USD/TRY challenges monthly lows around 8.2700

- USD/TRY reverses the recent strength and drops to 8.2700.

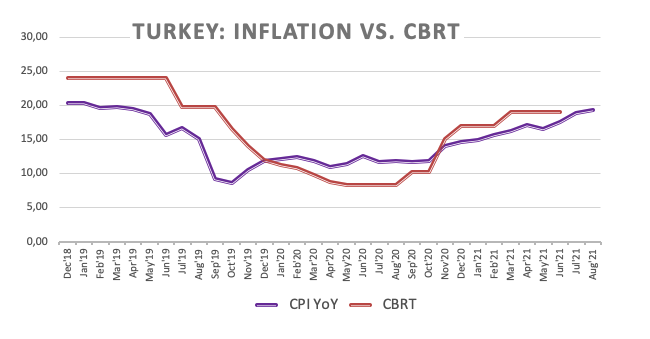

- Inflation seen below 10% by end of 2022 and around 8% in 2023.

- August’s inflation figures rose above 19.0% YoY, 1.12% MoM.

The Turkish lira reverses the recent weakness and appreciates to the 8.27 region vs. the dollar on Monday.

USD/TRY in 4-month lows

After two consecutive daily advances, USD/TRY has resumed the downside and already puts multi-week lows in the 8.2700 region to the test. Therefore, spot has started the fifth consecutive week with losses, targeting at the same time the critical 8.0000 mark, where also coincides the always relevant 200-day SMA.

The lira manages to regain important upside traction after the government unveiled details of a 3-year economic program. According to this, the inflation is seen grinding lower to levels below the 10% by end of 2022 and dropping further to the 8% area for the subsequent year.

Furthermore, the economy is forecast to expand by 9% in 2021 and around 5% next year, always sustained by the faster vaccination campaign, a solid rebound in tourism figures and healthy performance of exports.

It is worth recalling that inflation tracked by the CPI rose at an annualized 19.25% during last month and 1.12% from a month earlier. Producer Prices rose 2.77% inter-month and 45.52% over the last twelve months.

USD/TRY key levels

So far, the pair is losing 0.40% at 8.2778 and a drop below 8.2612 (monthly low Sep.2) would aim for 8.1316 (ow Apr.29) and finally 8.0193 (200-day SMA). On the other hand, the next up barrier lines up at 8.3463 (monthly high Sep.3) followed by 8.4789 (100-day SMA) and then 8.5578 (high Aug.20).