Back

23 Mar 2020

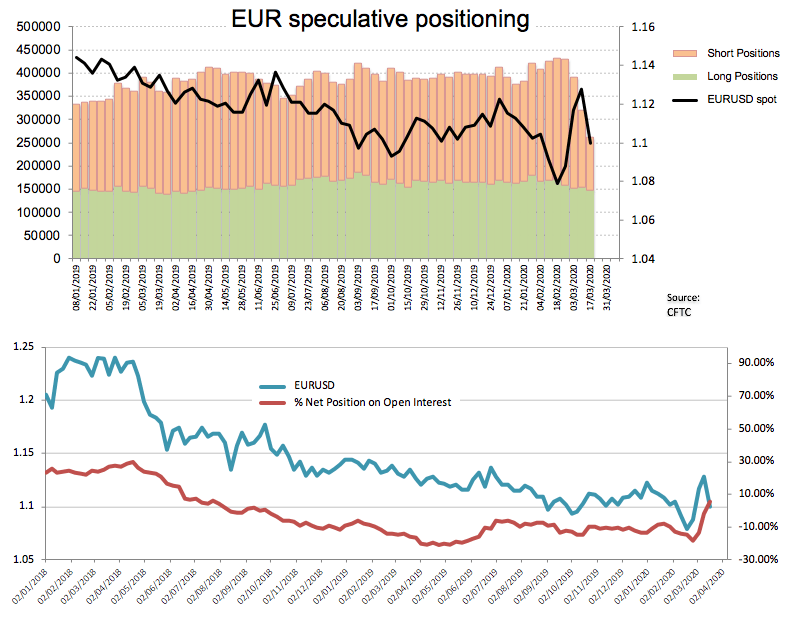

CFTC Positioning Report: Speculators turned positive on EUR

These are the main highlights of the latest CFTC Positioning Report for the week ended on arch 17th:

- EUR net longs re-emerged for the first time since late September 2018. Speculators increased their positive exposure on EUR on the back of stretched positioning in past weeks, the favourable balance of the current account in the euro area and the weaker buck following Fed initial wave of easing monetary conditions.

- JPY net longs climbed to the highest level since late August 2019 in response to the continuation of the firm demand for the safe haven universe. By the same token, net longs in CHF advanced to levels last seen in September 2016.

- RUB net longs decreased to the lowest level since mid-January 2019 as traders kept assessing the impact of the oil price crisis on the Russian currency and economy.