WTI challenging lows near $52.20

Crude oil prices are slightly in the red at the beginning of the week, with the West Texas Intermediate around the $52.20 area per barrel.

WTI weaker on USD buying, Saudi officials

Prices for the WTI are retreating for the second consecutive session so far today, testing lows near the key $52.00 mark following a string rebound in the demand for the greenback.

Risk-off sentiment has picked up extra pace today in response to heightened risks on the likeliness of a Brexit scenario, all in light of the speech by UK’s PM Theresa May on Tuesday.

Somewhat alleviating upside pressure, Saudi Energy Minister said the current deal to limit the oil output is unlikely to extend beyond six months.

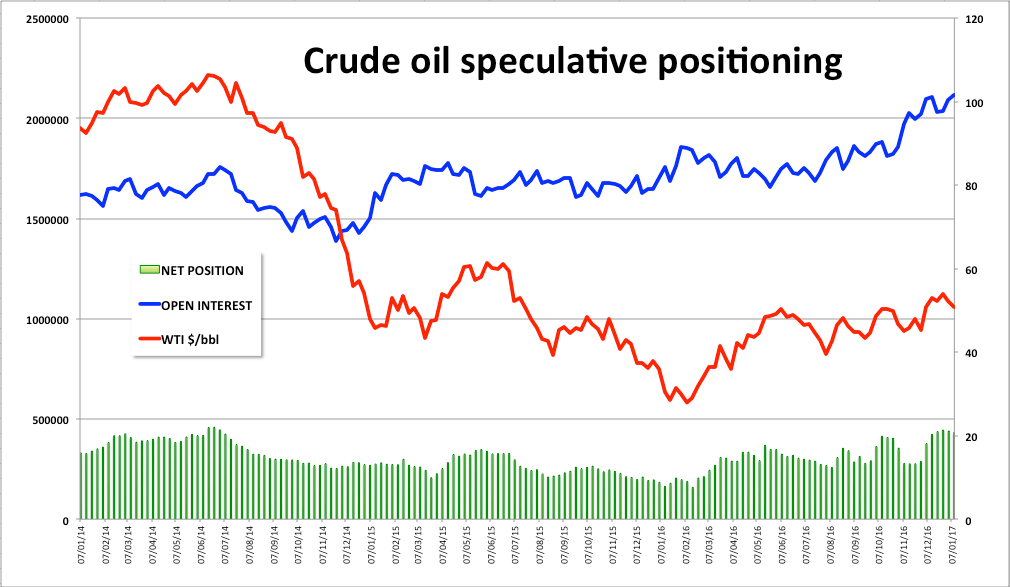

On another direction, WTI speculative net longs have decreased to 4-week lows during the week ended on January 10, as per the latest CFTC report.

WTI levels to consider

At the moment the barrel of WTI is losing 0.38% at $52.16 and a break below $50.71 (low Jan.10) would expose $49.95 (low Dec.15) and then $49.88 (55-day sma). On the other hand, the next hurdle lines up at $52.97 (20-day sma) followed by $54.32 (high Jan.6) followed by $53.50 (high Jan.12) and finally $54.32 (high Jan.6).