Gold Price Analysis: $1883 is the level to beat for the XAU/USD bears – Confluence Detector

Gold is under pressure starting out a fresh week, battling $1900 amid resurgent haven demand for the US dollar. The greenback regains ground on Monday, as the second wave of the coronavirus accelerates at full steam in Europe while the US sees a record daily surge in cases. Meanwhile, the ongoing wrangling over the US fiscal stimulus deal, with fading hopes of an agreement likely to be reached ahead of next week’s Presidential election, also continue to bode well for the dollar.

The flight to safety has also boosted the US Treasuries, knocking-off the yields. If selling pressure intensifies around the Treasury yields, it could help put a floor under the non-yielding gold. Let’s take a look at gold on the charts for key trading levels in the final week ahead of the US election.

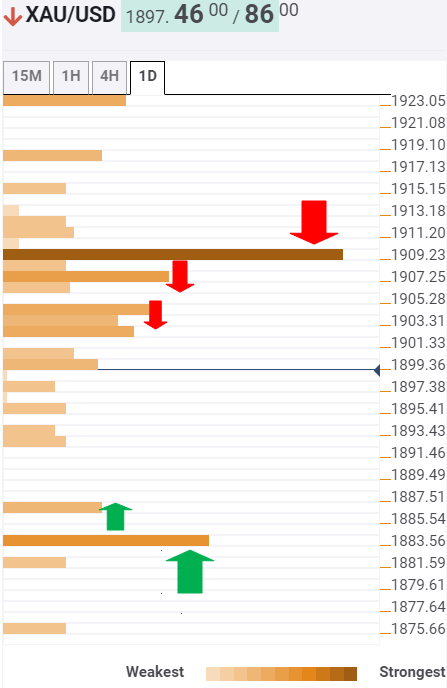

Gold: Key resistances and supports

The Technical Confluences Indicator shows that the path of least resistance for the bright metal appears to the downside, with minimal support levels seen ahead of the critical cushion at $1883, which is the confluence of the pivot point one-day S2 and Fibonacci 23.6% one-month.

Ahead of that level, the bears could be challenged by $1886, where the pivot point one-

On the flip side, the bulls are likely to have a hard time recovering ground above the $1900 level, as a dense cluster of resistance is aligned around $1902.30, the intersection of the previous high four-hour, Fibonacci38.2% one-month and one-day.

Further north, the convergence of the SMA50 four-hour and Fibonacci 61.8% one-day at $1907 will offer the next resistance.

Acceptance above the $1910 level is critical to reviving the near-term bullish momentum. At the point, the Fibonacci 61.8% one-week lies.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence