Gold Price Analysis: Record highs in sight while above $1861 – Confluence Detector

The corrective slide in Gold lost legs near $1845 region on Wednesday, prompting the bulls to fight back control and reach fresh nine-year highs of $1876.66 early Thursday. Gold is off the multi-year high, with the earlier $1861 cap now turned into critical support back in play.

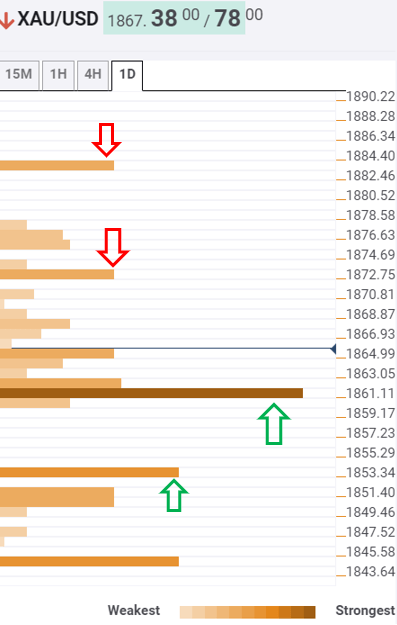

The Technical Confluences Indicator shows that the yellow metal is challenging minor support at $1865 on a quick retracement from fresh multi-year highs. That level is the Fibonacci 23.6% one-day.

The next cushion awaits at $1863, the SMA100 15-minutes. Below that level, the critical $1861 (pivot point one-month R2) will challenge the bears’ commitment.

A sharp sell-off could be triggered if the aforesaid powerful support gives way, which could call for a test of $1853, the confluence of SMA10 four-hour and Fibonacci 61.8% one-day.

Alternatively, the immediate resistance is aligned at $1872, the previous day high, above which the multi-year high will be put to test.

Should the bulls remain successful in taking out the latter, the pivot point one-day R1 at $1883 looks like the next upside target en route the record highs of $1920

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Learn more about Technical Confluence