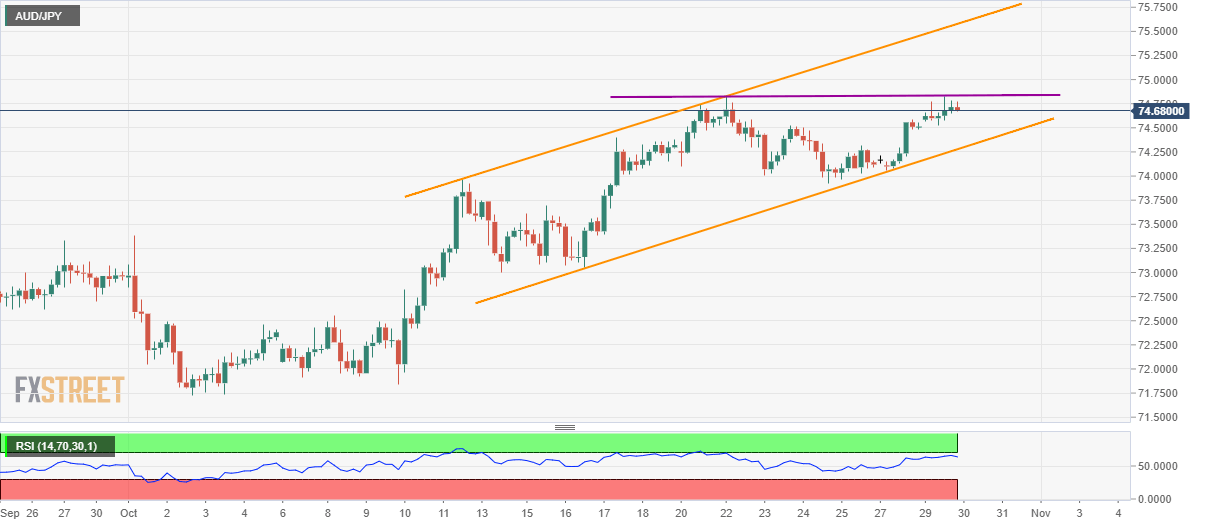

AUD/JPY technical analysis: Horizontal resistance, overbought RSI contradict rising channel ahead of AU CPI

- AUD/JPY confronts one-week-old horizontal resistance amid overbought RSI conditions.

- A bit broader rising channel portrays the strength of buyers.

- Third-quarter (Q3) inflation numbers from Australia will be the key fundamental catalyst to watch for now.

Having successfully bounced from the sub-74.00 area, AUD/JPY confronts key short-term resistance inside a bullish chart formation while trading near 74.71 amid early Asian morning on Wednesday.

Not only immediate horizontal-line around 74.83/85, but overbought conditions of 14-bar Relative Strength Index (RSI) also increase hardships for the pair ahead of Q3 Consumer Price Index (CPI) data from Australia.

Forecasts favor headline inflation figure to soften from 0.6% to 0.5% on QoQ basis while the Reserve Bank of Australia’s (RBA) Trimmed Mean CPI is likely remaining static at 0.4% on the same format.

Should the pair fail to cross 74.83 following the data release, the channel’s support around 74.27 gains market attention in order to anticipate a downpour towards 73.00 region comprising multiple lows marked during mid-month.

On the contrary, pair’s additional run-up beyond 74.83 enables it to aim for the channel’s resistance-line, at 75.57 now, with early July month low near 75.15 likely acting as an immediate resistance to watch.

AUD/JPY 4-hour chart

Trend: pullback expected