USD/JPY bears taking the reigns as US dollar plummets to critical support

- USD/JPY suffers at the hands of the race to save the day by EU leaders.

- US economy under scrutiny, leaving the dollar out to dry.

USD/JPY has dropped to below the 107 handle and has marked a significant low on the charts, testing daily support.

At the time of writing, the pair is consolidating from printing a fresh low for the New York session at 106.68 within the 106.68/107.36 range for the day.

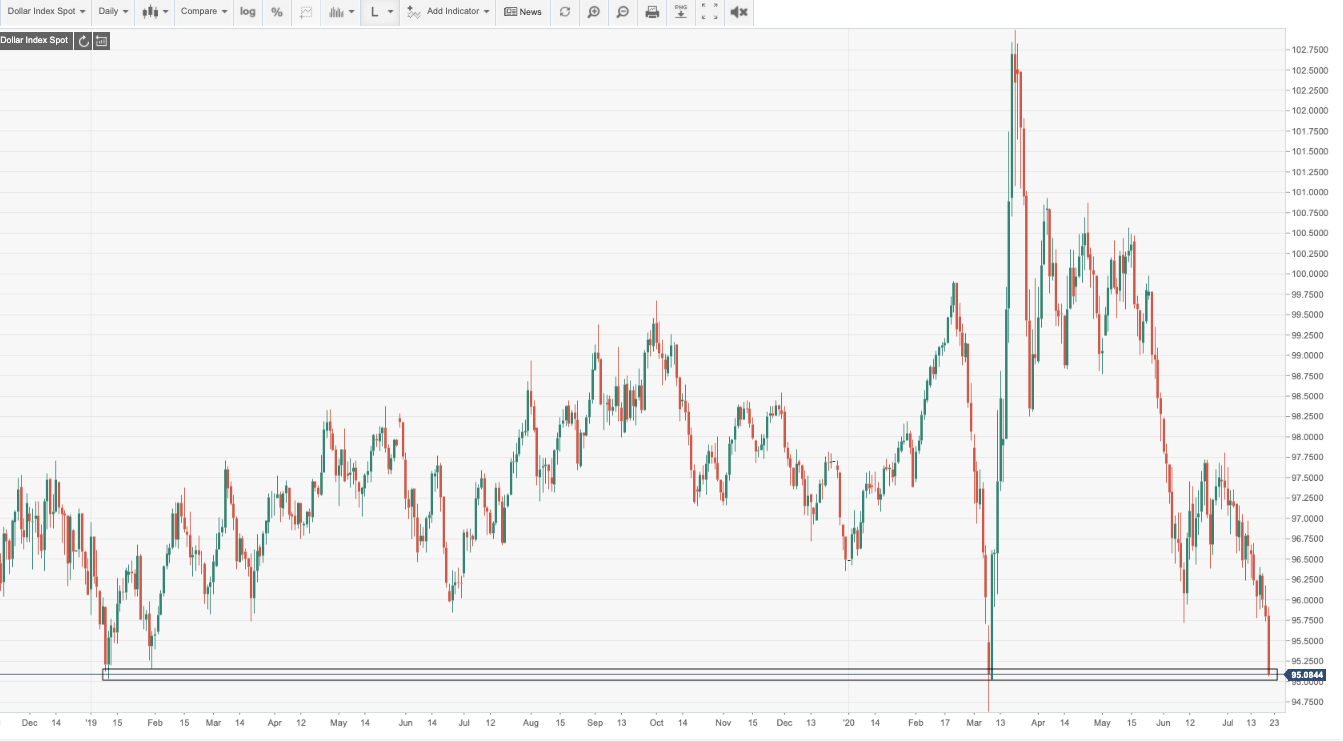

Its been a bad day for the US dollar bulls, with the greenback extending its decline to test monthly structure around the 95 figure.

DXY takes a hard fall

(DXY)

The bulls are moving away from the greenback and favouring the yen as safe-haven place, while investors weigh the economic impact of the coronavirus spread.

On a quiet economic calendar, Friday's data was likely revisited by markets on the light of the growing concerns pertaining to the spread of the virus in the US.

US consumer sentiment tumbled again in July following a lift in June.

To date opinions have been divided as to how quickly economies can recover from the damage caused by COVID-19.

But as case numbers keep rising around the world sentiment appear to favour a slower recovery than a rapid bounce back – which is how we have expected the economic recovery from the pandemic to play out.

This shift is starting to show up in the data such as the recent US consumer sentiment survey but is now yet reflected in equity markets.

If new case numbers don’t subside soon then consumers are likely to be spooked further and become more conservative in their spending habits,

analysts at ANZ Bank explained.

Dollar falling over the fiscal cliff

Meanwhile, fiscal policy remains the center of attention. Traders are leaning on the growth-enhancing policies in the wake of COVID and for that reason, the euro has left in a rocket ship on Tuesday following the virus deal news.

EU leaders ended a marathon Summit with agreement on proposed Budget (EUR1,0674bn per year until 2027) and Recovery Fund (EUR750bn).

While the agreement still needs to be ratified, markets are cheering the news that undoubtedly lowers EUR tail risks. An outlooked explained in this week's Chart of the Week.

- The Chart of the Week: EUR/USD to complete a reverse H&S prior to next leg higher?

This too is weighing on the US dollar which suffers at the hands of a less forthcoming agreement on home soil.

A US coronavirus relief bill is not likely to pass before the end of the month which has dented an already weakened USD.

Meanwhile, there is still far too much risk out there to leave the dollar out of one's portfolio.

Geopolitical tensions and uncertainties related to the virus will remain a threat to risk appetite for which either or has a tendency to allure investors to the safety of the greenback.

USD/JPY levels