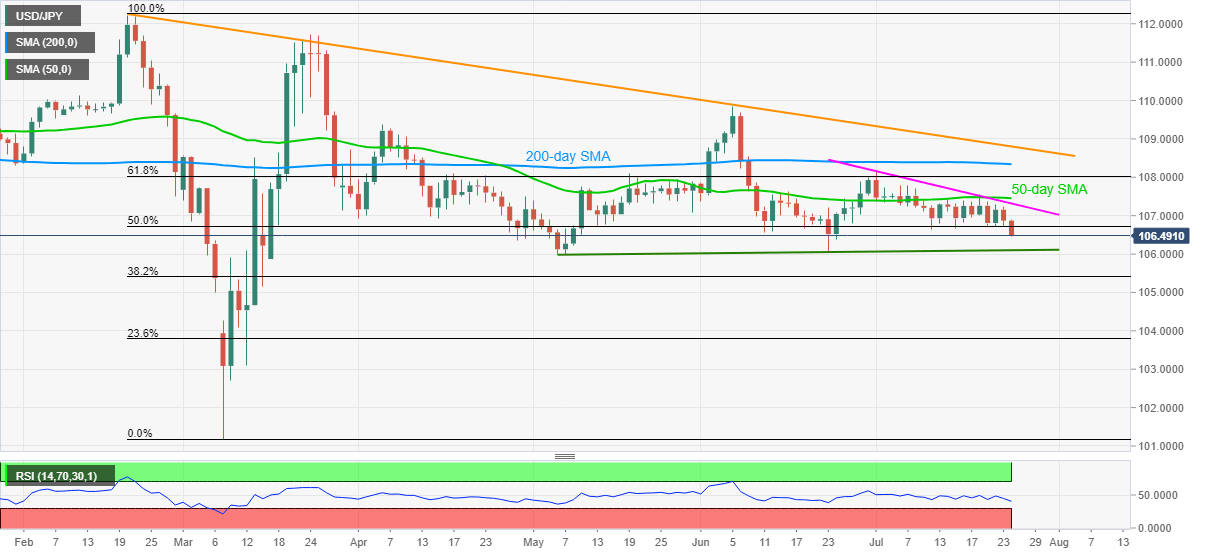

USD/JPY Price Analysis: Bears dominate near monthly bottom, 106.00 in focus

- USD/JPY breaks the below the mid-month low near 106.66 to test the lowest levels since June 24.

- Lows marked in June and May months on the bears’ radars.

- Bulls have multiple upside barriers to cross before taking control.

USD/JPY stays depressed around 106.50, down 0.34% on a day, during the early Friday. The pair’s latest weakness takes clues from its break of two-week-old horizontal support around 106.60. Also likely to favor the sellers is the pair’s sustained trading under the key SMAs and resistance lines.

As a result, June month’s low of 106.07 and May’s bottom surrounding 106.00 grab the market’s attention during the pair’s further downside.

However, any more declines past-106.00 will be difficult and if portrayed will not hesitate to aim for March 06 trough close to 105.00.

Alternatively, a downward sloping trend line from July 01 and 50-day SMA, respectively around 107.30 and 107.45, guard the pair’s immediate upside.

Other than that, 61.8% Fibonacci retracement of February-March downside, at 108.00, followed by a 200-day SMA level of 108.35, will also challenge the optimists trying to confront a descending trend line from February 20, currently near 108.80.

USD/JPY daily chart

Trend: Bearish