Back

5 Nov 2019

GBP Futures: extra losses look likely

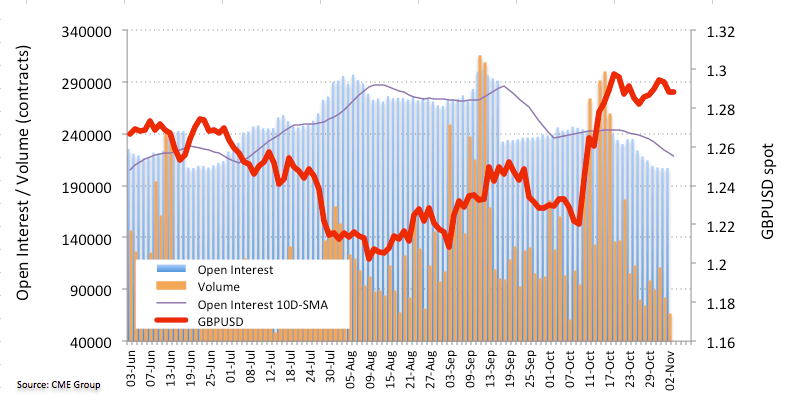

CME Group’s flash data for GBP futures markets noted investors added just 216 contracts to their open interest positions following six consecutive daily pullbacks. Volume, instead, went down for the second consecutive session, this time by around 15.4K contracts.

GBP/USD risks a test of the 1.2800 area

Cable’s decline at the beginning of the week was in tandem with a small increase in open interest after last week’s short covering phase. On the flip side, volume dropped once again and it could somewhat warn against a quick correction lower. Against this backdrop, a visit to the 1.2800 neighbourhood in the near term should not be ruled out. This area of contention is also reinforced by the vicinity of the 21-day SMA at 1.2773.