EUR/USD stays bid and approaches 1.1900 ahead of Lagarde

- EUR/USD reverses part of the recent pullback and targets 1.19.

- German 10-year yields edge higher to levels above -0.20%.

- ECB C.Lagarde speaks later in the session.

The single currency leaves behind part of the recent weakness and pushes EUR/USD back to the proximity of the 1.1900 hurdle on Monday.

EUR/USD looks firmer, focuses on Lagarde

Finally, EUR/USD shows some signs of life after bottoming out in the 1.1850 region earlier in the session.

The FOMC-led deep pullback from levels around 1.2130 on Wednesday appears to have met some decent support in the mid-1.1800s for the time being, as investors seem to be cashing out part of the recent strong gains in the dollar.

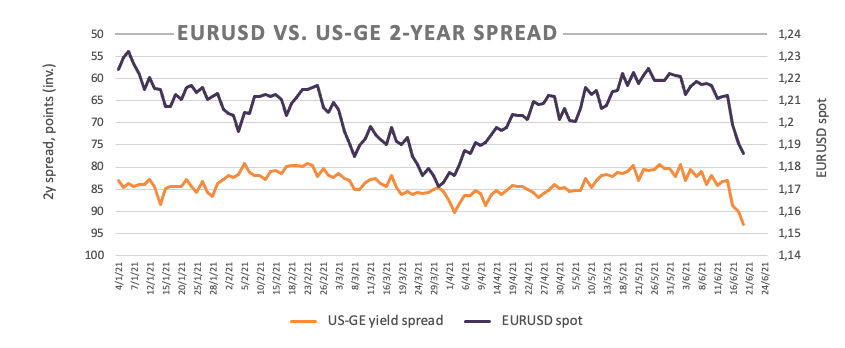

The move up in the pair comes in tandem with a positive tone in yields of the German 10-year benchmark, which manage to return to the -0.20% neighbourhood after briefly flirting with multi-week lows near -0.30 earlier in the month. A more evident driver of the recent drop in EUR/USD, however, comes from the yield spread in the shorter end of the curve between the US and German notes.

No data releases scheduled in the euro area on Monday, although investors are expected to closely follow the speech by Chairwoman Lagarde before the European Parliament later in the session.

What to look for around EUR

EUR/USD collapsed to levels last seen in early April well below 1.1900 the figure on Friday, always in response to the strong improvement in the sentiment surrounding the greenback exclusively following the latest FOMC event. In the meantime, support for the European currency comes in the form of auspicious results from fundamentals in the bloc coupled with higher morale, prospects of a strong rebound in the economic activity and the investors’ appetite for riskier assets.

Key events in the euro area this week: ECB Lagarde (Monday) – Advanced EMU Consumer Confidence (Tuesday) – EMU, Germany June flash PMIs – (Wednesday) – German IFO survey (Thursday) – German GfK Consumer Confidence, European Council meeting (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities.

EUR/USD levels to watch

So far, spot is gaining 0.27% at 1.1894 and faces the next hurdle at 1.1992 (200-day SMA) followed by 1.2032 (100-day SMA) and finally 1.2064 (38.2% Fibo retracement of the November-January rally). On the downside, a break below 1.1847 (monthly low Jun.18) would target 1.1835 (low Mar.9) and route to 1.1704 (2021 low Mar.31).