Back

12 Apr 2021

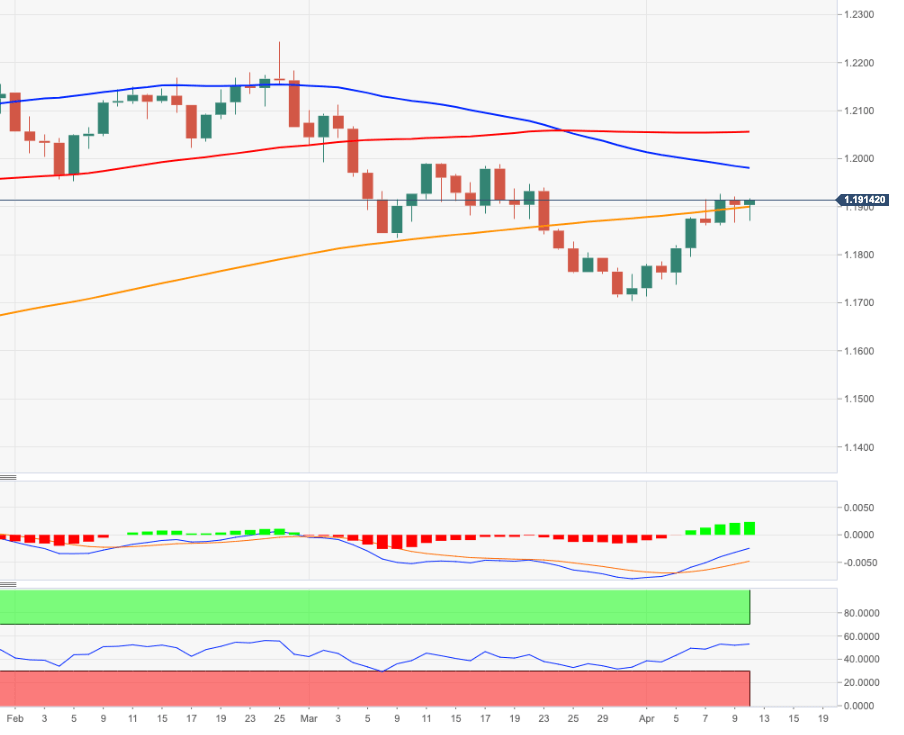

EUR/USD Price Analysis: Immediate to the upside comes in 1.1930

- EUR/USD reclaims the area above the 1.1900 level.

- The next target of note emerges at the 1.1980/90 band.

EUR/USD reverses the initial pessimism and advances beyond the 1.1900 hurdle at the beginning of the week.

The rebound from YTD lows near 1.1700 remains healthy so far. A sustainable breakout of the 200-day SMA (1.1891) should open the door to further gains with the next target at the 1.1980/90 region. In this area converge the mid-March peaks, the 50-day SMA and a Fibo level (of the November-January rally). A surpass of this area allows for a move to the key 1.2000 hurdle.

Above the 200-day SMA (1.1891) the stance for EUR/USD is expected to shift to positive.

EUR/USD daily chart