EUR/USD Price Analysis: 200-HMA questions further downside

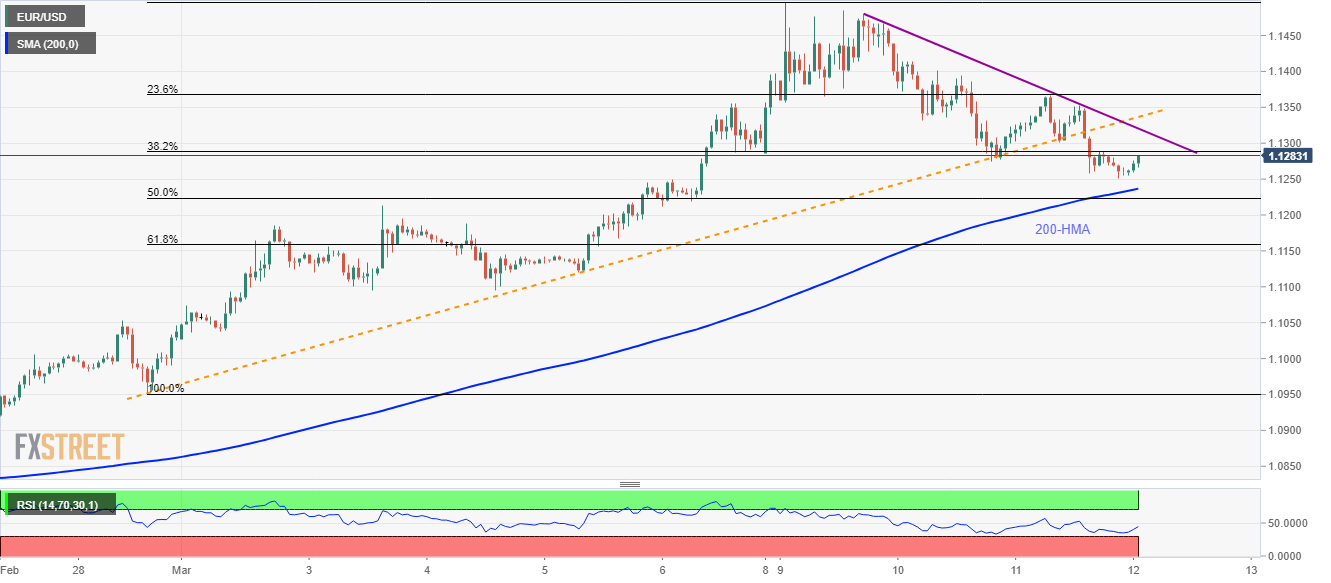

- EUR/USD stays below two-week-old trend line, which was broke the previous day.

- The weekly descending trend line also favors the bears.

Having breached a short-term support line, now resistance, EUR/USD seesaws takes rounds to 1.1270 during the Asian session on Thursday. The pair recently took clues from US President Donald Trump’s fiscal stimulus.

Read: Trump: We will defeat this virus, US will suspend all travel from Europe to US for next 30 days

Even so, the pair remains above 200-HMA, which in turn pushes the quote to confront a downward sloping trend line from Monday, at 1.1320.

Given the quote’s ability to cross 1.1320, 23.6% Fibonacci retracement of its run-up from February 28, at 1.1368, can check the buyers ahead of pushing them to 1.1400.

If at all the pair remains strong above 1.1400, the monthly high near 1.1500 could please the bulls.

Meanwhile, the pair’s declines below 200-Hour Moving Average (HMA) level of 1.1235 can drag it towards 1.1180 and 61.8% Fibonacci retracement level near 1.1160.

EUR/USD hourly chart

Trend: Pullback expected