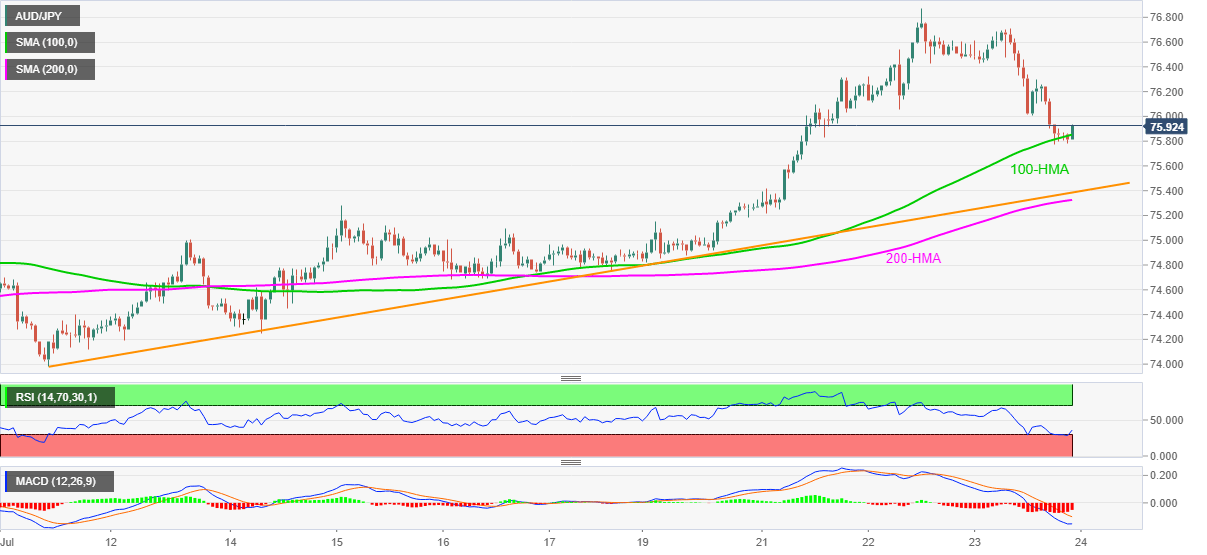

AUD/JPY Price Analysis: 100-HMA support, oversold RSI trigger pullback towards 76.00

- AUD/JPY bounces off 75.77, defies Thursday’s pause to a four-day winning streak.

- 76.05 can question the recovery moves ahead of highlighting the 77.00 threshold.

- A two-week-old ascending trend line, 200-HMA adds to the downside support.

AUD/JPY picks up the bids near 75.90 during the early Friday morning in Asia. The pair flashed its first negative daily closing in five the previous day but oversold RSI and 100-HMA trigger its latest bounce.

As a result, buyers are again targeting the fresh yearly high to 77.00 with 76.05 being immediate upside barrier. Additionally, tops marked in June and on Wednesday, respectively near 76.80 and 76.87, will offer extra filters to the north.

In a case where the bulls manage to remain strong past-77.00, February 2019 bottom close to 78.00 will be on the cards.

Meanwhile, the pair’s declines below 100-HMA level of 75.84 aren’t the call to the bears as an upward sloping trend line from July 10 and 200-HMA stand tall to restrict further downside around 75.39/32.

AUD/JPY hourly chart

Trend: Bullish