USD/INR Price News: Indian rupee struggles near yearly high of 72.67

- USD/INR fades bounce off 11-month low, snaps three-day losing streak.

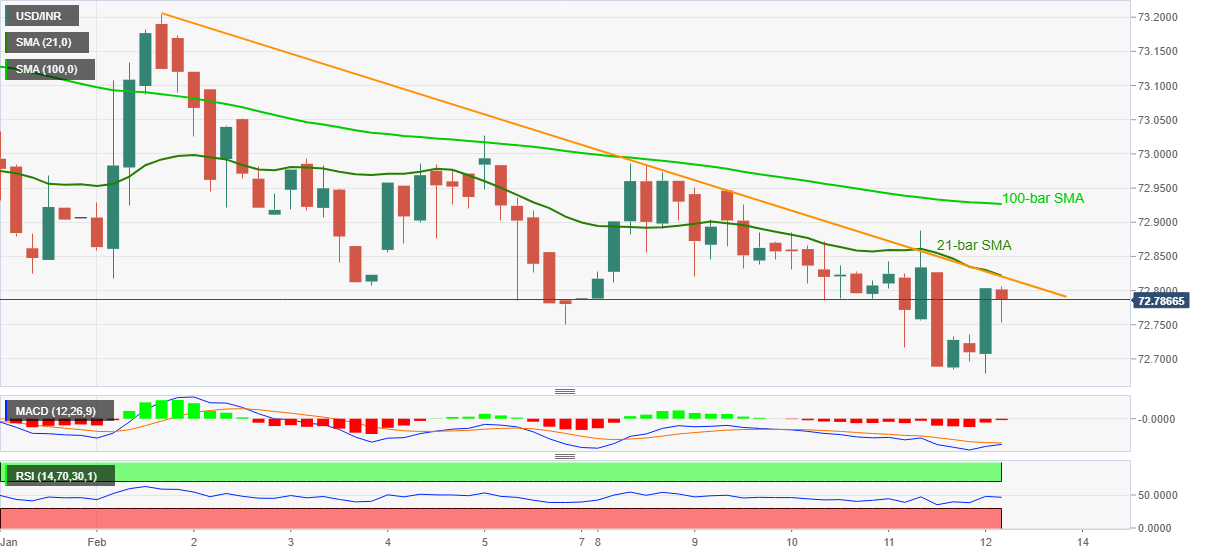

- Upbeat RSI joins receding strength of MACD to suggest further recovery.

- 21-bar SMA, monthly resistance line probes short-term bulls.

USD/INR portrays corrective pullback from the lowest since March 2020 while taking the bids near 72.78 amid the initial Indian session on Friday. In doing so, the Indian rupee pair benefits from the RSI and MACD conditions to eye a confluence of 21-bar SMA and a falling trend line from February 01.

Though, recently sluggish moves raise doubt on the pair’s upside past-72.82 resistance confluence.

Even if the quote manages to cross 72.82, 100-bar SMA near 72.92 and the 73.00 threshold will be ready to challenge the USD/INR buyers.

Meanwhile, fresh selling can wait for the downside break of the intraday low, also the multi-month low, surrounding 72.67.

Following that, the September 2019 peak of 72.37 and the highs marked during early 2020 near 72.20 will precede USD/INR sellers targeting the 72.00 threshold.

Overall, USD/INR remains depressed but a short-term bounce can’t be ruled out.

USD/INR four-hour chart

Trend: Further recovery expected