US Dollar Index Price Analysis: DXY looks set for a bumpy road to 91.00 on FOMC day

- DXY stays near monthly top, picks up bids of late.

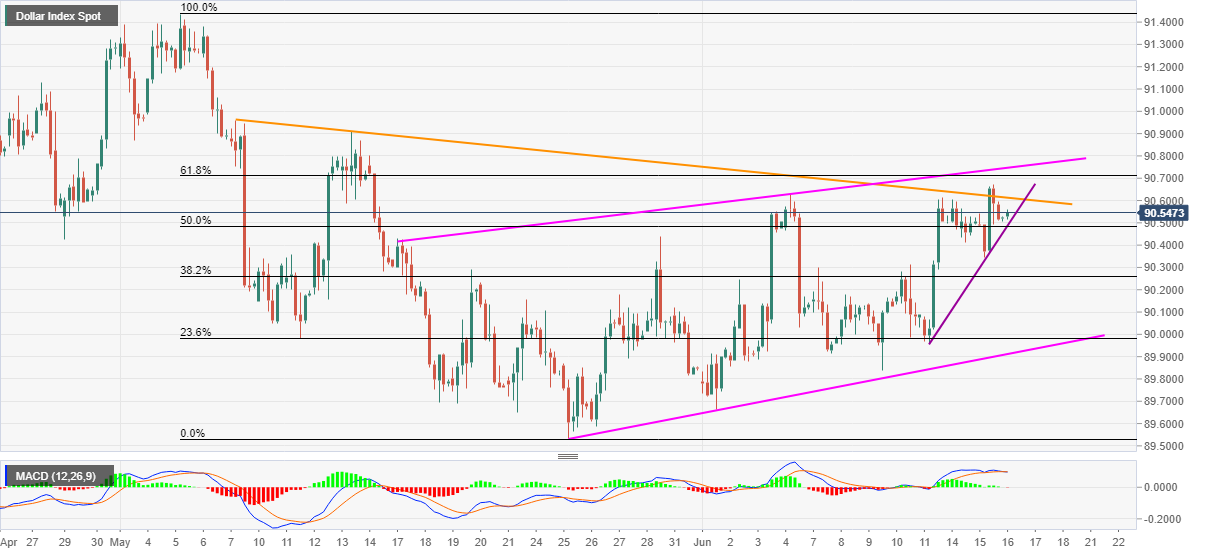

- Five-week-old resistance line probes bulls inside monthly rising channel.

- Weekly ascending trend line adds to the bullish bias despite sluggish MACD signals.

US dollar index (DXY) keeps the previous day’s recovery moves in a choppy range around 90.50-60, recently up 0.03% to an intraday high of 90.56, amid Wednesday’s Asian session.

Although a descending trend line from May 07 joins subdued MACD to test the greenback bulls, short-term rising support line and upward sloping trend channel favor DXY optimists.

That said, the stated resistance line around 90.61 offers an intermediate stop during the run-up targeting the channel’s upper line close to 90.75. Also acting as a nearby hurdle is the 61.8% Fibonacci retracement of May’s downside near 90.70.

It should, however, be noted that the quote’s successful rise past-90.75 will run for the 91.00 round figure before challenging the previous month’s high of 91.43.

Meanwhile, pullback moves will be challenged by 90.48 support confluence including the adjacent support line from June 11 and 50% Fibonacci retracement level.

In a case where the quote drops below 90.48, the 90.00 psychological magnet and the aforementioned channel’s support line near 89.90 will be the key to watch.

Overall, the pre-Fed trading lull could keep the US dollar index directed to the north. However, Jerome Powell & Company is known for surprises and could disappoint bulls. Hence, DXY traders should remain cautious heading into the key event of the week.

Read: Federal Reserve Preview: First up, then down? Playbook for trading the Fed

DXY four-hour chart

Trend: Bullish