WTI bulls take on a deeper resistance level, eye $73.30 next stop

- WTI is penetrating deeper into daily resistance, albeit with a lack of conviction.

- The Delta coronavirus variant is a risk which traders are weighing, capping bullish progress.

- Bulls look to the 78.6% Fibonacci retracement level near $73.30.

West Texas Intermediate crude has been seeking direction at the start of the week and trades flat on the day again after moving within a range of between $70.59 and $72.40.

Traders are trying to find the bias between demand and supply narratives due to the risks associated with the spread of the delta coronavirus variant.

On the one hand, the World Health Organization (WHO) says the Delta variant of Covid-19 has now been detected in 124 territories worldwide. It is expected to become the dominant variant globally in the coming months.

The WHO is predicting that there could be more than 200 million confirmed cases within a matter of weeks.

Infections are rising, particularly in Europe and the western Pacific region.

However, in the latest reports, there has been a quadrupling of daily US infections to levels approaching those seen in last summer's virus surge.

Nations without access to vaccines or with a slower vaccine rollout are facing a deadlier threat, but nevertheless, the risk is to global economic growth is a troubling factor to the energy complex and the price of oil.

However, on the other hand, there is still price optimism over demand growth vs tight supply.

''Firm demand, hindered shale supply and the cautious monthly increase in supply from OPEC+ should not be enough to prevent a deep deficit in the coming month, which should continue to fuel stronger prices and tightening spreads,'' analysts at TD Securities said.

''After all, despite the often mention delta variant concerns, road traffic in Asia continues to recover while air travel is also rising at a fast clip, particularly in Europe, but with the US and China also continuing to post gains,'' the analysts argued.

''All of this suggests last week's shakeout was not justified and crude will remain strong through the summer months.''

Meanwhile, the Energy Information Administration last week reported the first rise in US oil inventories in eight weeks.

Additionally, the Baker-Hughes rig count, released on Friday, showed the number of US drilling rigs operating rose by seven to 387 as businesses seek to capitalise in response to prices that remain near the highest in more than two years.

WTI technical analysis

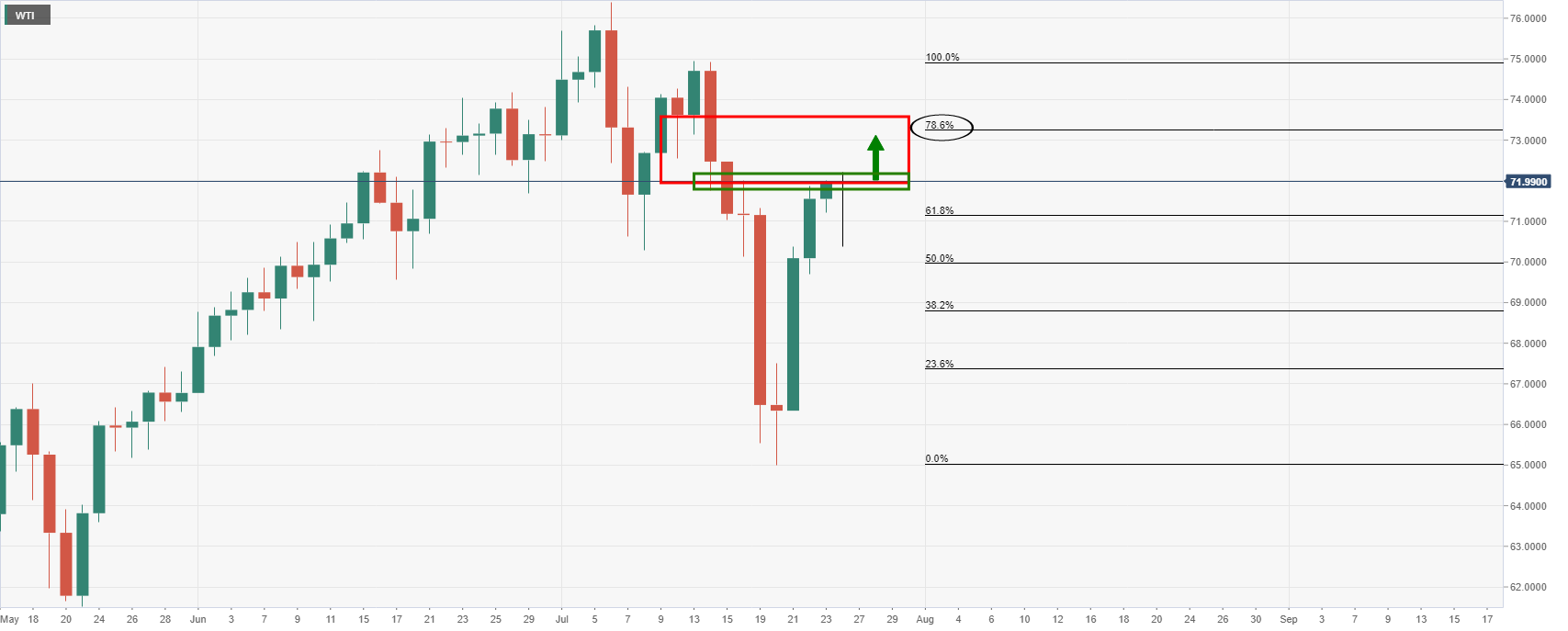

Technically, the price is pressuring the critical daily resistance and a break there will leave the bulls in good stead for a higher high in the coming days.

The 78.6% Fibonacci retracement of the prior daily bearish leg is located near 73.30:

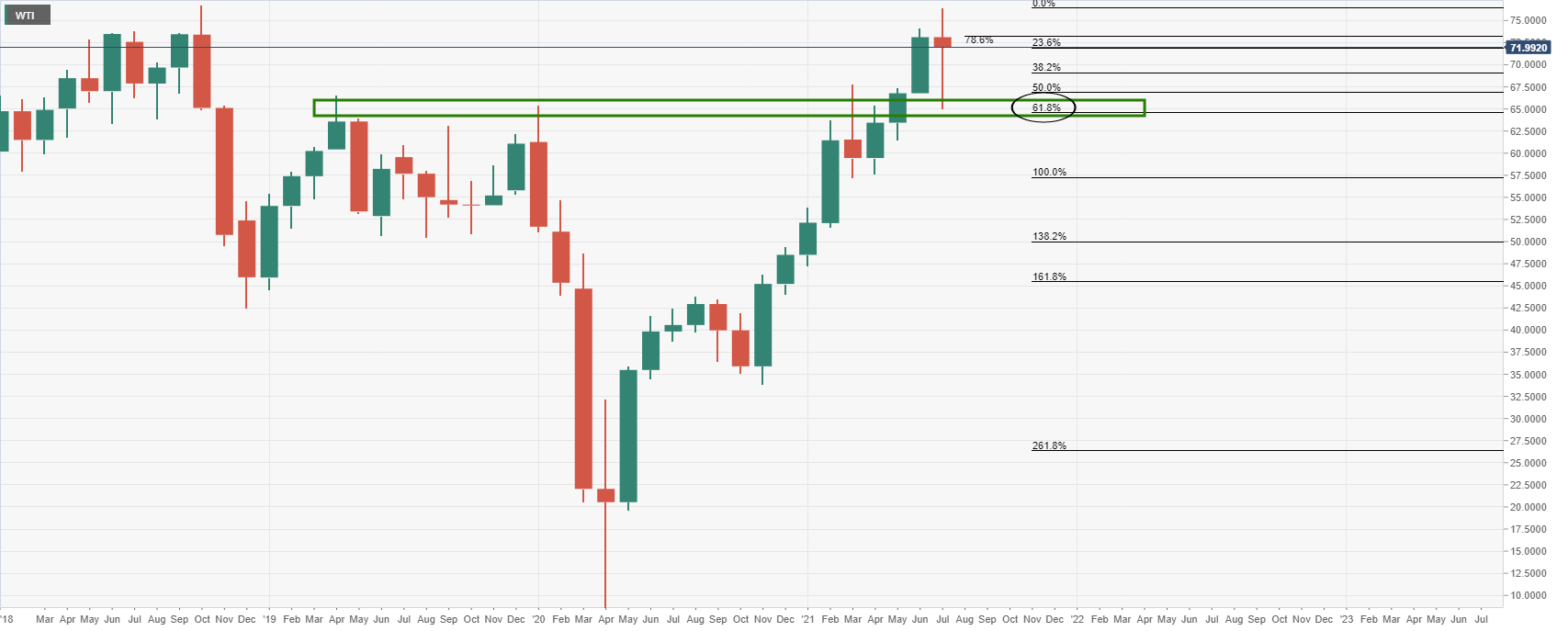

Meanwhile, the monthly 61.8% Fibonacci retracement in the 64.50/60s support area is compelling on a break of 65 the figure: