US Dollar Index clinches daily highs near 92.70 ahead of Fed

- DXY now moves higher and approaches the 92.70 level.

- US flash trade balance showed the deficit widened to $91.2 billion.

- Investors’ attention remains on the FOMC event later on Wednesday.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main competitors, accelerates gains to the area above 92.60 on Wednesday.

US Dollar Index bid ahead of FOMC

The index now trades on a firmer note and manages well to reclaim further ground near 92.70 as the FOMC gathering looms closer.

Collaborating with the upside momentum in the dollar, yields of the US 10-year benchmark manage to surpass the 1.26% level following recent lows, although the upside stays so far capped by the 1.30% hurdle.

In the US calendar, advanced Goods Trade Balance figures showed the trade deficit widened to $91.21 billion during June. Earlier MBA’s Mortgage Applications increased 5.7% on the week finished on July 23.

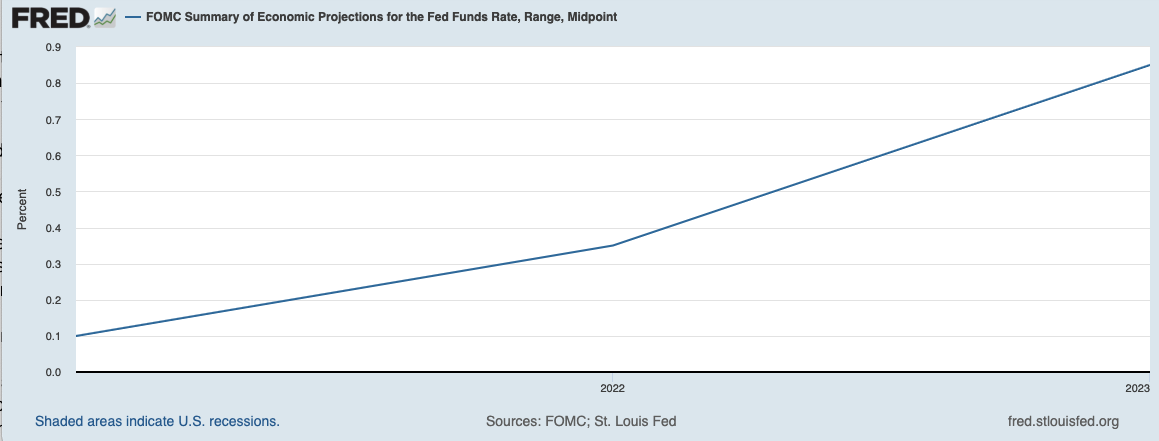

Later, all the attention will be on the FOMC event, where market participants are expected to closely follow any hint of the timing of the QE tapering, inflation prospects and potential earlier-than-anticipated interest rate hikes.

US Dollar Index relevant levels

Now, the index is gaining 0.20% at 92.65 and a break above 93.19 (monthly high Jul.21) would open the door to 93.43 (2021 high Mar.21) and finally 94.00 (round level). On the other hand, the next down barrier comes in at 92.31 (weekly low Jul.27) followed by 92.00 (monthly low Jul.6) and then 91.51 (weekly low Jun.23).