Back

11 Mar 2020

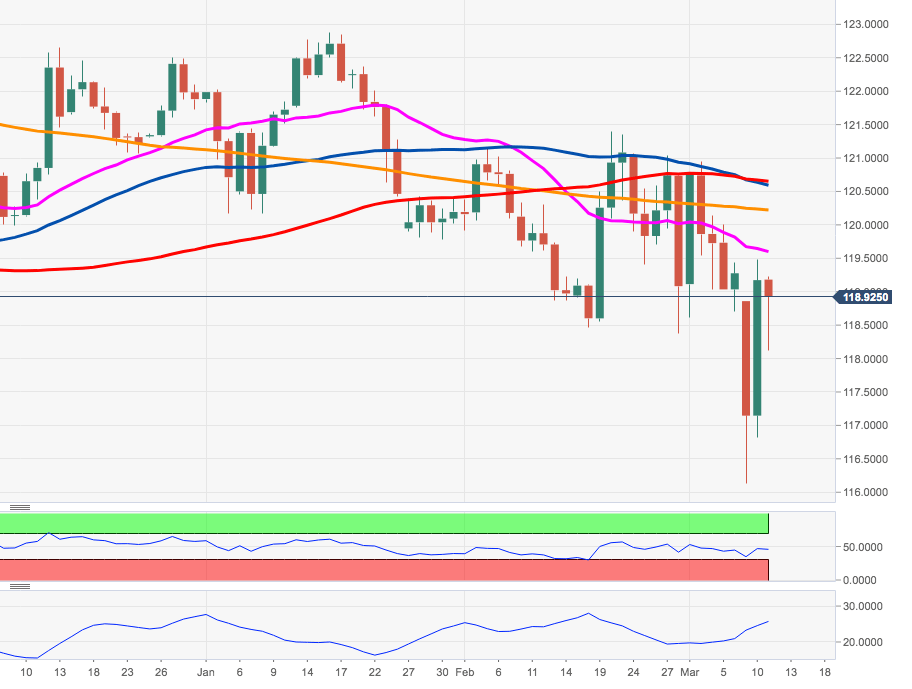

EUR/JPY Price Analysis: Consolidation appears likely in the near-term

- EUR/JPY is shedding some ground following Tuesday’s advance.

- The cross could spark some consolidation in the short-term.

EUR/JPY is giving away part of Tuesday’s strong gains to the 119.50 region, where it lost some upside momentum.

The resumption of the demand for the yen and the supportive tone in the single currency are expected to keep the cross within a consolidative fashion for the time being, or until some more defined driver turns up in the markets.

In the meantime, and while below the 200-day SMA - today at 120.20 - the downside pressure in the cross is expected to prevail.

EUR/JPY daily chart