Back

19 Feb 2019

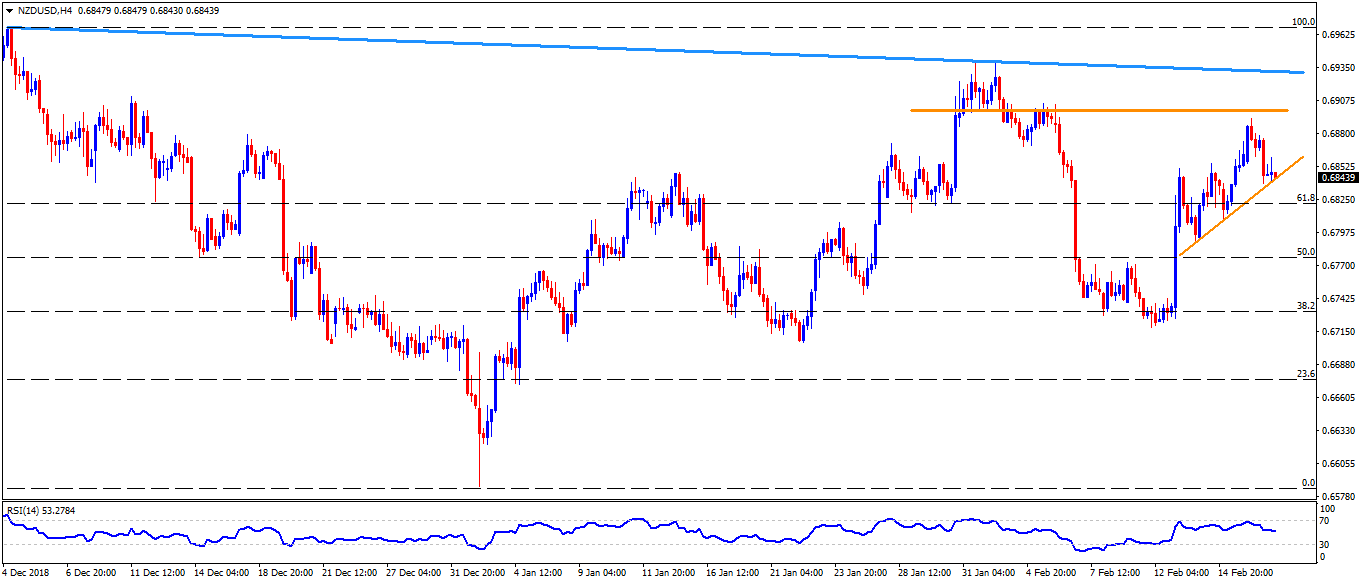

NZD/USD Technical Analysis: Immediate support-line at 0.6845 guards the downside

- The New Zealand Dollar (NZD) trades around 0.6845 against the USD during early Tuesday.

- The pair now rests on an immediate support-line connecting lows marked on February 13 and 15.

- Should the pair provides a decisive break below the 0.6845 support, the 0.6800 round-figure may offer intermediate halt during its drop to 50% Fibonacci retracement of December to January downturn, at 0.6775.

- Assuming the seller’s dominance past-0.6775, 0.6720 and 0.6700 can become their favorites.

- On the flipside, 0.6870 may act as adjacent cap ahead of diverting market attention to 0.6900 horizontal-line.

- Additionally, pair’s successful rise over 0.6900 enables it to confront a downward sloping resistance-line stretched since late-December, at 0.6935 now.

NZD/USD 4-Hour chart