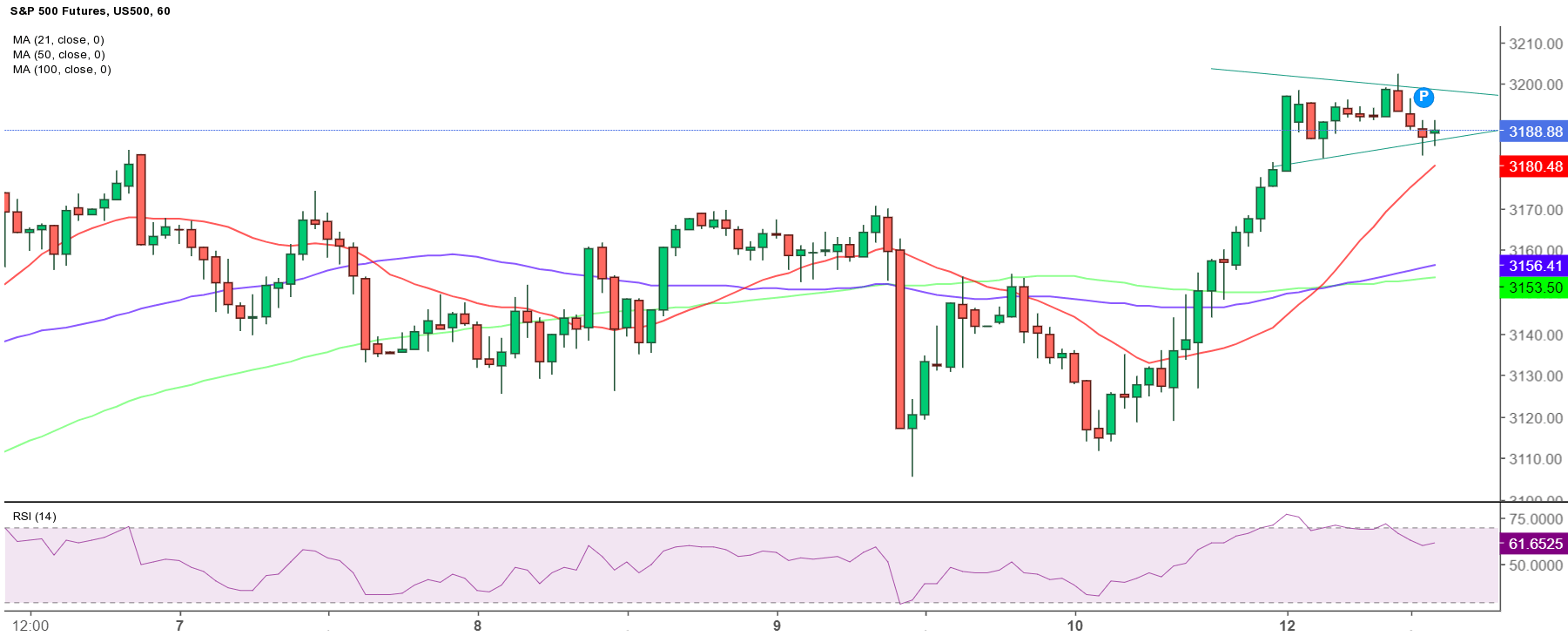

S&P 500 Futures Price Analysis: Bull pennant on hourly sticks points to further upside

- S&P 500 futures look to regain 3200 levels.

- Bull pennant on hourly sticks to get confirmed above 3198.50.

- Gains in US stock futures point to positive Wall Street open.

S&P 500 futures, the lead risk indicator, is off the highs but trades with moderate gains in mid-Europe, as the market mood remains upbeat amid the coronavirus vaccine hopes.

From a technical perspective, the price maintains the upside bias and is poised to chart a bull pennant breakout on the one-hour chart, should it see an hourly closing above 3198.50, the falling trendline resistance.

The pattern confirmation could likely call for a test of the 3250-3280 levels in the coming days.

On the flip side, the immediate downside remains capped by the bullish 21-hourly Simple Moving Average (HMA), now placed at 3,180.55.

Should sellers regain control below that level, powerful support awaits around 3,155, where the falling trendline support, 50 and 100-HMAs intersect.

To conclude, the path of least resistance appears to the upside, with bullish hourly Relative Strength Index (RSI), which inches higher near 62.0. Also, the US futures hold above most major HMAs.

S&P 500 Futures: Hourly chart