EUR/USD Price Analysis: Bears eye a run to 0.9950 on a break of trendline support

- EUR/USD bears eye a break of key hourly trendline support.

- 0.9950 is beckoning on a break below 1.0035.

Market sentiment bounced on Friday night, despite more hawkish rhetoric from Fed speakers and the euro subsequently rallied. However, the following illustrates the potential for a downside continuation while below the 1.0300 level.

EUR/USD weekly chart

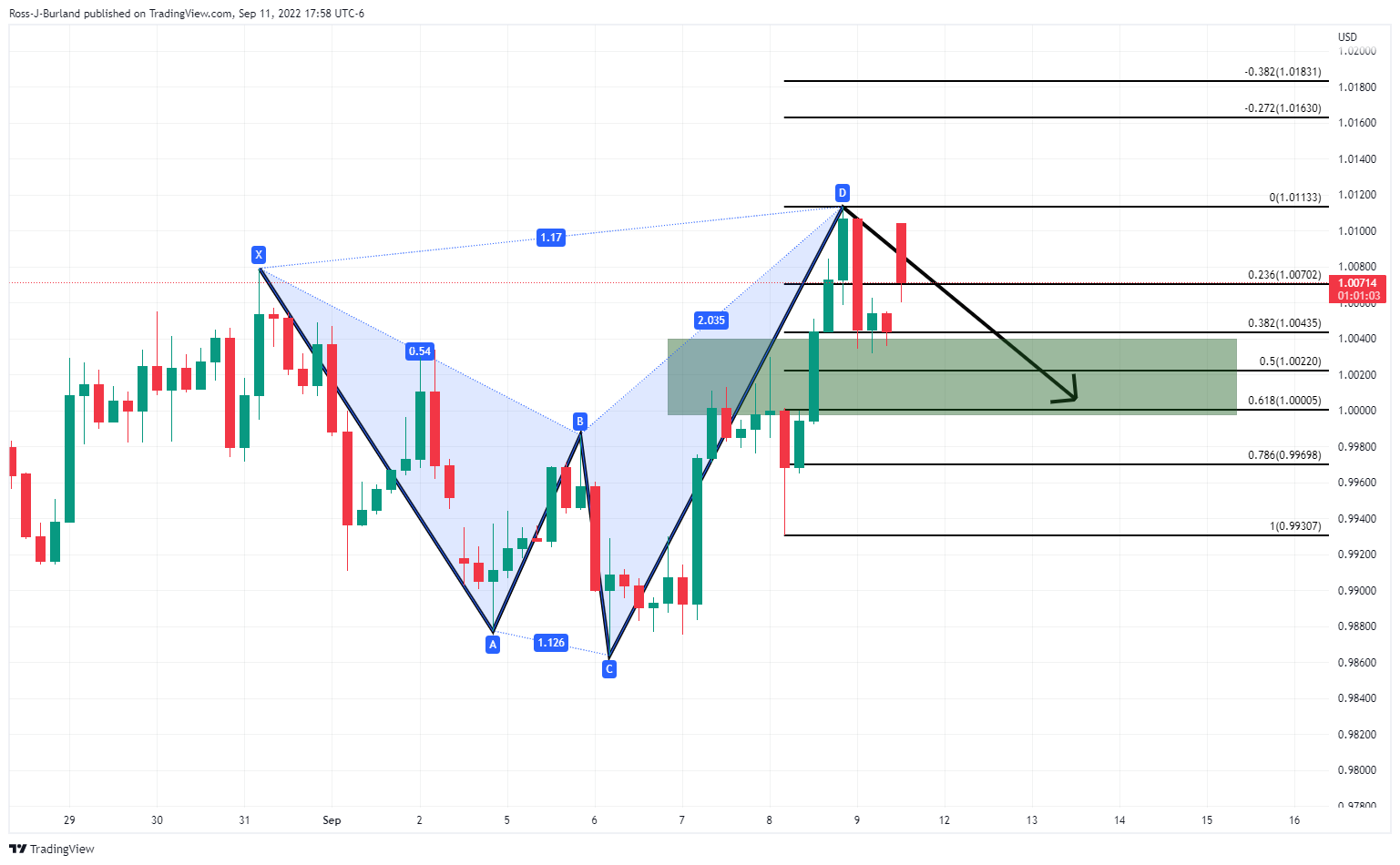

The weekly chart shows that the price is correcting into the neckline of the M-formation. While there is scope for a deeper correction towards a 61.8% or even the 78.6% Fibonacci levels, the 4-hour time frame's harmonic pattern is bearish as follows:

The price has opened strongly bid in early Asia but while below D and 1.0120, there is the potential for further downside and a deeper correction of the 4-hour impulse to challenge 1.0000.

From a 1 hour perspective, the key support is seen at 1.0035 which guards a run down towards 0.9950. In such a scenario, the trendline support will give way for the grind lower.