Back

11 Sep 2020

Gold Futures: Further rangebound likely

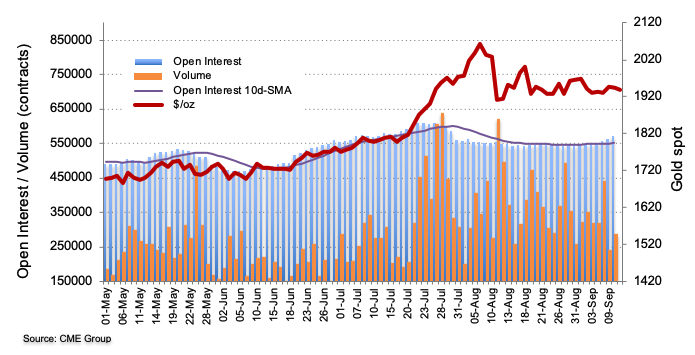

Open interest in Gold futures markets increased for the fourth consecutive session on Thursday, now by more than 6K contracts in light of preliminary figures from CME Group. In the same line, volume partially reversed the previous drop and went up by around 47.1K contracts.

Gold faces extra consolidation near-term

Gold prices keep trading below the $2,000 mark per ounce against the backdrop of inconclusive performance and rising open interest and volume. That said, the key $2,000 yardstick remains the key hurdle in the short-term horizon.