Back

4 Feb 2020

USD/JPY Asia Price Forecast: Greenback recovers strongly vs. yen

- USD/JPY had a surprising recovery smashing through multiple resistances.

- The level to beat for bulls is the 109.66 resistance.

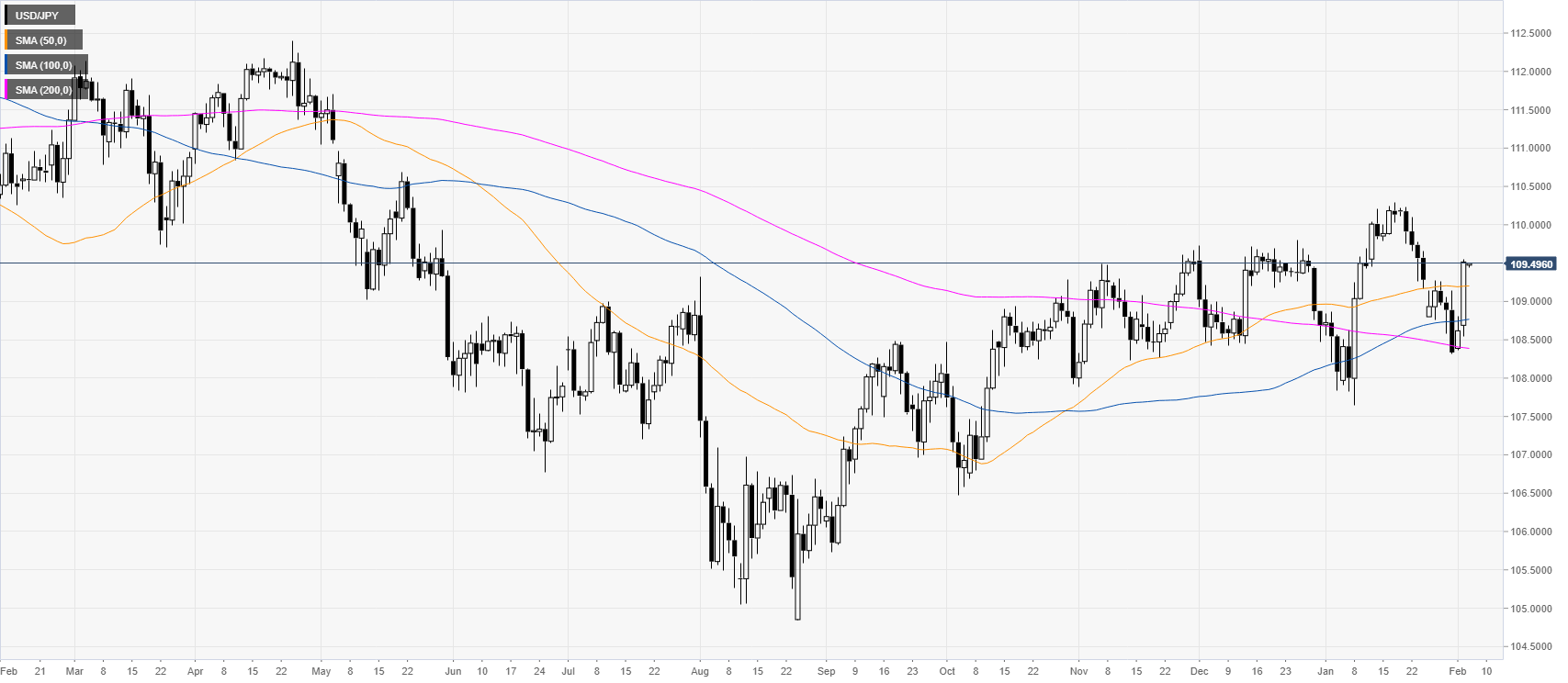

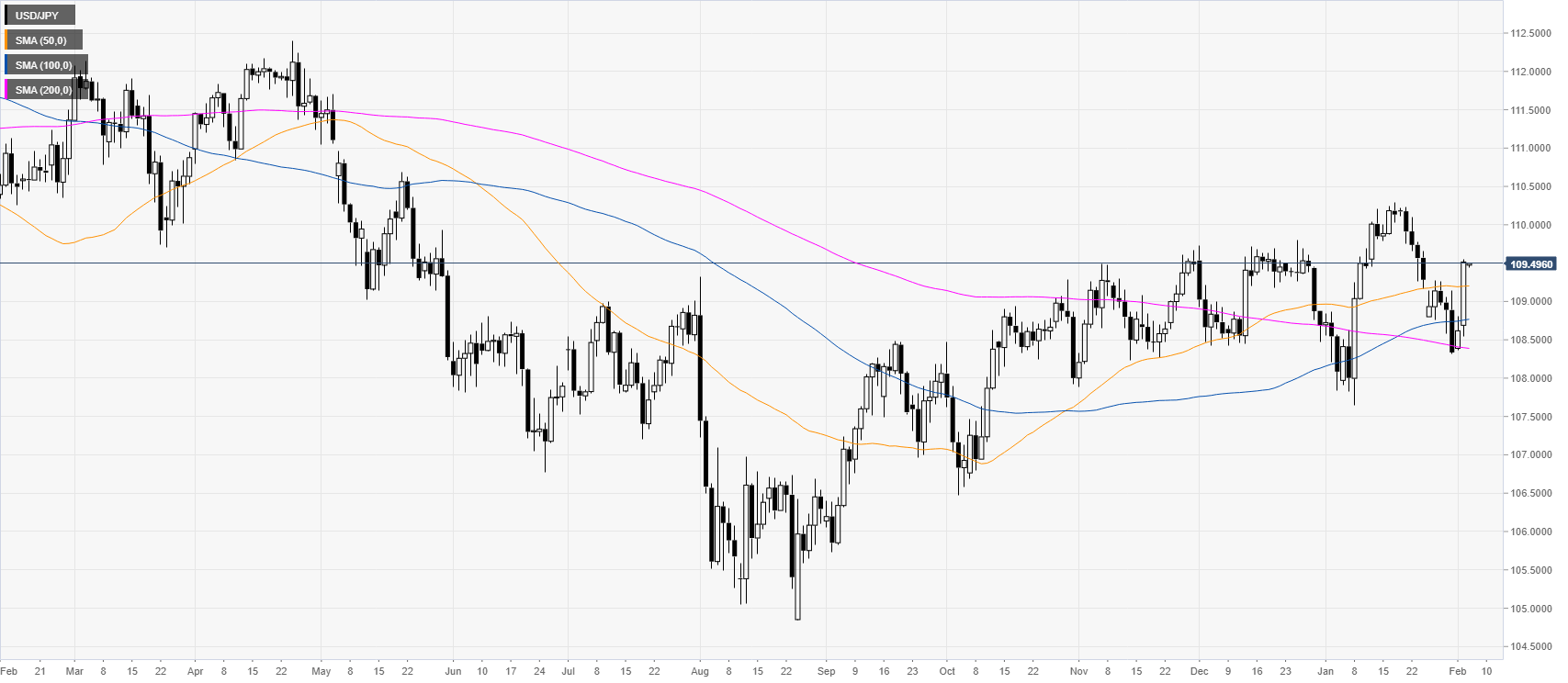

USD/JPY daily chart

USD/JPY jumped sharply back above the main simple moving averages (SMAs) as the market mood switch to risk-on.

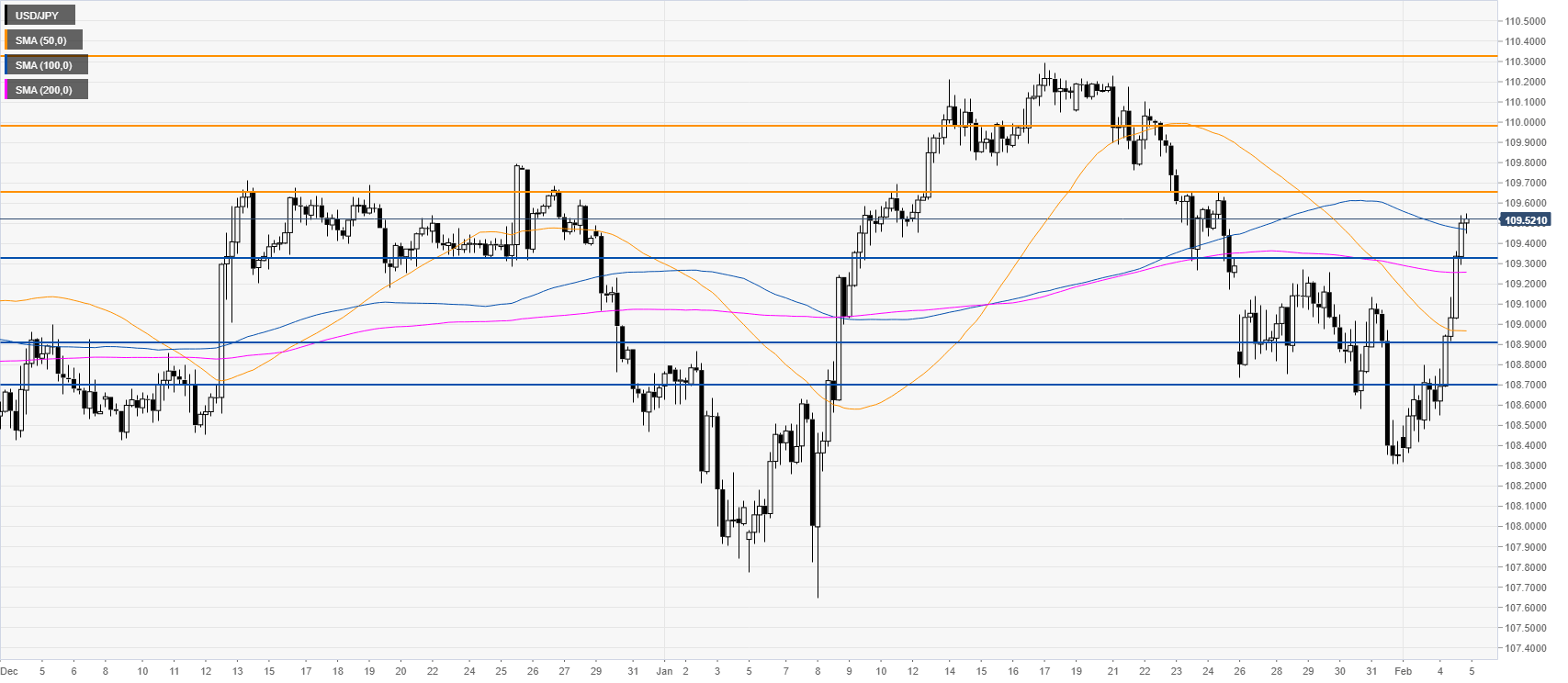

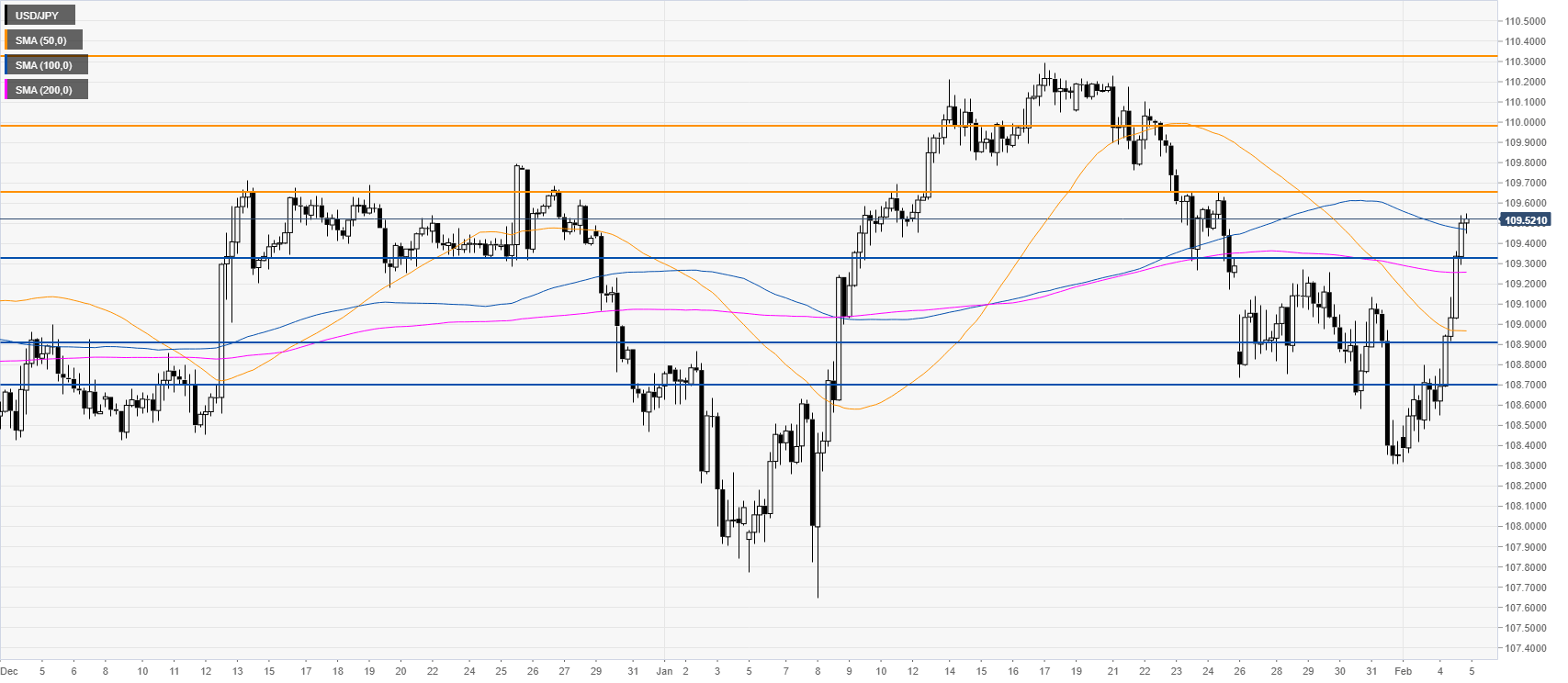

USD/JPY four-hour chart

USD/JPY had a strong boost to the upside rebounding from multi-week lows. The bulls seem to be back in control and the spot might attempt to overcome the 109.66 resistance to reach 110.00 and 110.34 on the way up. Retracement down could find support near the 109.32, 108.90 and 108.70, according to the Technical Confluences Indicator.

Resistance: 109.66, 110.00, 110.34

Support: 109.32, 108.90, 108.70

Additional key levels