 15% from the year's opening bids near 158.40. The pair remains incredibly well-bid in the long term, but a lack of continued momentum sees prices failing to make a decisive break for the last major swing high into 186.77, and the immediate bearish target currently sits at early October's low of 178.08.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

GBP/JPY Technical Levels