EUR/USD rises for the second week, eyes Italian referendum, ECB

EUR/USD reached the strongest levels in two weeks on Friday, after the US employment report, and boosted by a correction of the greenback in the currency market. The pair moved with an upside bias during all week, in a recovery mode, after hitting a fresh 2016 low at 1.0515 last week.

After NFP, Italy’s referendum, then ECB

US economic data during the current week supported a Federal Reserve hike in December. Today the NFP report showed numbers in line with expectations but with a limited impact on the market, that appears to have discounted a rate hike from the Fed.

The next risk event for the pair will take place on Sunday: the Italian referendum. “The outcome of the referendum should become clear early on Monday morning but the following political path is very likely to remain uncertain. Overall, we expect the Italians to vote ‘no’ and Prime Minister Matteo Renzi steps down but without it resulting in ‘Italexit’ or a major sell-off in Italian government bonds”, said analysts at Danske Bank. Many fear a jump in volatility with the referendum (and also with elections in Austria), so some brokers have risen their margin requirements.

On Thursday will take place the European Central Bank meeting. An extension of the purchase program is expected but is not clear how and for how long.

EUR still under pressure

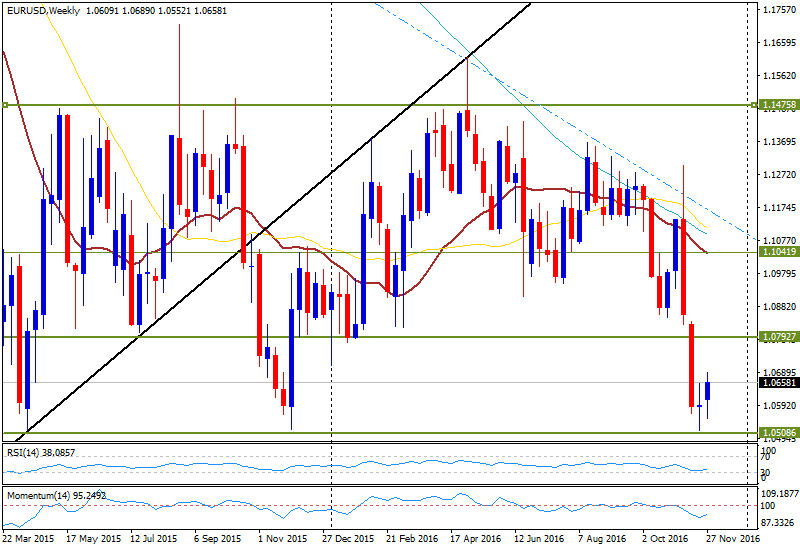

The euro has been, and continues under pressure, amid political risks in Europe and also from the divergence of monetary policy between the US and the Eurozone.

EUR/USD has been able to rise for the second week in a row but still remains near 2016 lows. During Friday, it approached 1.0700 but lost strength and pulled back toward 1.0650 where it was about to end the week.