Breaking: A mixed New Zealand jobs report sends NZD to 0.65 the figure

This is a developing news

- Unemployment rate was expected to hold steady again at 4.2%, arrived at 4%, bullish.

- Employment Change was expected to come in at 0.3% QoQ, arrived unchanged 0.0%, bearish.

- NZD/USD has moved to test 0.65 the figure.

The NZD is in play with the release of the key New Zealand jobs report, the final data for the quarter ahead of the Reserve Bank of New Zealand's interest rate meeting on 14th Feb. The data has arrived as follows and has helped support a bullish outlook for NZD.

Expectations

- Unemployment rate expected to hold steady again at 4.2%.

- Annual wage inflation is expected to come in also unchanged at 2.3%.

- Employment Change is expected to come in at 0.3% QoQ, looking for 1.2% YoY.

- Labour force participation is expected to hold steady at to 70.4% of the working-age population, a historically high level.

NZ jobs report: The outcome

- NZ Unemployment Rate (Q4): 4.0% (est 4.2%, prev 4.2%)

- Employment Change (Q/Q): 0.0% (est 0.3%, prevR 0.3%)

- Employment Change (Y/Y): 1.0% (est 1.2%, prev 0.9%)

- Participation Rate: 70.1% (est 70.4%, prev 70.4%)

- Pvt Wages Ex Overtime (Q/Q): 0.6% (est 0.5%, prev 0.6%)

- Pvt Wages Inc Overtime (Q/Q): 0.6% (est 0.5%, prev 0.6%)

- Average Hourly Earnings (Q/Q): 0.1% (est 0.5%, 0.6%)

Something for everyone there, but unlikey to see the RBNZ too concerned. Unemployment is bullish for NZD.

NZD/USD in focus: Impact expectations before and after release

New Zealand Employment & Unemployment Preview: How will the data impact NZD/USD?

- Bullish outcome: A jobs report that underpins the RBNZ staying on hold for the foreseeable future, motivated to move toads a more neutral stance than a firm dovish bias, NZD can continue to pair back short position in the spot-FX space into the 0.65 handle, testing 0.6520 structure at a 38.2% retracement before a 50% mean revision of the downtrend located around the 0.6540s.

- Bearish outcome: On a freak downside outcome, 0.64 the figure will be back on the bear's agenda. It is worth noting that the daily ATR for the year has been at 40 pips. We have seen a low of 0.6449-0.6489 overnight already – However, on an outcome that vastly deviates from the expected, we have the 0.6520 structure at a 38.2% and 0.6420/00 range in play.

NZD/USD sitting at 0.6490 into the release and has popped to print a fresh high at 0.65 the figure.

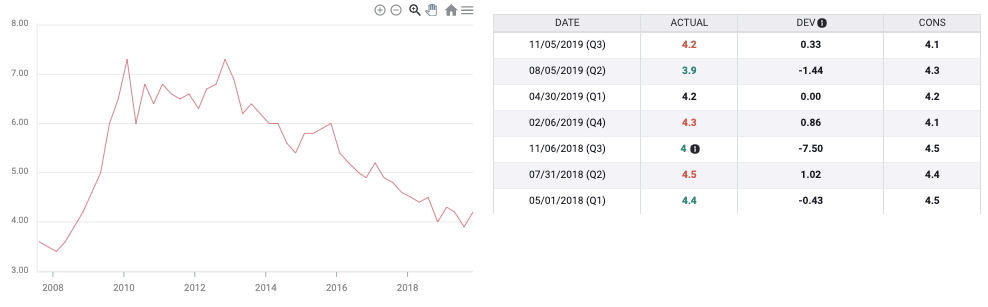

Historical data

Description

The Unemployment Rate released by the Statistics New Zealand is the number of unemployed workers divided by the total civilian labour force. If the rate is up, it indicates a lack of expansion within the New Zealand labour market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).