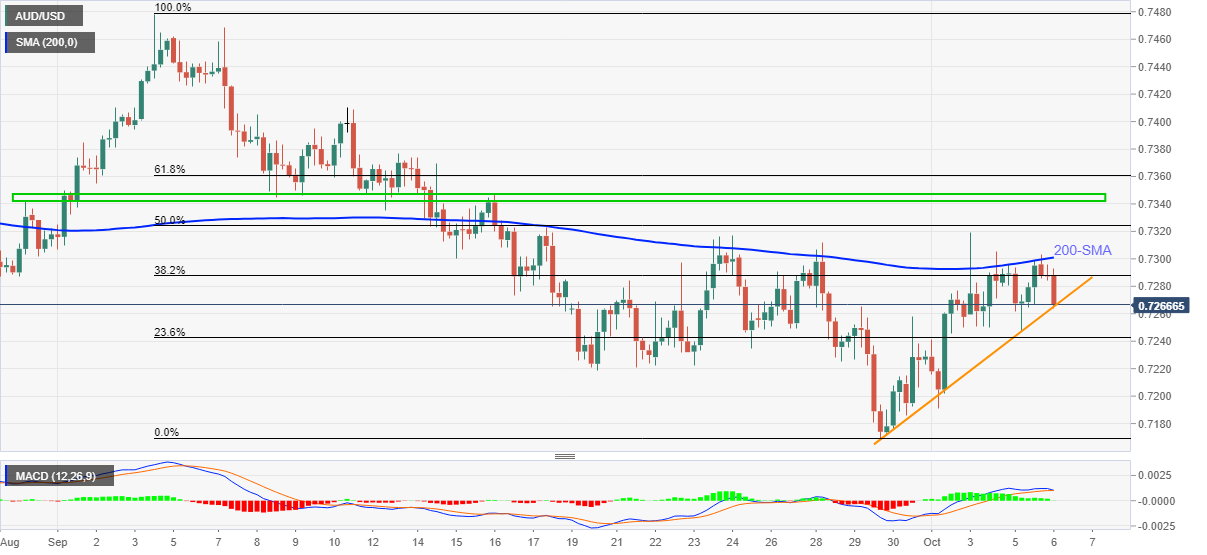

AUD/USD Price Analysis: Extends pullback from 200-SMA to attack weekly support line

- AUD/USD takes offers to refresh intraday low, snaps four-day uptrend.

- Repeated failures to cross the key SMA, MACD conditions hint at the bearish move.

- Late-September’s swing high adds to the upside filters.

AUD/USD sellers attack a short-term support line, standing on slippery grounds near 0.7265, down 0.34% intraday, during early Wednesday.

In doing so, the Aussie pair extends the previous day’s pullback from the 200-SMA to refresh the daily low, not to forget marking the first loss in five days.

Given the multiple rejections from the 200-SMA and MACD line that teases the bearish cross, AUD/USD is likely to conquer the immediate support surrounding 0.7265, including a one-week-old rising trend line.

However, the quote’s weakness past 0.7265 will be tested by the 23.6% Fibonacci retracement (Fibo.) of the last month’s downfall and the September 20 low, respectively around 0.7240 and 0.7220.

In a case where AUD/USD bears keep reins past 0.7220, the odds of witnessing a fresh low under the latest 0.7171 can’t be ruled out.

On the flip side, a clear cross of the 200-SMA level of 0.7300 needs validation from the September 23 high of 0.7317 to aim for the five-week-old horizontal area near 0.7345.

AUD/USD: Four-hour chart

Trend: Further weakness expected