AUD/USD bulls like buying the 0.7700 level

- US Personal Consumption Expenditure Prices (PCE) are scheduled next week on Thursday.

- AUD/SUD traders are cautious as the week is ending virtually unchanged.

The AUD/USD is trading at around 0.7732, up 0.51% on the day so far as the dominant theme in the market on Friday seems to be the development of an all-out trade war as Trump seem decided to impose tariffs on steel and aluminum on the EU. Mrs. Lagarde, from the IMF, warned that trade wars benefited nobody.

Next week will see the US GDP readings on Wednesday as well as preliminary PCE which is the favorite inflation indicator of the Federal Reserve while on Thursday will see the final US CPE. No macro data is expected to be released from Australia.

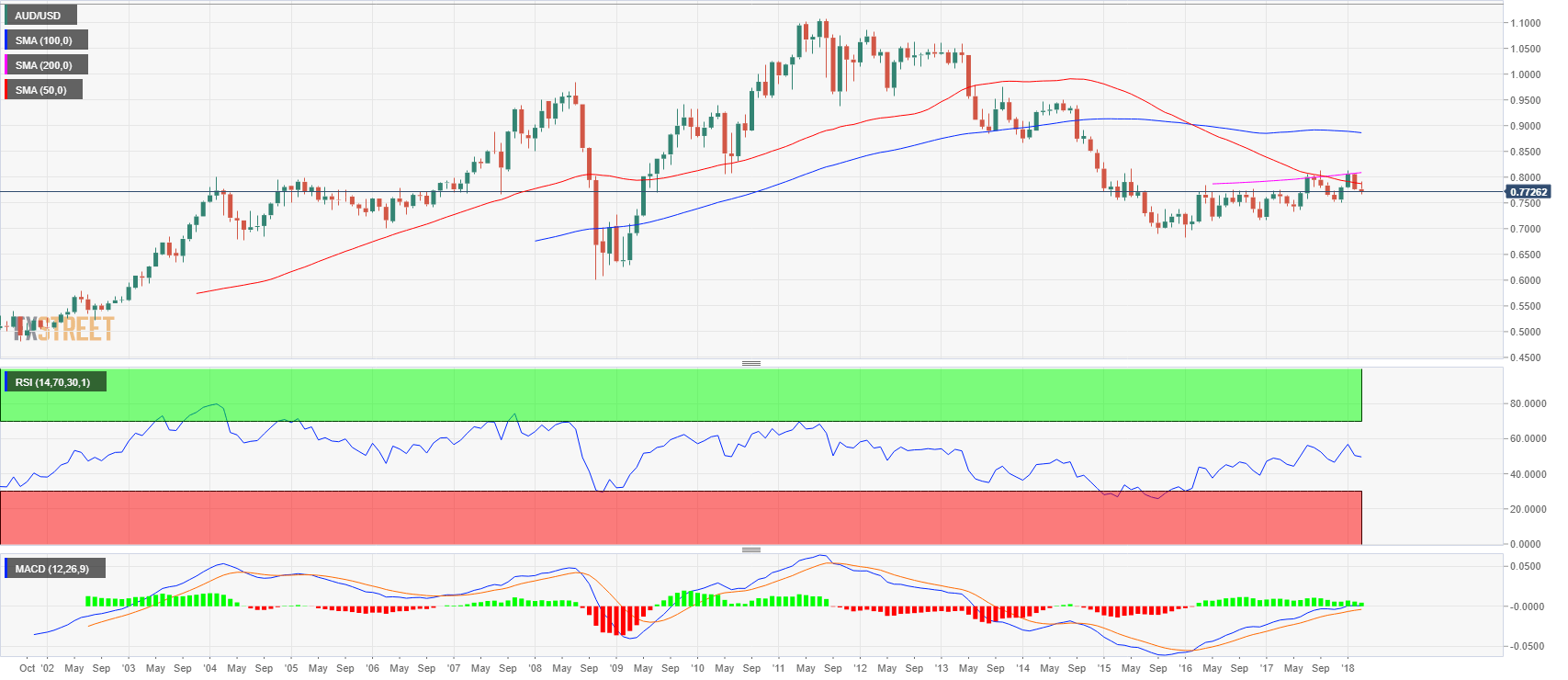

AUD/USD monthly chart:

The AUD/USD is trading below both its 100 and 200-period simple moving averages. The 50-period simple moving average has been rejected so far in March, which is considered a bearish sign. February saw the rejection of the 200-SMA. The Aussie has been evolving in a bull channel since mid-2015 and although the move lasted almost three years it might be considered as a correction from the 2011-2015 bear trend. Thus implying that a continuation of the bear trend at some point appears more likely than a bull acceleration at this stage. We have to see if the rate differential will come into play in the medium-term. Technical indicators RSI and MACD remain constructive to the upside so far.

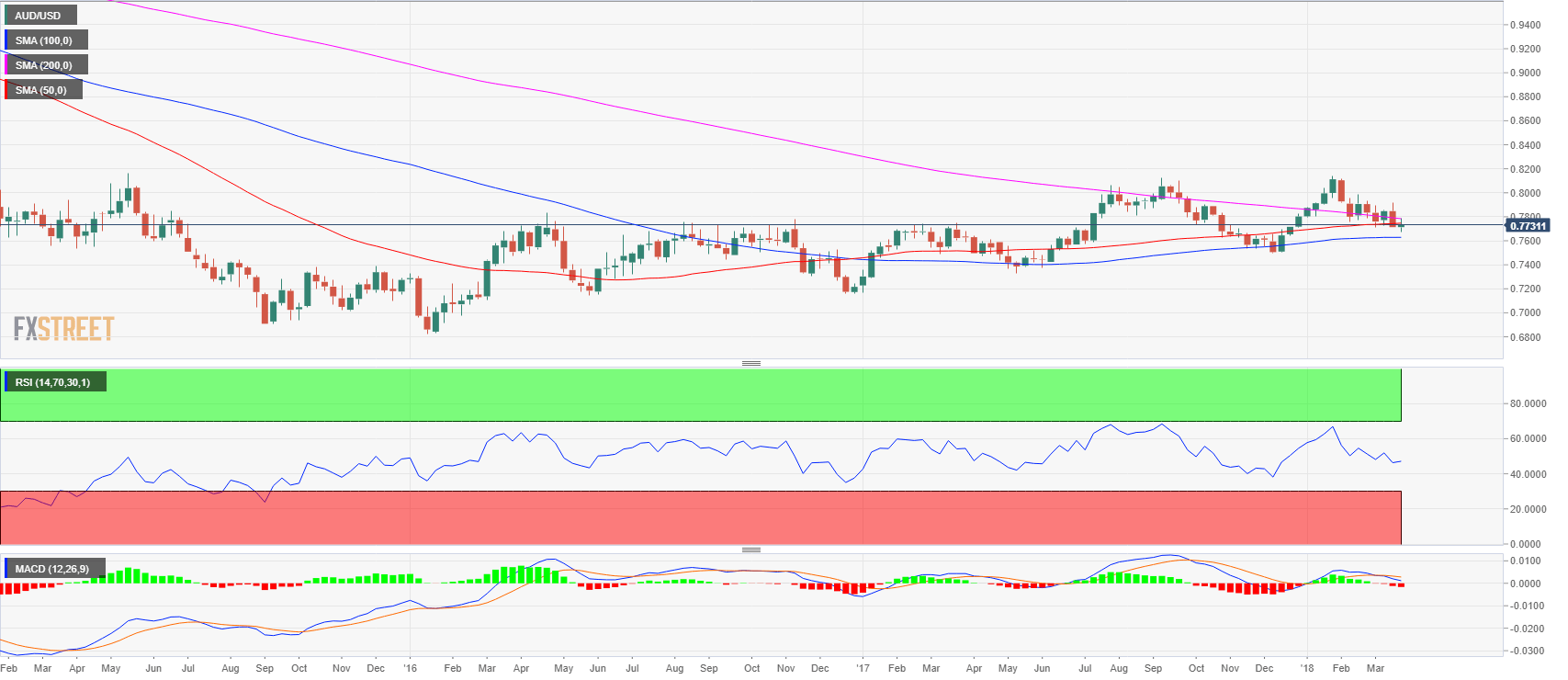

AUD/USD weekly chart:

It seems the week is going to close little changed below the 50 and 200 SMA as the bears made an attempt below 0.7700 but failed as the bulls stepped back in to lift the market back up. The RSI and MACD are bearishly configured, implying that there might be an underlying bear trend going on.

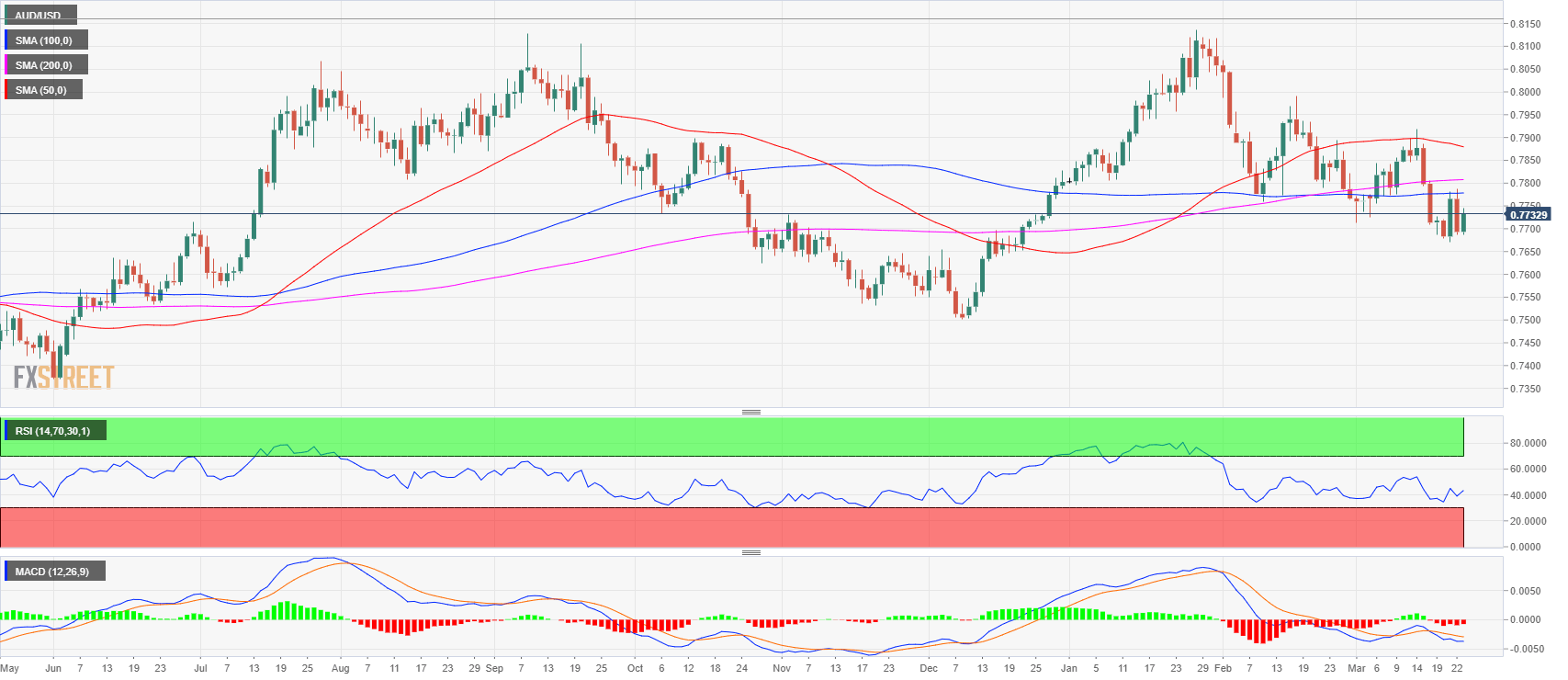

AUD/USD daily chart:

The AUD/USD this week kept consolidating in the lower part of the 3-month wedge bull flag supported at the 0.770 level. As to make a statement, the bear rejected the 100-period simple moving average on two occasions. Support is clearly the 0.7700 level after which it seems that the only significant level in sight would be the 0.7550 cyclical low established on December, 8 -2017. resistance is seen at 0.7780 high of the week and 0.7850 previous supply zone.