Back

22 Jan 2021

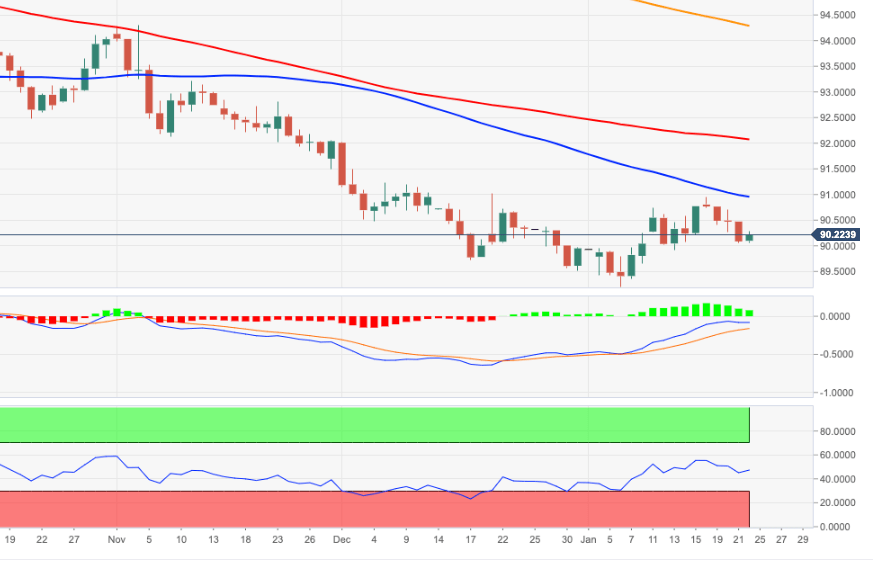

US Dollar Index Price Analysis: A breach of 90.00 exposes 2021 lows at 89.20

- DXY trades in a volatile fashion above 90.00 so far on Friday.

- Further south of 90.00 emerges the YTD low at 89.20.

DXY alternates gains with losses and always above the key 90.00 level for the time being.

The inability of USD-bulls to push further north of recent tops in the 91.00 region prompted sellers to return to the market and now the focus of attention shifted to the continuation of the downtrend.

That said, a breach of the 90.00 yardstick should not surprise anyone in the short-term horizon. Below this psychological level is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

In the longer run, as long as DXY trades below the 200-day SMA, today at 94.28, the negative view is expected to persist.

DXY daily chart