Back

30 Mar 2020

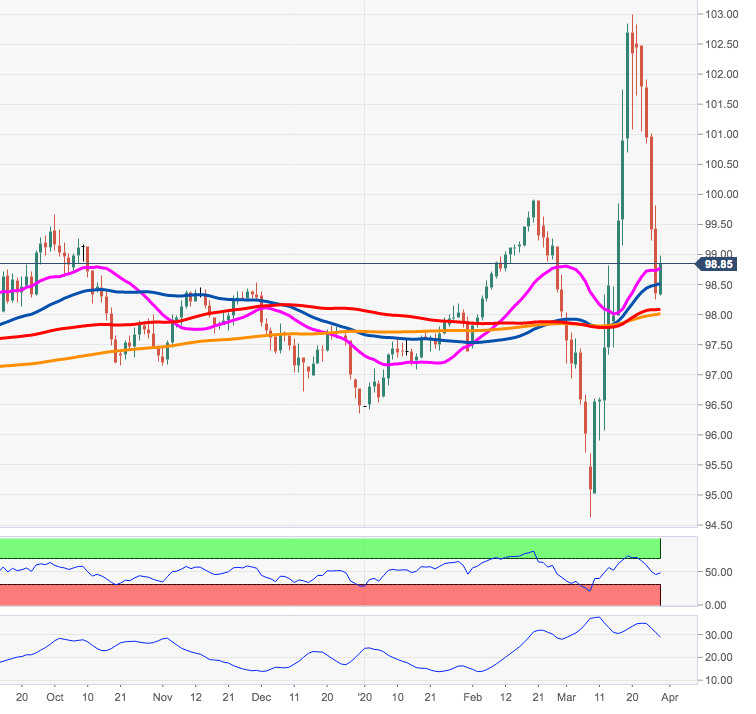

US Dollar Index Price Analysis: Stays constructive above the 200-day SMA

- DXY rebounds from lows in the 98.30 region on Monday.

- The outlook remains positive above the 200-day SMA at 98.00.

DXY met some contention in the 98.30 zone earlier in the session, managing to regain buying interest soon afterwards.

If the bullish attempt picks up extra pace, then a potential visit to the psychological 100.00 barrier should come to the fore ahead of the Fibo retracement at 100.49.

So far, the positive outlook in the buck remains unchanged as long as the 200-day SMA at 98.00, holds the downside.

DXY daily chart