Back

13 Feb 2019

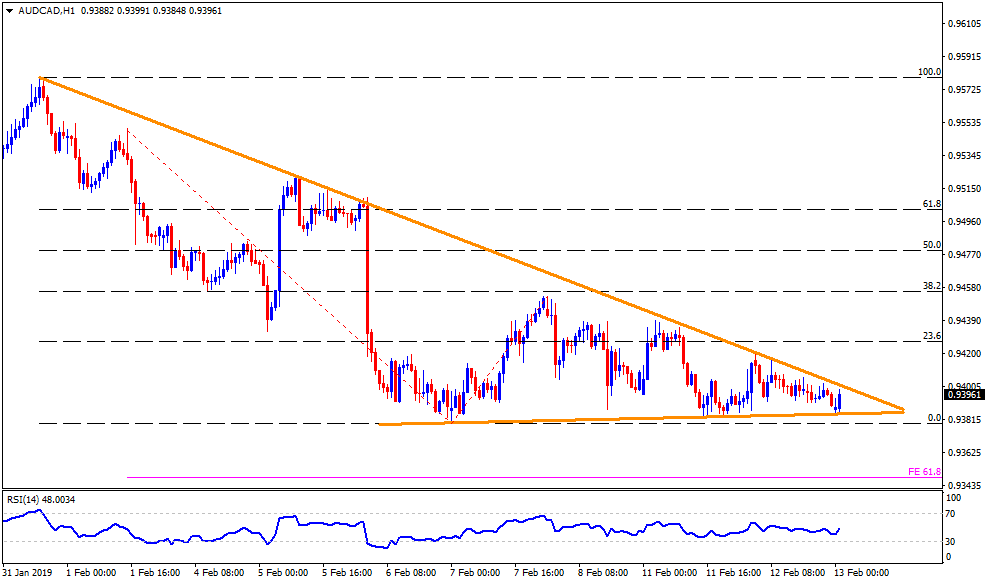

AUD/CAD Technical Analysis: Upbeat Australian consumer sentiment highlights descending triangle resistance of 0.9405 on the hourly chart

- AUD/CAD struggles near 0.9395 during early Asian trading sessions on Wednesday.

- The pair forms descending triangle formation on the hourly chart with 0.9380 being support and 0.9405 acting as resistance.

- Considering latest rise of February month Westpac Consumer Sentiment to +4.3% from -4.7% released last-month, the pair may challenge 0.9405 resistance level.

- A break of 0.9405 could trigger the upside to 0.9420 and then to 0.9440 whereas 38.2% Fibonacci retracement of its early month moves, at 0.9455, followed by the 0.9490, may entertain buyers afterward.

- On the contrary, a downside break of 0.9380 formation support may take a rest around 0.9375 before declining towards the 61.8% Fibonacci expansion level of 0.9345.

AUD/CAD hourly chart