Back

22 Jan 2020

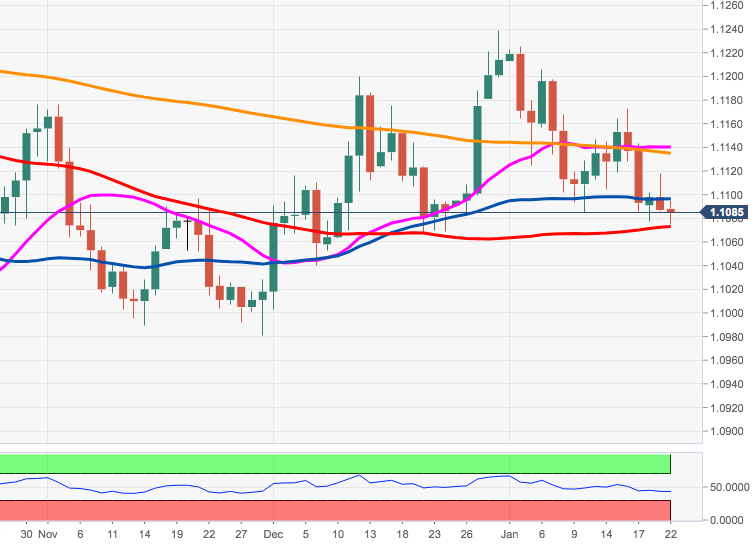

EUR/USD Price Analysis: Decline looks supported near 1.1060

- EUR/USD is bouncing of earlier 2020 lows at 1.1075.

- The 100-day SMA/support line near 1.1060 act as solid support.

EUR/USD is struggling for direction on Wednesday, managing to regain some poise after bottoming out in new yearly lows at 1.1075.

If sellers remain in control, the pair could attempt a visit to the 1.1070/65 band, where converge the 100-day SMA and the 3-month support line.

The offered bias in the spot should alleviate somewhat above the 55-day SMA, today at 1.1090.

EUR/USD daily chart