GBP/USD Technical Analysis: Cable reverses up as 1.2700 figure is back on the bulls radar

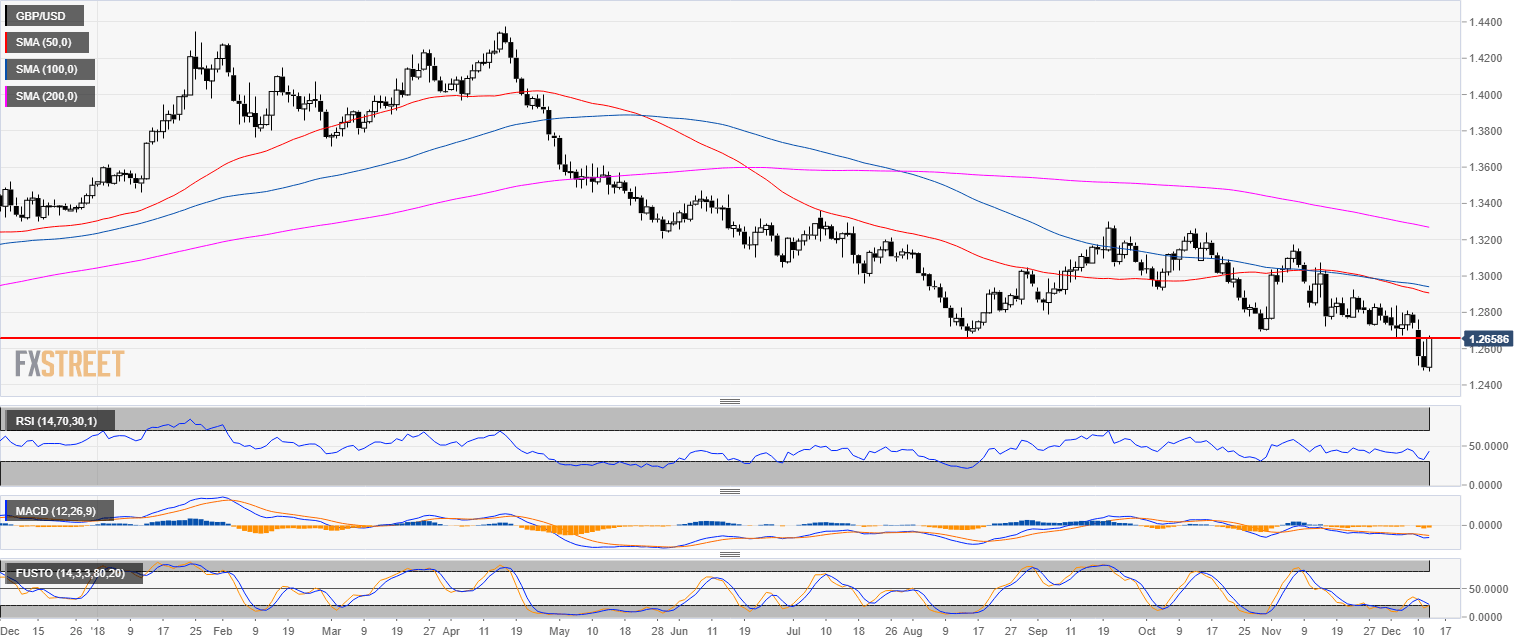

GBP/USD daily chart

- GBP/USD is trading in a bear trend below the 50, 100 and 200-day simple moving average (SMA).

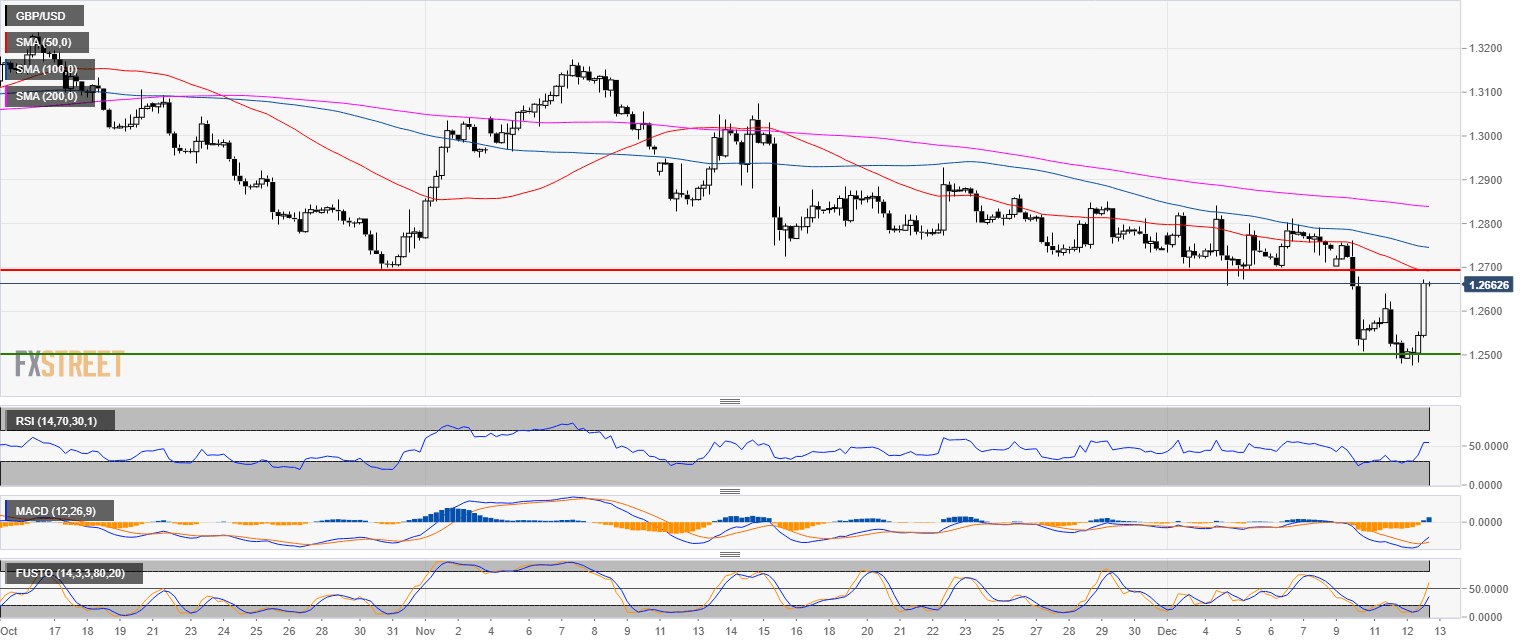

GBP/USD 4-hour chart

- GBP/USD rebounded from the 1.2500 figure as it is trading below its main SMAs.

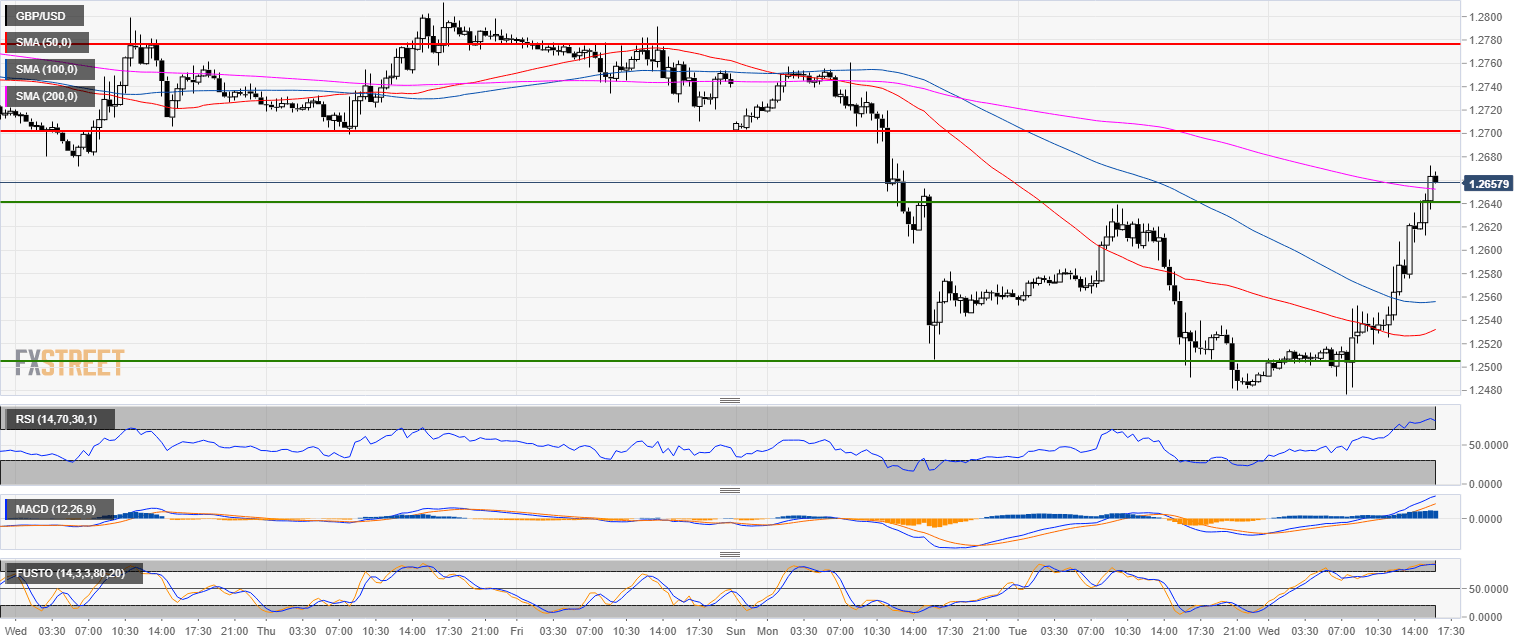

GBP/USD 30-minute chart

- GBP/USD broke above the 1.2640 resistance and the 200 SMA.

- The 1.2700 figure and 1.2775 become the next targets.

Additional key levels

GBP/USD

Overview:

Today Last Price: 1.2663

Today Daily change: 1.7e+2 pips

Today Daily change %: 1.33%

Today Daily Open: 1.2497

Trends:

Previous Daily SMA20: 1.2769

Previous Daily SMA50: 1.2913

Previous Daily SMA100: 1.2946

Previous Daily SMA200: 1.3275

Levels:

Previous Daily High: 1.2639

Previous Daily Low: 1.2481

Previous Weekly High: 1.284

Previous Weekly Low: 1.2659

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2542

Previous Daily Fibonacci 61.8%: 1.2579

Previous Daily Pivot Point S1: 1.2439

Previous Daily Pivot Point S2: 1.2381

Previous Daily Pivot Point S3: 1.2281

Previous Daily Pivot Point R1: 1.2598

Previous Daily Pivot Point R2: 1.2698

Previous Daily Pivot Point R3: 1.2756