EUR/USD technical analysis: Gradually declines to revisit short-term rising support-line

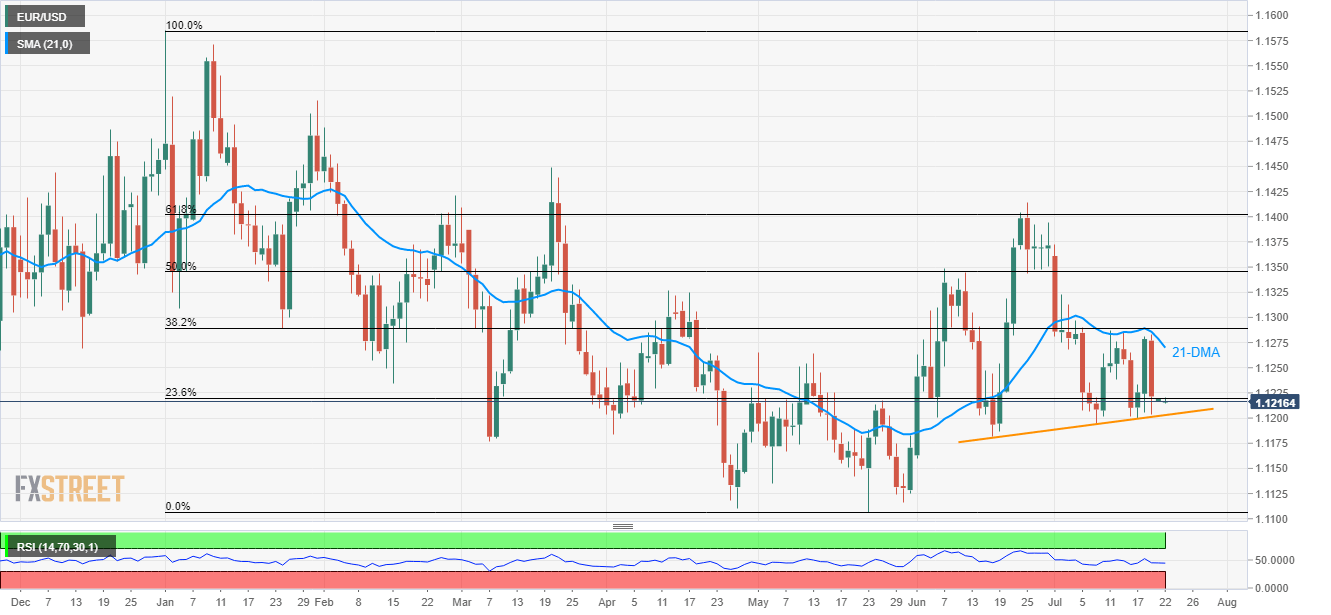

- 21-DMA limits near-term EUR/USD upside, highlights 4-week old support-line for sellers.

- Steady RSI and sustained trading below 23.6% Fibonacci retracement favor declines.

In addition to remaining below the 21-day moving average (21-DMA), the EUR/USD pair’s decline below 23.6% Fibonacci retracement of January – May south-run also portrays the quote’s weakness as it makes the rounds to 1.1216 on early Monday.

However, a daily closing below an ascending trend-line since June 18, at 1.1203, becomes necessary for the pair to lure the sellers.

Should the 14-day relative strength index (RSI) also support the downside, current month low surrounding 1.1193 and June month bottom close to 1.1181 seem to be on bears’ radar ahead of watching over 1.1130 and 1.1100 key supports.

On the contrary, 1.1240 can entertain short-term buyers while 21-DMA figure of 1.1270 and the 1.1300 round-figure may question further upside.

EUR/USD daily chart

Trend: Bearish