Back

11 Oct 2019

AUD/USD technical analysis: Aussie clings to daily gains near 0.6800 after the London close

- The risk-on sentiment boosts AUD/USD to the 0.6800 handle.

- The level to beat for bulls is the 0.6815 resistance.

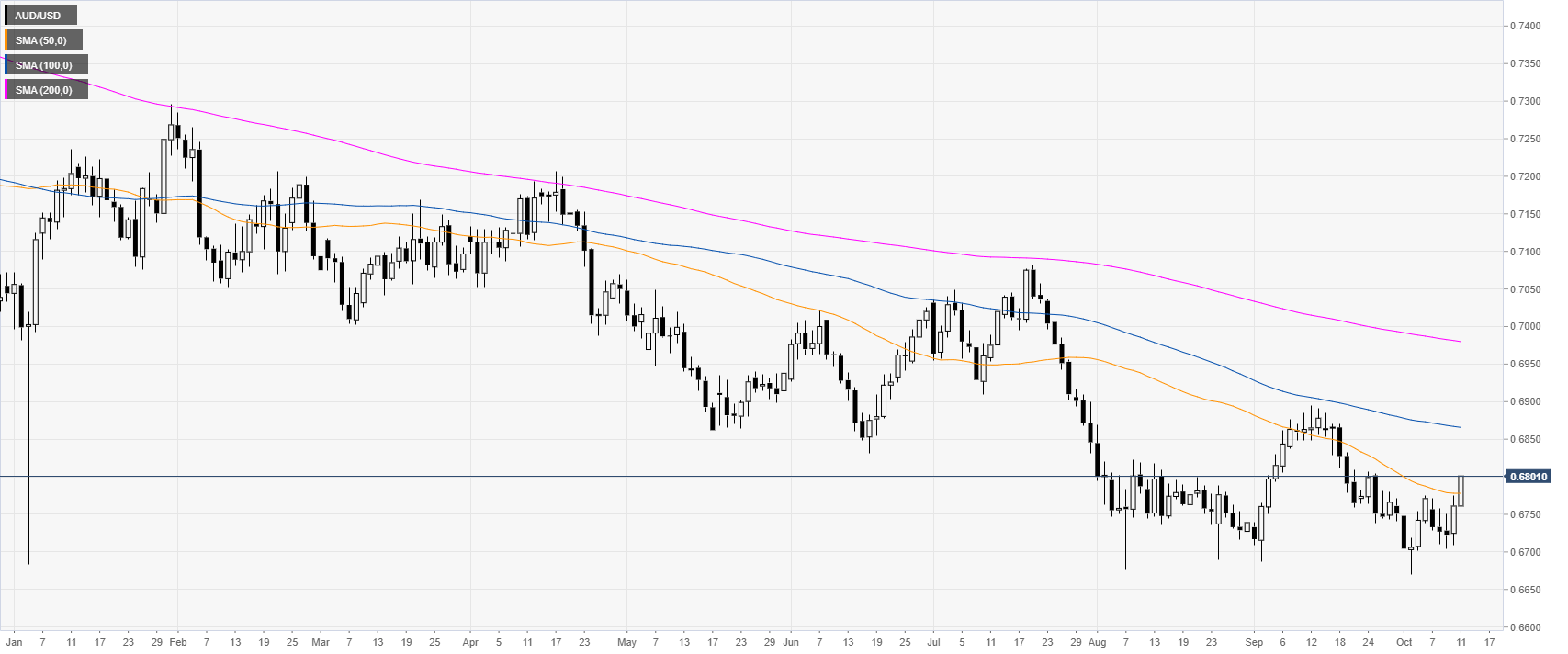

AUD/USD daily chart

The Aussie is trading in a bear trend below the 100 and 200 simple moving averages (SMAs) on the daily chart. The risk-on mood is boosting the AUD.

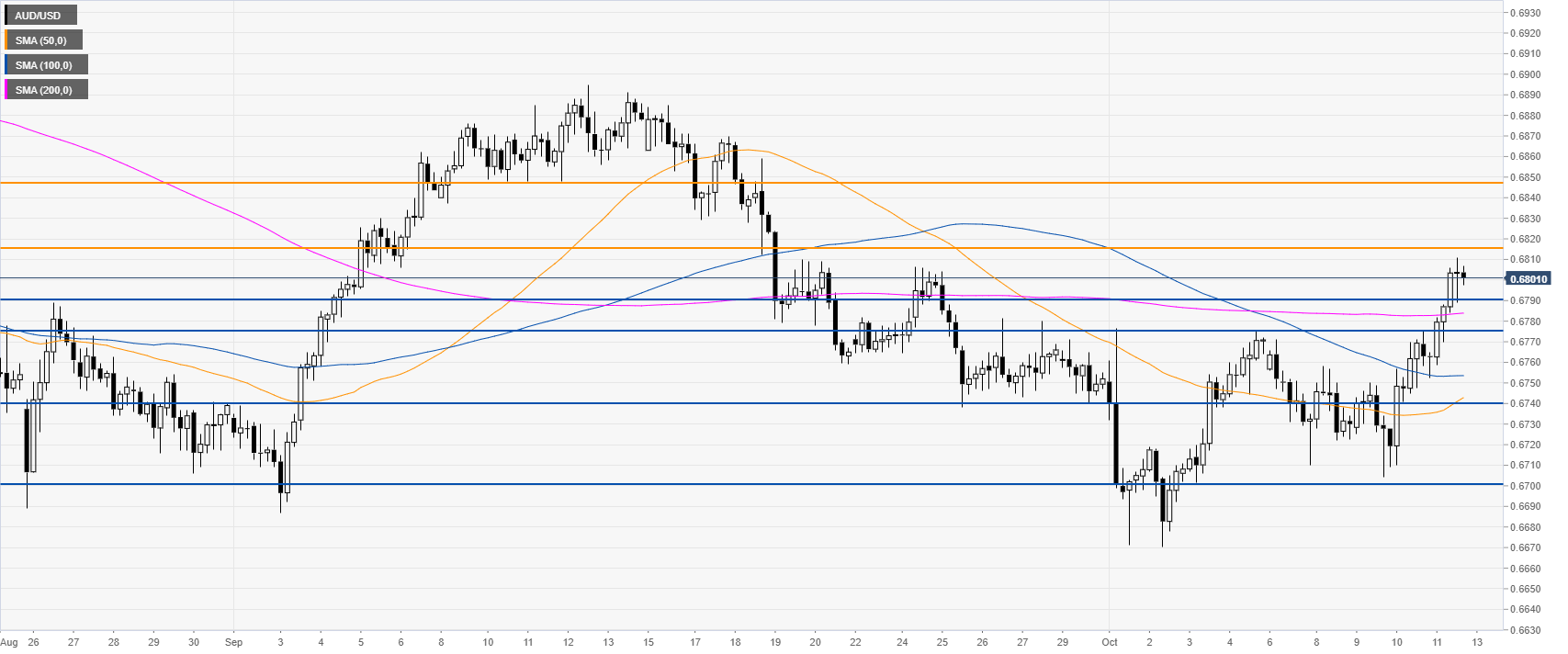

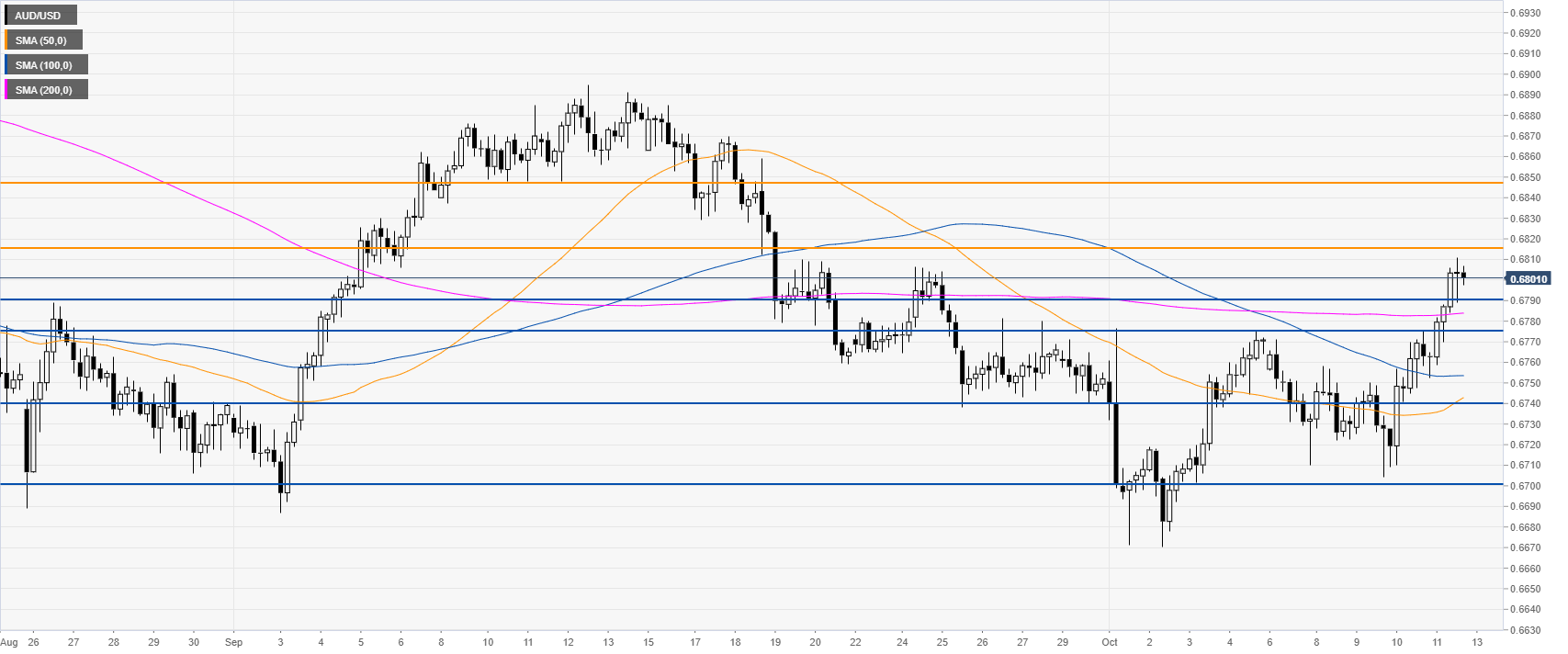

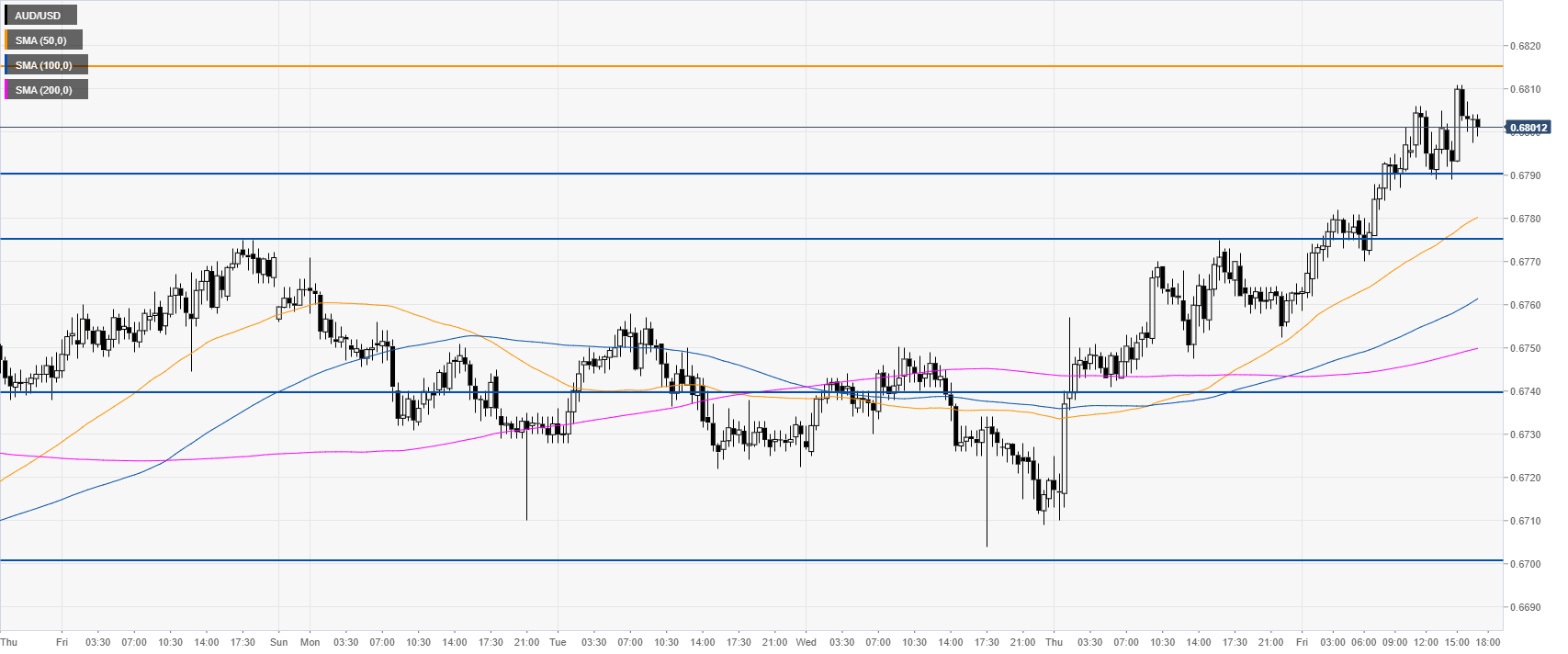

AUD/USD 4-hour chart

The AUD/USD exchange rate is trading above the main SMAs, suggesting a bullish momentum in the medium term. The market is challenging the 0.6815 resistance. A break above the level can see the Aussie going up to the 0.6847 level, according to the Technical Confluences Indicator.

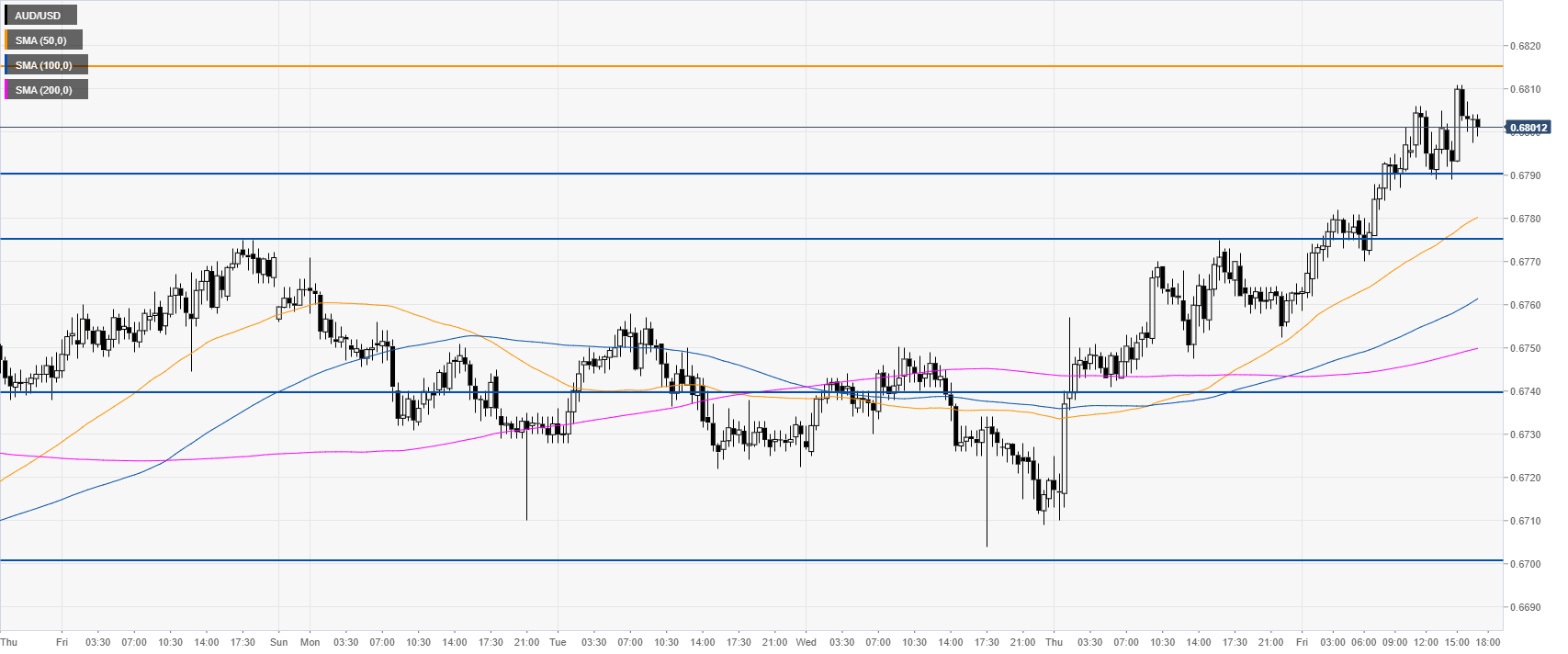

AUD/USD 30-minute chart

AUD/USD is trading above its main SMAs on the 30-minute chart, suggesting bullish momentum in the near term. Immediate supports are seen at the 0.6790, 0.6776 and 0.6741 price levels.

Additional key levels