Gold Price Analysis: $1759 is the level to beat for the XAU bulls – Confluence Detector

Gold reached fresh monthly highs but once again failed to sustain at higher levels, thanks to the turnaround in the risk sentiment. Will the bulls fight back control?

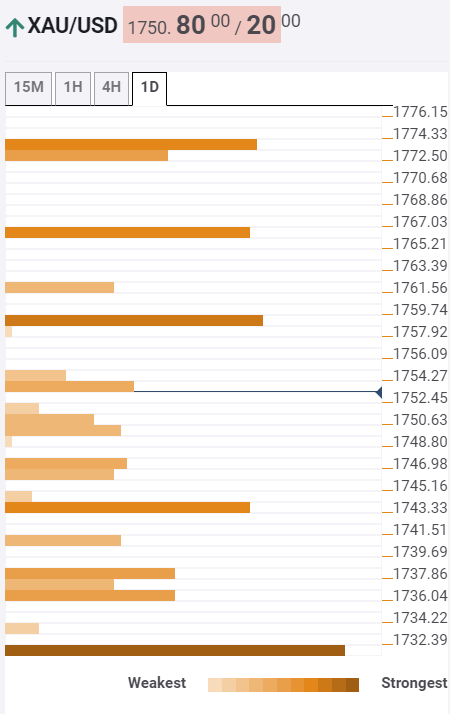

As observed in the Technical Confluences Indicator, the precious metal stalled its recent rally just shy of the stiff resistance at $1,759, where the Bollinger Band one-hour Upper, Pivot Point one-week Resistance 1 and previous 1H high coincide.

Should the bulls take out the latter, the next hurdle is placed at near $1765, the 2020 high (May 18 high).

To the downside, the immediate support is seen at $1,744, the Fibonacci 23.6% one-month.

Further south, a breach of the strong support at $1732 could revive the selling bias in the near-term. That level is the intersection of the Fibonacci 61.8% one-day and Bollinger Band four-hour Middle.

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.