Gold Price Forecast: XAU/EUR retreats from monthly hurdle despite Omicron-led cautious optimism

- Gold eases from one-week high to snap four-day uptrend.

- US Treasury yields stay firmer, German Bund coupons refreshed monthly top.

- Omicron cases remain high but fears recede on global studies, policymakers’ actions.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal

Gold (XAU/EUR) prints mild losses around €1,598, down 0.10% intraday heading into Tuesday’s European session. In doing so, the gold prices decline for the first time in five days while stepping back from a weekly high, flashed the previous day.

Although technical resistance could be more suitable to link the XAU/EUR pullback, firmer yields can be mentioned as the catalysts to weigh on the bullion.

That said, the US 2-year Treasury yields jumped to the highest since March 2020 before recently easing to 0.75% while the 10-year counterpart stays mostly inactive around 1.48% after the 1.7 basis points (bps) of a decline marked on Monday. On the other hand, the German Bund yields refreshed monthly peak with -0.22% figure the previous day, before closing around -0.238%.

Global traders seem to cheer the holiday mood while the latest positives concerning the South Africa-linked covid variant, namely Omicron, seems to add to the market optimism, challenging gold’s safe-haven demand. Also weighing on the gold are the escalating talks over the need for the monetary policy tightening at the European Central Bank (ECB) and the Federal Reserve (Fed), which in turn favor yields and weigh on gold.

The US Centers for Disease Control and Prevention’s (CDC) reduction in the isolation and quarantine period for the general population from the previous 10 to five and an 8.5% jump in US retail sales during the holiday season, per Mastercard, are the key catalysts. On the same line were hopes of US President Joe Biden’s Build Back Better (BBB) stimulus plan and receding fears of the Russia-Ukraine tension. Furthermore, headlines from the People’s Bank of China (PBOC) and the Chinese Finance Ministry, suggesting further easy money to help sustain the growth of the world’s second-largest economy, added to the risk-on mood.

Above all, the year-end holiday season and a light calendar restrict short-term market moves.

Technical analysis

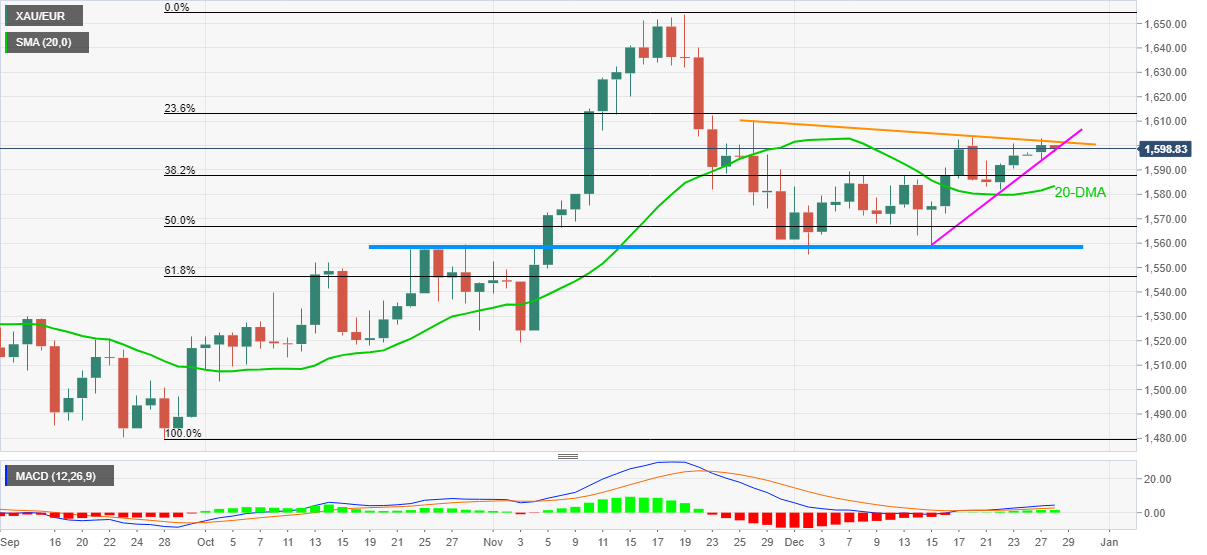

Gold prices remain pressured between the monthly resistance line and an upward sloping trend line support from mid-December, respectively around €1,602 and €1,598.

It’s worth noting, however, that the bullish MACD signals and the quote’s refrain from breaking the short-term support line keep XAU/EUR buyers hopeful to cross the €1,602 nearby hurdle.

Following that, the late November’s peak near €1,610 and €1,633 resistance levels will be in focus ahead of last month’s top of €1,654.

Meanwhile, a downside break of €1,598 will quickly drag the quote to the 20-DMA level of €1,583.

Should gold prices remain weak past €1,583, a two-month-old horizontal area near €1,558 will lure the bears.

Gold: Daily chart

Trend: Sideways