Gold price slips below $3,300 amid weak US data, set for over 5% monthly gains

- Gold retreats but heads for the third-strongest monthly gain during 2025.

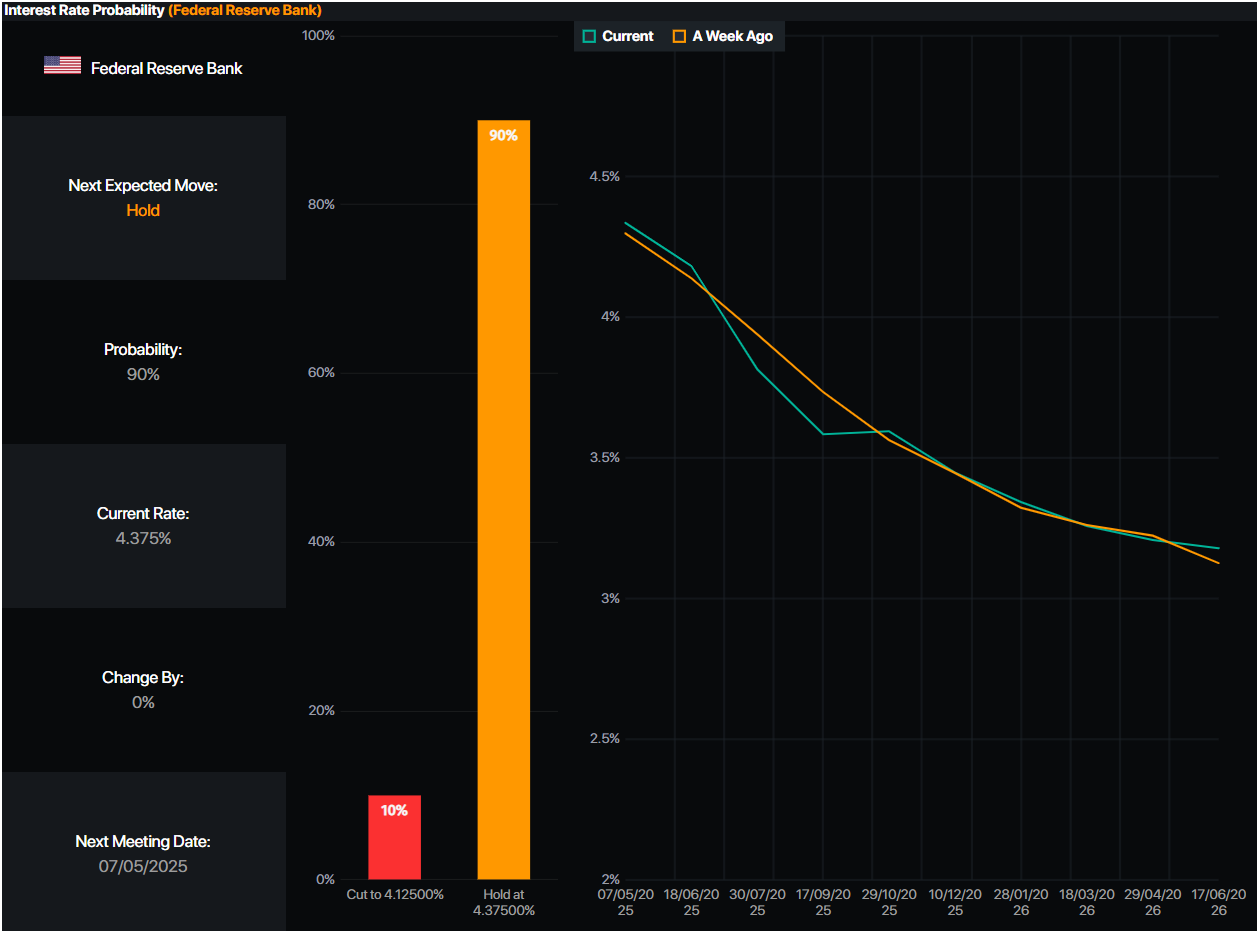

- Traders price in 100 bps of Fed cuts despite inflation remaining sticky.

- US GDP contraction fuels recession fears and boosts Fed rate cut bets.

- Core PCE dips in line with forecasts, but remains above 2% inflation target.

Gold fell some 0.69% during the North American session on Wednesday after hitting a daily high of $3,328. Data from the United States (US) revealed an economic contraction and fueled speculation for further interest rate cuts by the Federal Reserve (Fed). At the time of writing, XAU/USD trades at $3,293, near the current week's lows.

The largest economy in the world is facing an ongoing economic slowdown, as revealed by the US Department of Commerce. Gross Domestic Product (GDP) figures for the first quarter of 2025 disappointed investors, exerting pressure on the Federal Reserve, which is fighting to bring inflation back towards its 2% goal.

After the data release, investors rushed to price in 100 basis points of rate cuts by the Fed, meaning that the fed funds rate will end near 3.45%, as revealed by data from Prime Market Terminal.

Source: Prime Market Terminal

Bullion traders were also attentive to the March release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index. The figures dipped as expected by analysts, though they remain above the US central bank's 2% goal.

Labor market data was soft, as revealed by ADP in its National Employment Change report in April.

Despite posting daily losses, Bullion prices are set to end April with gains of over 5.49%.

Ahead in the week, traders are eyeing the release of the ISM Manufacturing PMI for April and Nonfarm Payroll figures for the same period.

Daily digest market movers: Gold price prints losses and fails to capitalize on US yields fall

- The yield on the US 10-year Treasury note drops one a half basis points, reaching 4.154%.

- US real yields edges down two bps to 1.90%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

- US GDP for Q1 2025 shrank 0.3%, missing the mark for a 0.4% expansion and a drop from Q4 2024's 2.4% increase, revealed the US Commerce Department.

- Labor market data revealed by the ADP National Employment Change in April suggests that Friday’s Nonfarm Payroll figures could be lower than projected. Private companies hired 62K people, below estimates of 108K.

- At the same time, the US Federal Reserve preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, rose by 2.6% as projected, down from the 3% rise in February.

XAU/USD technical outlook: Remains bullish but poised to test $3,200

Gold price uptrend remains in place, though sellers seem to be gathering momentum as XAU/USD has fallen below $3,300; it remains shy to clear the latest swing low of $3,261 on April 23. A breach of the latter will expose the $3,200 mark, followed by the $3,150 mark.

On the other hand, if Gold claims $3,300, the next resistance would be $3,350, followed by the $3,400 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.