Back

15 Jun 2021

GBP/USD Price Analysis: Bulls target breakout to old hourly support

- GBP/USD bulls are taking charge on the shorter-term time frames but bears lurking.

- The price action is choppy as traders await the Fed, but technicals speak for themselves.

The following is a top-down analysis that illustrates the bearish bias for the near/medium term compared to a bullish bias longer term.

For the very immediate future, the bulls are taking charge and are on the verge of a breakout to the hourly resistance as shown below.

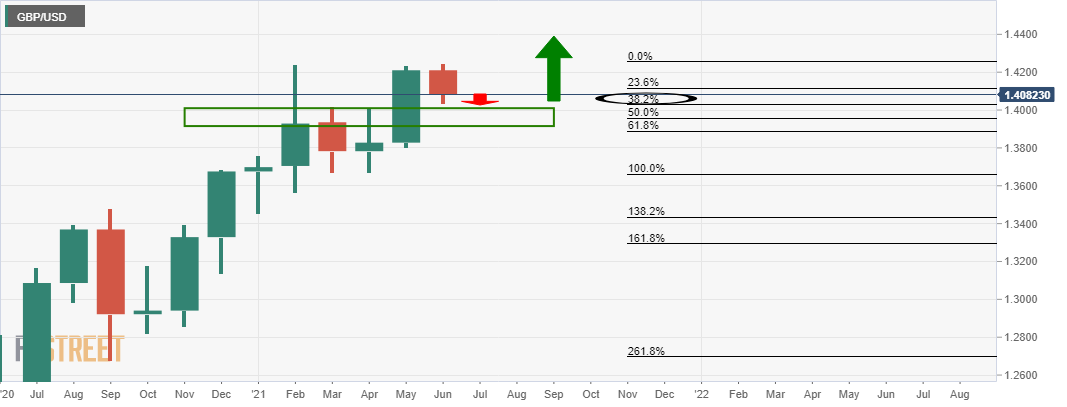

Monthly chart

The monthly chart is bearish near term, bullish longer term.

A fuller test of the 38.2% Fibonarri is expected.

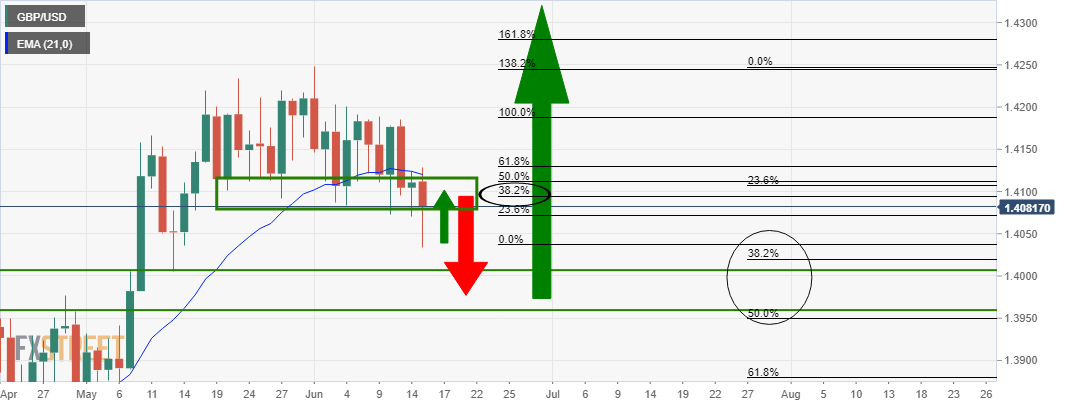

Weekly chart

As the weekly chart illustrates, the bears are in control and there is space to go until the weekly old resistance s properly tested.

Daily chart

The daily chart illustrates that the bulls are attempting to test old support.

Hourly chart

This gives rise to an imminent breakout on the hourly chart to test old hourly support for the hours ahead.