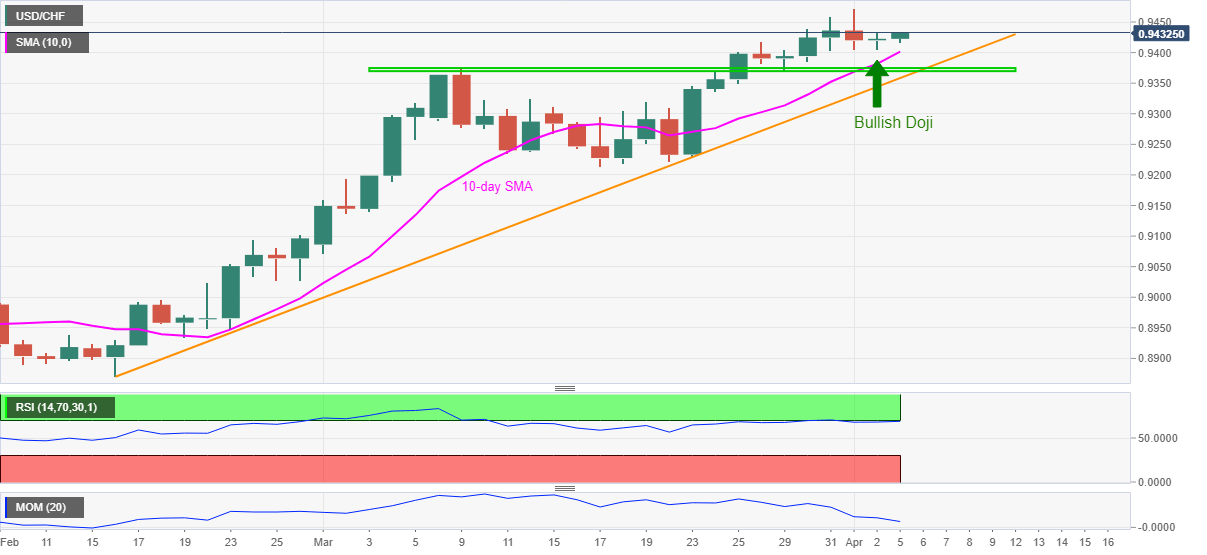

USD/CHF Price Analysis: Responds to Friday’s bullish Doji with mild gains above 0.9400

- USD/CHF follows Friday’s bullish candlestick formation, buyers catch a breather around intraday high off-late.

- Sustained trading above short-term SMA, trend line suggests refreshing multi-day top.

- Overbought RSI, downbeat Momentum challenge the pair’s further upside.

USD/CHF holds upper ground while staying firm around 0.9430, up 0.09% intraday, during early Monday.

Friday’s bullish Doji takes clues from the pair’s successful trading above 10-day SMA and an ascending trend line from February 16 to favor the USD/CHF buyers targeting a fresh nine-month high above 0.9472.

However, overbought RSI conditions and sluggish momentum suggests limited upside of the pair past-0.9472, which in turn indicates the importance of late June 2020 tops near 0.9535-40.

Meanwhile, a 10-day SMA level of 0.9400 and a one-month-old horizontal area around 0.9375-70 can restrict USD/CHF pullback before highlighting a short-term rising support line, near 0.9358 by the press time, for sellers.

During the quote’s downside break below 0.9358, the 0.9300 and March 17 low close to 0.9215 will be the key levels to watch.

USD/CHF daily chart

Trend: Further expected