Back

23 Mar 2020

US Dollar Index Asia Price Forecast: Largest QE operation ever for worst crisis in history? DXY clings to 3-year’s highs

- DXY consolidates gains after an exceptional spike up.

- The level to beat for bulls is the 103.00 figure.

- Fed launches the largest stimulus program in history in response to the coronavirus crisis.

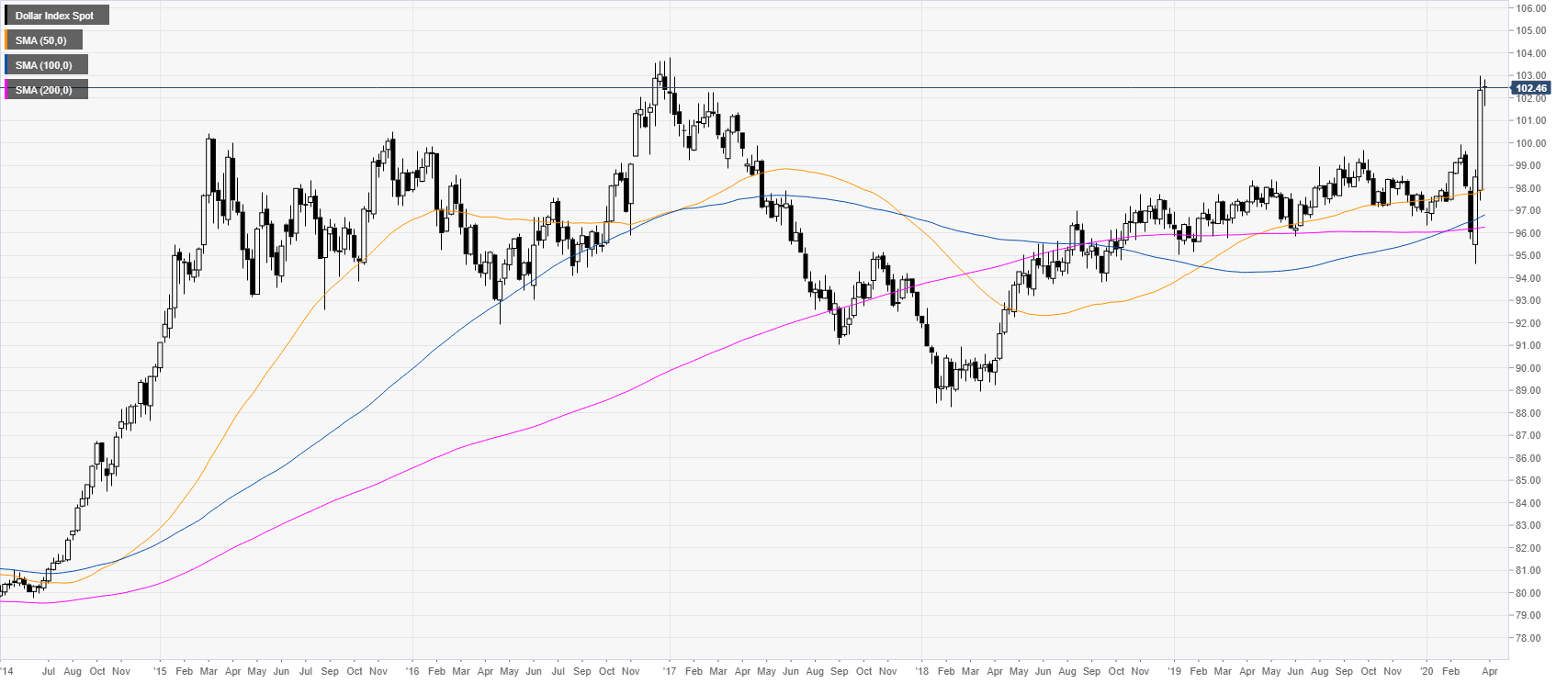

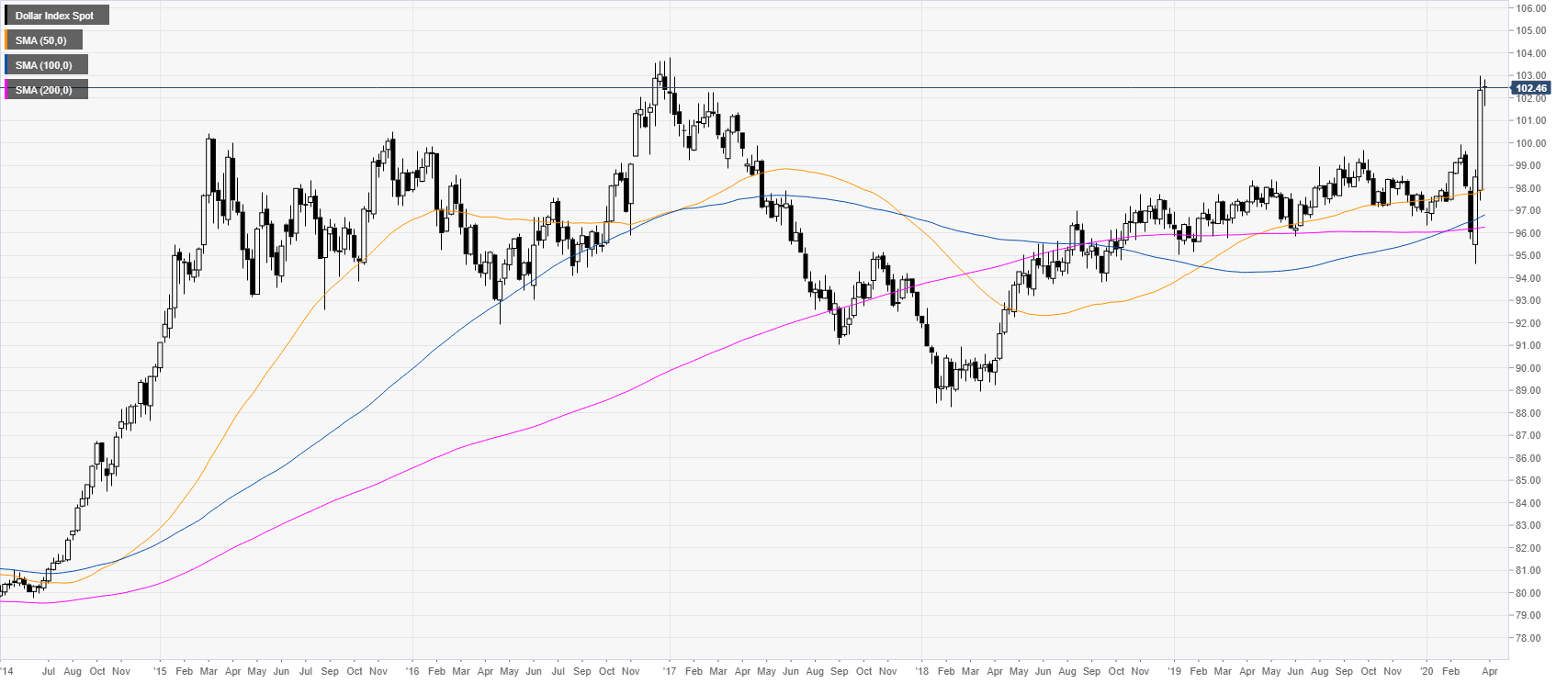

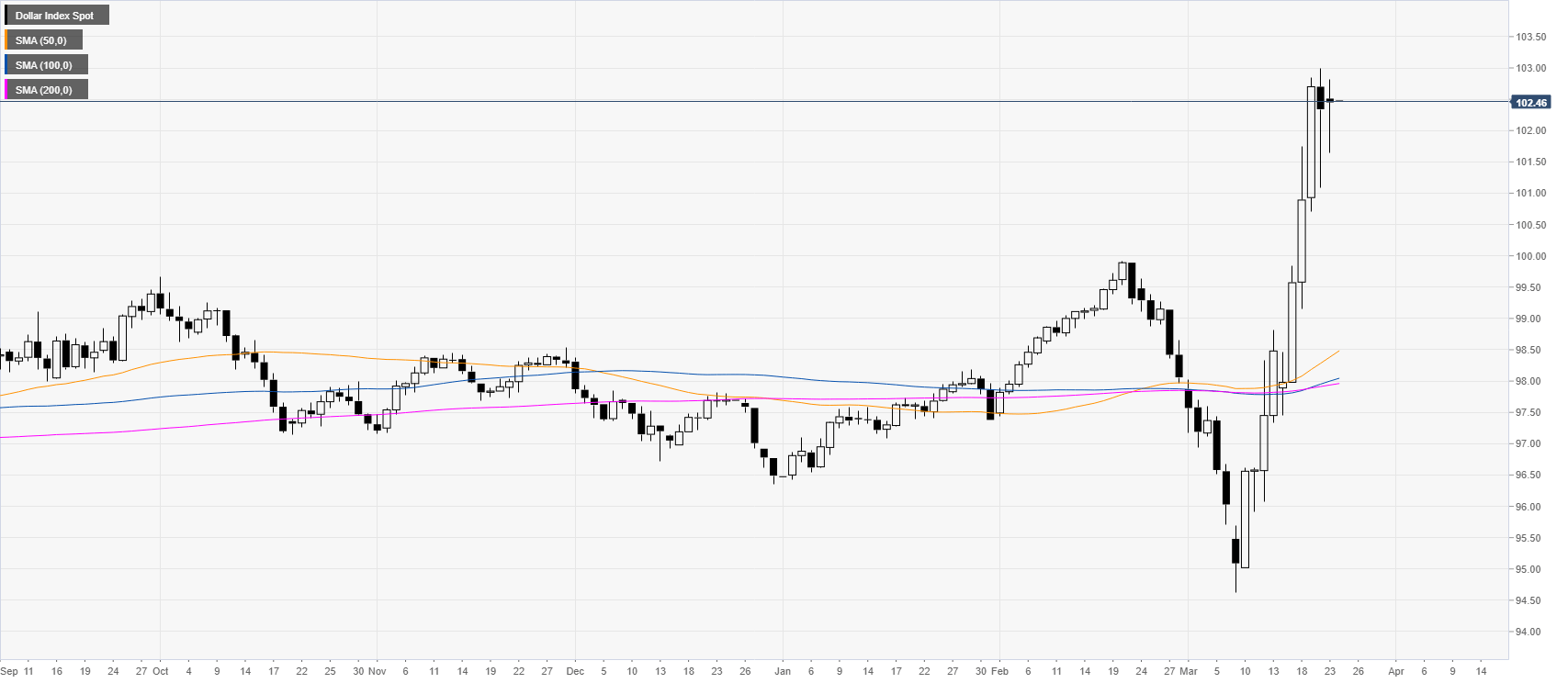

DXY weekly chart

DXY (US dollar index) is trading near its highest since January 2017 as USD is benefitting from above-average buying interest. Interestingly, the 2020 stock crash is one of the steepest and fastest declines the market ever experienced. Therefore, the Federal Reserve of the United States announced today that there would be no limit to how much it will support the economy through Quantitative Easing (QE). Essentially, yes, this is more USD printing which should, in theory, devalue the US dollar, but by doing QE unlimited, the Fed is attracting investors which buy USD-denominated assets. This is the largest stimulus package the Fed ever issued in times of crisis, which is surely a sign that this financial crisis, if maybe not the worst, will probably not be a stroll in the park.

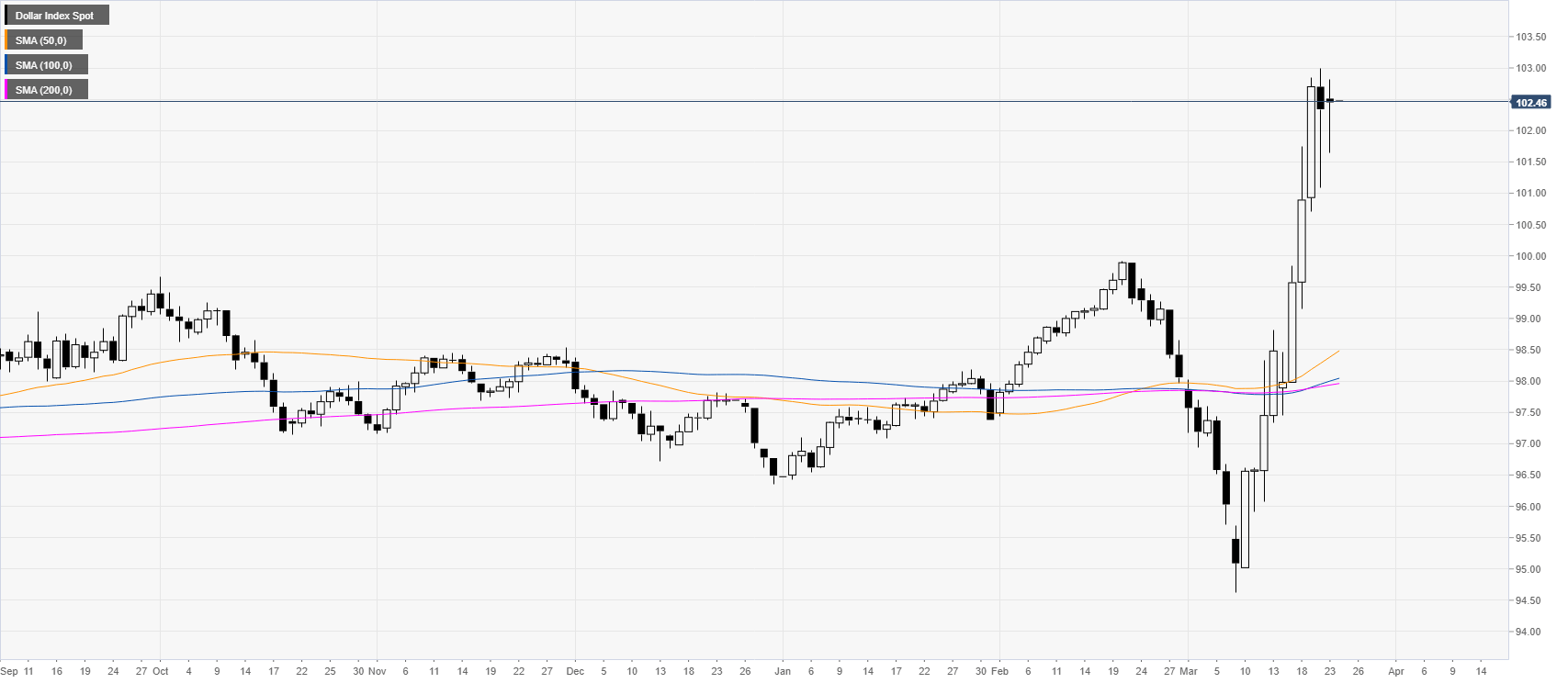

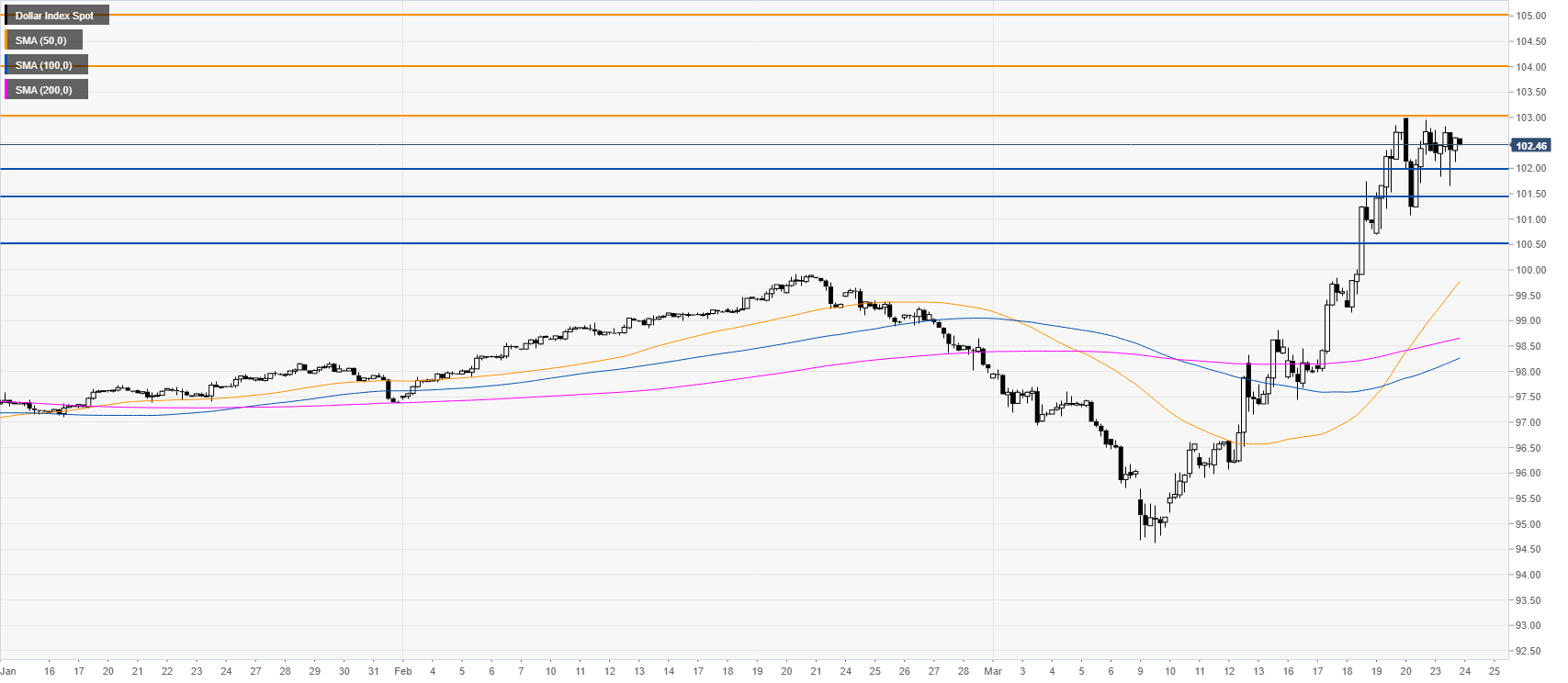

DXY daily chart

DXY is consolidating after an unusually strong spike to the upside as the market is trading well-above the main SMAs.

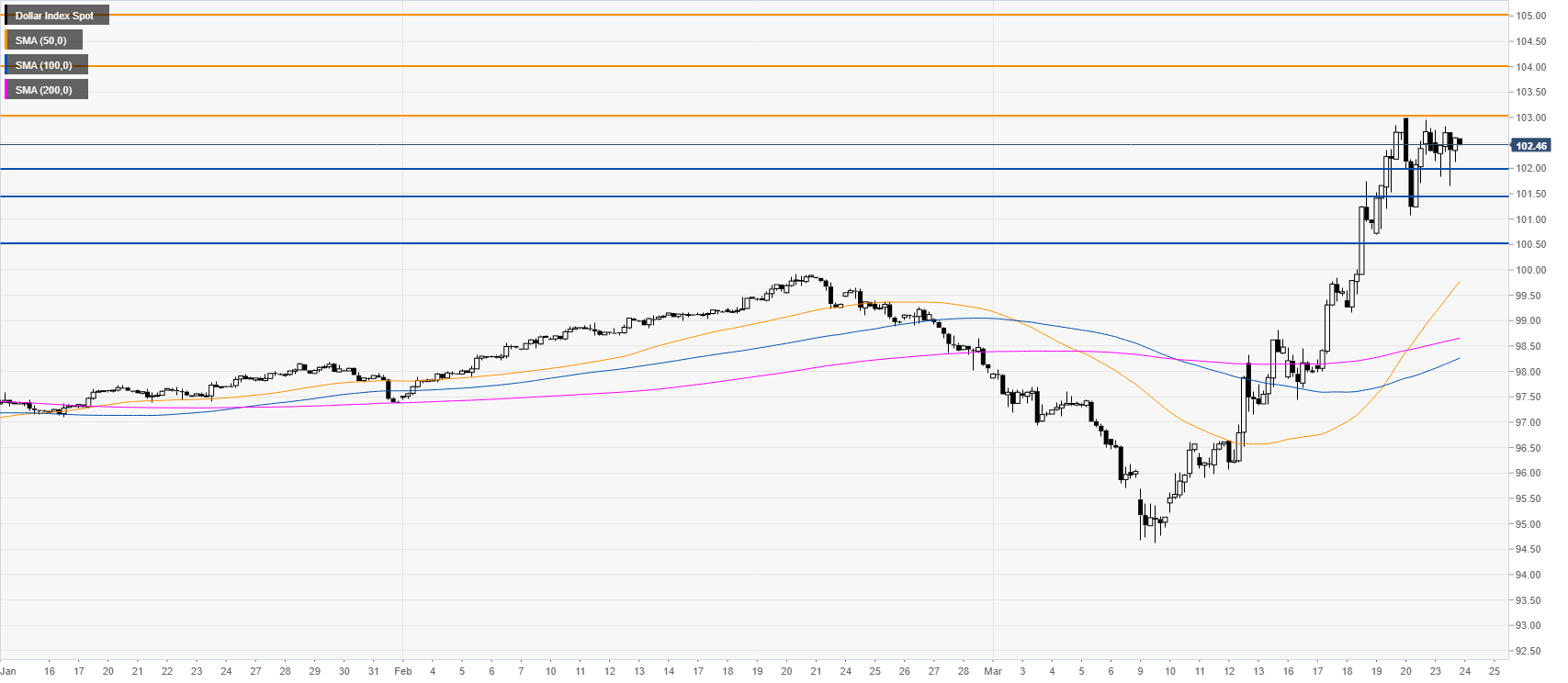

DXY four-hour chart

The bull trend remains intact as DXY is trading above its main SMAs. Pullback down are likely to remain shallow as DXY remains in high demand. Bulls are likely looking for a break above the 103.00 resistance which could introduce scope to the 104.00 and 105.00 figures in the coming sessions or weeks. The market is expected to find support near the 102.00, 101.50 and 100 levels on the way down.

Additional key levels