Back

17 Jul 2020

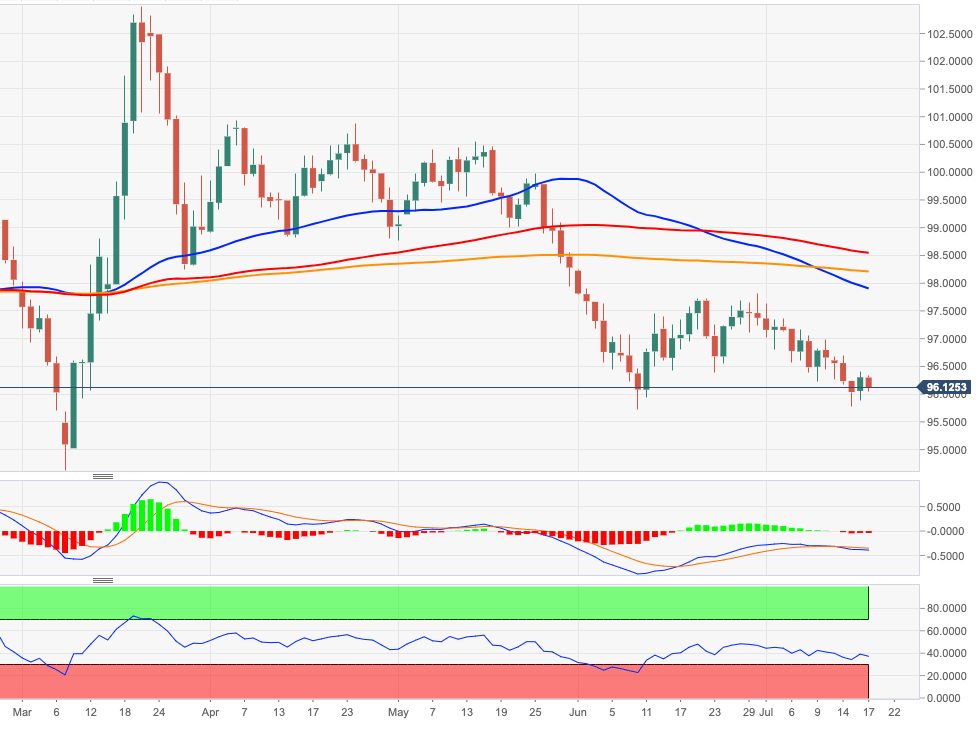

US Dollar Index Price Analysis: Extra losses stays in the pipeline

- DXY remains under heavy pressure around the 96.00 region.

- Further decline exposes the key support band at 95.80/70.

DXY has resumed the downside on Friday, partially fading Thursday’s decent uptick. The index, however, manages well so far to keep the trade above 96.00 the figure.

The ongoing price action leaves intact the probability of another visit to the June/July lows in the 95.80/70 zone (June 10/July 15) ahead of 2020 low at 94.65 recorded on March 9.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.20.

DXY daily chart