When is US CPI/Retail Sales and how could affect EUR/USD

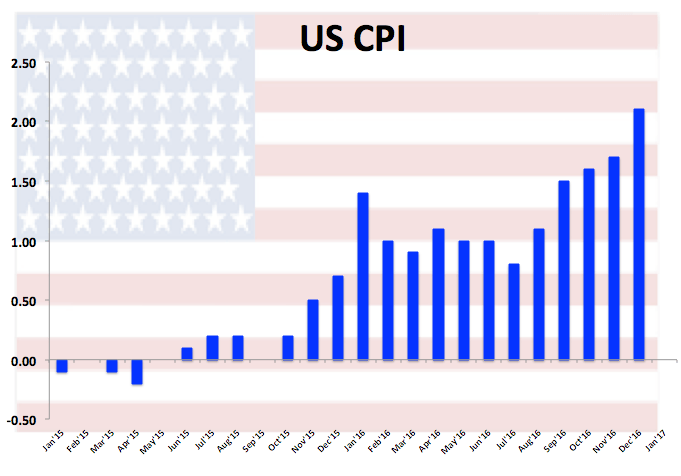

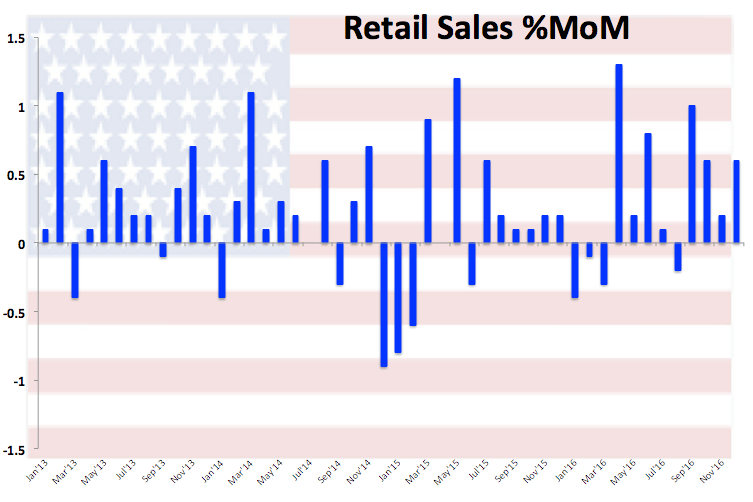

The Bureau of Labor Statistics will publish later today the inflation figures tracked by the CPI for the month of January (13:30h GMT), while the Census Bureau will release its results for Retail Sales during the same period (13:30h GMT).

What does the consensus expect?

Market consensus sees US headline consumer prices to have risen at an annualized 2.4%, while prices excluding Energy and Food costs are seen advancing 2.1% over the last twelve months.

Regarding Retail Sales, prior surveys point to a 0.1% gain on a monthly basis, while Sales stripping the Autos sector should have expanded 0.4 inter-month.

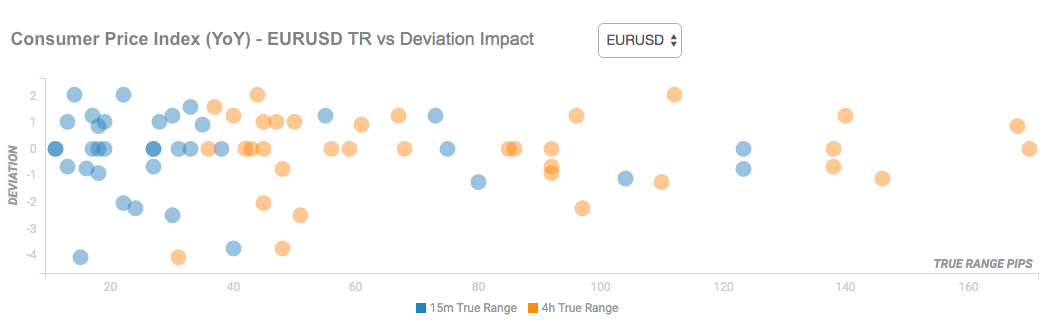

What’s the likely effect on EUR/USD?

In light of the current scenario of USD-strength, positive readings today should sustain further the upside momentum around the buck. Despite the CPI is not the preferred gauge of inflation for the Federal Reserve, a continuation of the uptrend should be seen as healthy nonetheless, collaborating with the already strong US fundamentals and adding to rising expectations of a sooner-rather-than-later rate hike by the Fed.

In this case, EUR/USD is expected to intensify its decline, which is already navigating 5-week lows, opening the door for a test of the key area in the mid-1.0400s (2015 lows) ahead of 14-year troughs in the 1.0340 region seen in early January.