Back

1 May 2020

USD/CHF Price Analysis: Greenback down vs. Swiss franc, challenges 0.9600 figure

- USD/CHF starts May on the defensive amidst USD weakness.

- The level to beat for bears is the 0.9600 figure.

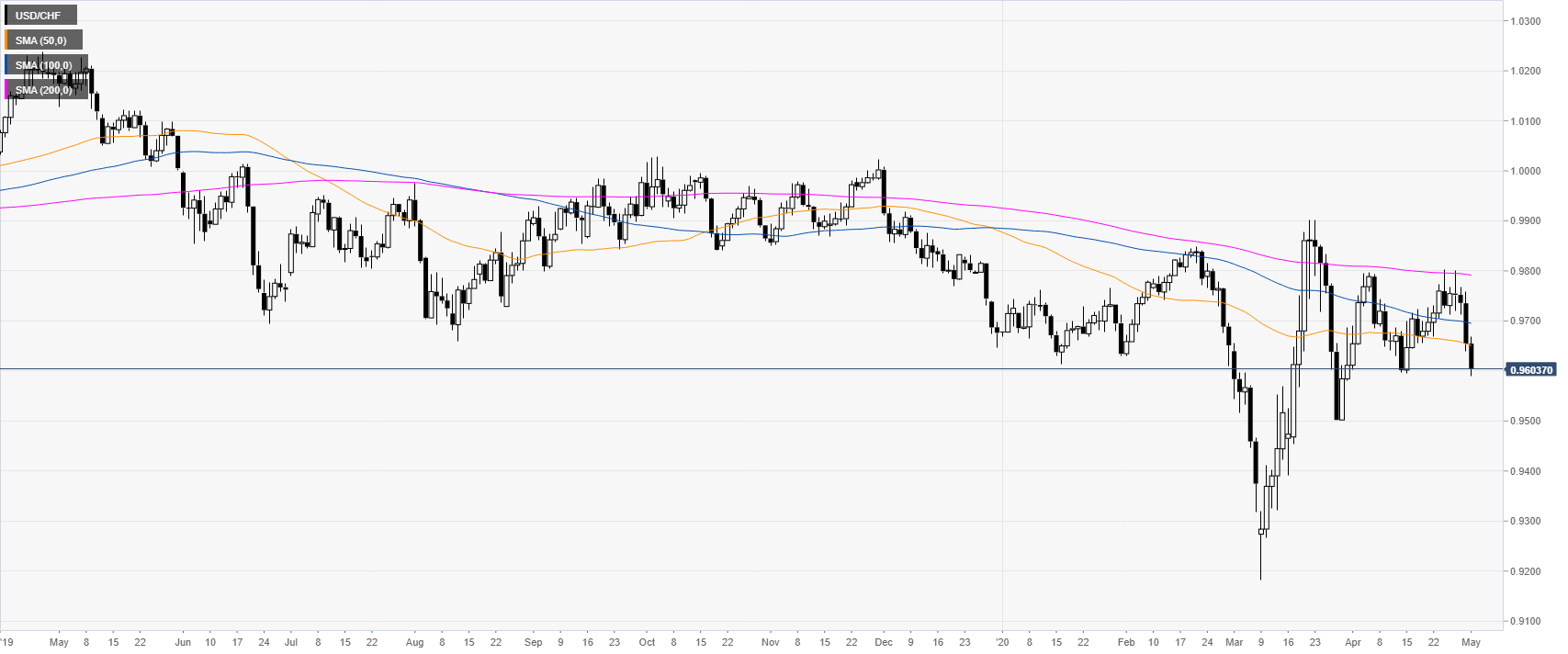

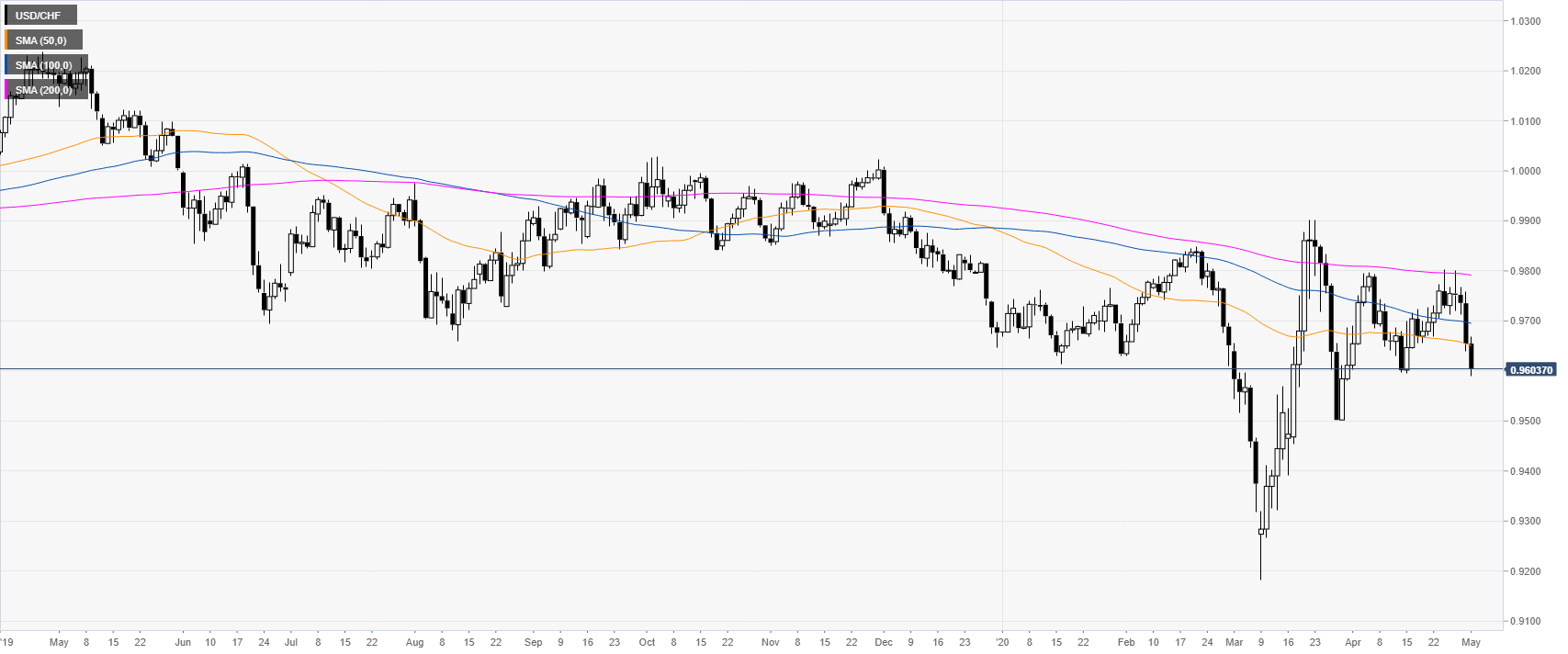

USD/CHF daily chart

USD/CHF is trading below the main SMAs on the daily chart as the US Dollar Index is down across the board. The spot is testing a swing low located near the 0.9600 level.

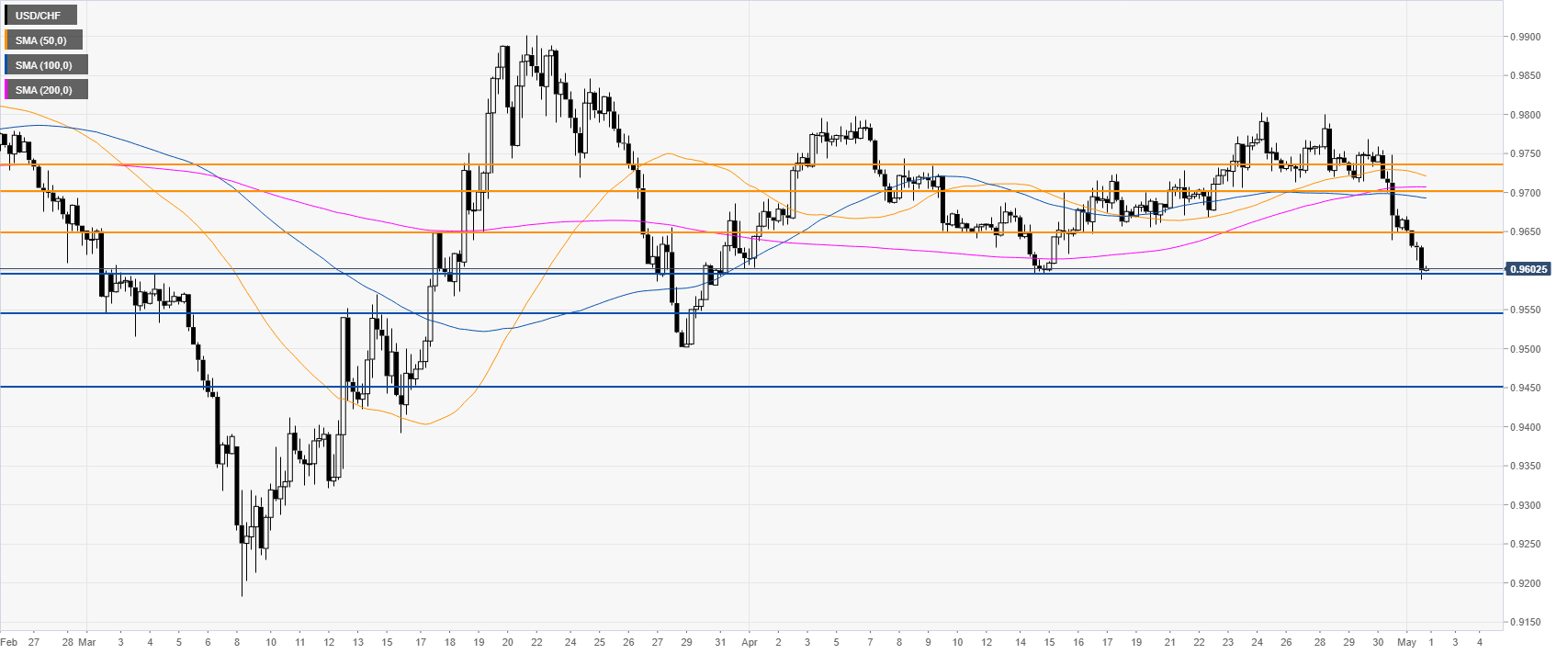

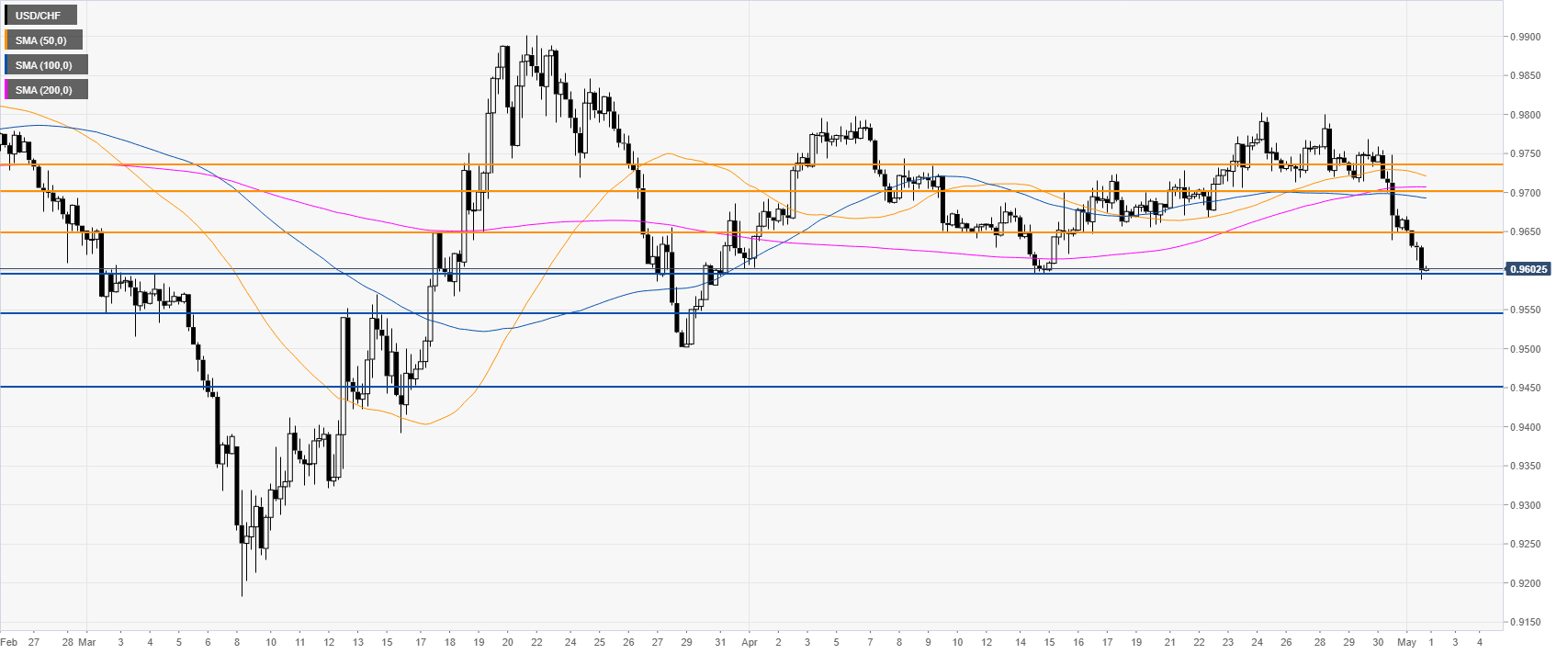

USD/CHF four-hour chart

Dollar/Swiss is challenging the 0.9600 figure as the market trades below the main SMAs on the four-hour chart. Bears remain firmly in control with little to no hope of a significant pullback for now. A break below the 0.9600 figure should attract further selling to lower levels with bears setting their eyes on the 0.9550 and 0.9450 price levels.

Additional key levels