When is the German IFO survey and how it could affect EUR/USD?

The German IFO Business Survey Overview

The German IFO survey for August is due for release later today at 0800 GMT. The headline IFO Business Climate Index is seen improving to 92.0 versus 90.5 previous.

The Current Assessment sub-index is seen arriving at 87.0 this month, while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to come in at 98.0 in the reported month vs. 97.0 last.

Deviation impact on EUR/USD

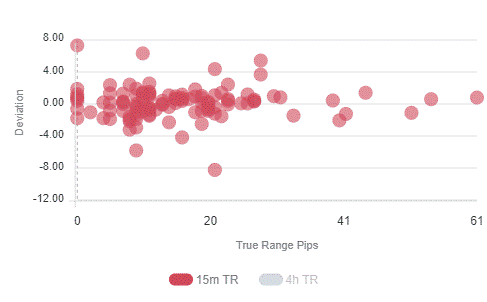

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 30 pips in deviations up to 3.0 to -4.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

EUR/USD is consolidating the overnight bounce above 1.1800, as we progress towards the European opening bells, as the shared currency paid little heed to the German Final Q2 GDP data. The German economy contracted 11.3% in Q2; the final estimate confirmed on Tuesday.

The main driver behind the EUR/USD uptick is the broad-based retreat in the US dollar across its main competitors. The progress on the US-China phase one trade deal dampened the demand for the greenback as a safe-haven.

Ahead of the German IFO Survey, the spot trades 0.20% higher at 1.1812, with the immediate resistance seen at the 10-DMA of 1.1833. Monday’s high of 1.1851 is the next upside barrier en route the 1.1900 level. To the downside, the buyers will find some support at 1.1783, the recent lows, below which the 1.1750 psychological level could be tested. Further down, the August 12 low of 1.1710 will be on the sellers’ radars.

Key notes

EUR/GBP Price Analysis: Bulls look for entry beyond 0.9040/45

Coronavirus update: Germany’s new infections jump 1,278 on Tuesday

Forex Today: Dollar pressured amid Sino-American optimism, coronavirus headlines, data eyed

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).